Airline pricing has undergone a significant transformation in recent years, moving beyond simple base fares to a complex structure dominated by ancillary charges. During peak holiday periods, passengers face fluctuating costs for seat selection, checked and carry-on luggage, and in-flight meals, making holiday travel fee intelligence an essential tool for both travelers and industry stakeholders. By understanding these trends, travelers can make informed, cost-effective decisions, while airlines can optimize revenue and enhance customer satisfaction.

Modern technology and analytics now enable holiday travel fees data extraction, allowing real-time monitoring of these add-on charges across multiple carriers and online travel agencies (OTAs). By using automated tools to Scrape airline fees during holidays season, analysts can identify pricing trends, measure travel cost inflation, and detect dynamic changes in ancillary fees. These insights provide a strategic foundation for airlines and OTAs to develop pricing strategies that reflect consumer behavior and market demand, ensuring competitive and profitable operations during high-demand holiday travel periods.

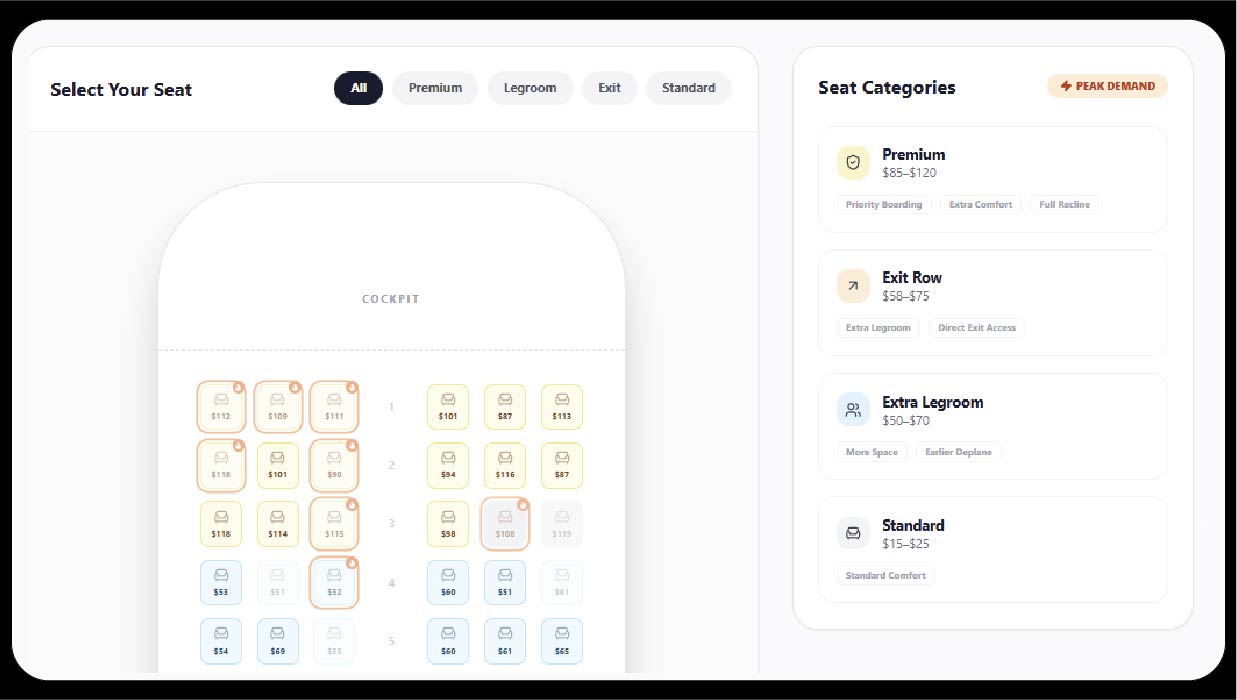

Seat Selection Charges

Airlines often segment seating into categories such as standard seats, extra legroom, exit row, and premium options. Fees vary by route, aircraft type, and time of booking. By using method to Extract holiday booking fee trends data, airlines and analysts can identify which seat types experience the highest demand.

For example:

During peak holiday weeks, these fees can increase by 2–3 times the normal rate, reflecting both demand and willingness to pay for comfort. Continuous travel surcharge Price tracking ensures airlines adjust fees dynamically to maximize revenue while responding to market demand.

Luggage Fees

Luggage fees, both for checked and carry-on bags, surge during peak periods:

International travelers are particularly impacted, with airlines charging premium rates for additional luggage due to higher operational costs.

In-Flight Meal Fees

Meal options range from standard offerings to premium or special dietary meals. These fees often reflect route distance and airline service quality:

Premium meals see the most price volatility, especially on flights with higher seat occupancy during holidays.

The research employed multiple techniques for accurate data collection:

The study also integrated Travel & Tourism App Datasets to ensure comprehensive coverage of both domestic and international flights.

Delta Air Lines

Delta shows a consistent increase in seat selection and luggage fees during peak holidays. Extra legroom and premium seat fees can increase up to 65% above regular rates. Baggage fees are moderately dynamic, while meal charges increase by 15–20% on transcontinental flights.

American Airlines

American Airlines implements dynamic pricing heavily influenced by occupancy. Exit row and premium seat fees show significant hourly fluctuations. Meal options, especially premium offerings, see a 25% increase closer to the holiday period. OTA platforms often bundle seat and meal fees, complicating comparison.

Emirates

Emirates demonstrates the highest ancillary charges among the monitored carriers. Premium seats, additional luggage, and meals on long-haul flights can double in price during peak holiday weeks. Emirates’ use of Travel Data Extraction Services ensures fees are adjusted in real time to match passenger demand.

United Airlines

United Airlines exhibits moderate dynamic fee adjustments. Baggage and meal fees see consistent inflation, especially for international routes. Early bookings offer cost savings, but last-minute travelers face steep surcharges, reflecting dynamic travel pricing data strategies.

Table 1: Seat Fees (USD)

| Airline | Standard Seat | Extra Legroom | Exit Row | Premium Seat |

|---|---|---|---|---|

| Delta | 18 | 55 | 60 | 90 |

| American Airlines | 15 | 50 | 58 | 85 |

| United | 20 | 60 | 65 | 95 |

| Emirates | 25 | 70 | 75 | 120 |

Table 2: Luggage Fees (USD)

| Airline | Carry-On Fee | 1st Checked Bag | 2nd Checked Bag | Oversized Bag |

|---|---|---|---|---|

| Delta | 30 | 40 | 60 | 90 |

| American Airlines | 28 | 38 | 58 | 85 |

| United | 32 | 42 | 65 | 95 |

| Emirates | 35 | 50 | 75 | 120 |

Table 3: Meal Fees (USD)

| Airline | Standard Meal | Premium Meal | Special Dietary Meal | Snack Packs |

|---|---|---|---|---|

| Delta | 12 | 20 | 18 | 8 |

| American Airlines | 10 | 18 | 16 | 7 |

| United | 11 | 19 | 17 | 9 |

| Emirates | 15 | 25 | 22 | 12 |

Holiday travel add-on fees play a crucial role in influencing consumer behavior, as passengers increasingly weigh costs for seat selection, luggage, and in-flight services. Airlines employ advanced travel pricing intelligence services to track real-time fee fluctuations and adjust pricing strategies accordingly. By utilizing Travel, hospitality, and tourism website scraper, carriers and online travel agencies can monitor trends, detect demand surges, and analyze competitive pricing across multiple platforms. These insights allow for effective peak season travel price monitoring, helping airlines and OTAs optimize revenue, manage capacity efficiently, and improve the overall traveler experience. Understanding these dynamic fees ensures both profitability for airlines and smarter, cost-effective choices for passengers during high-demand holiday periods.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.