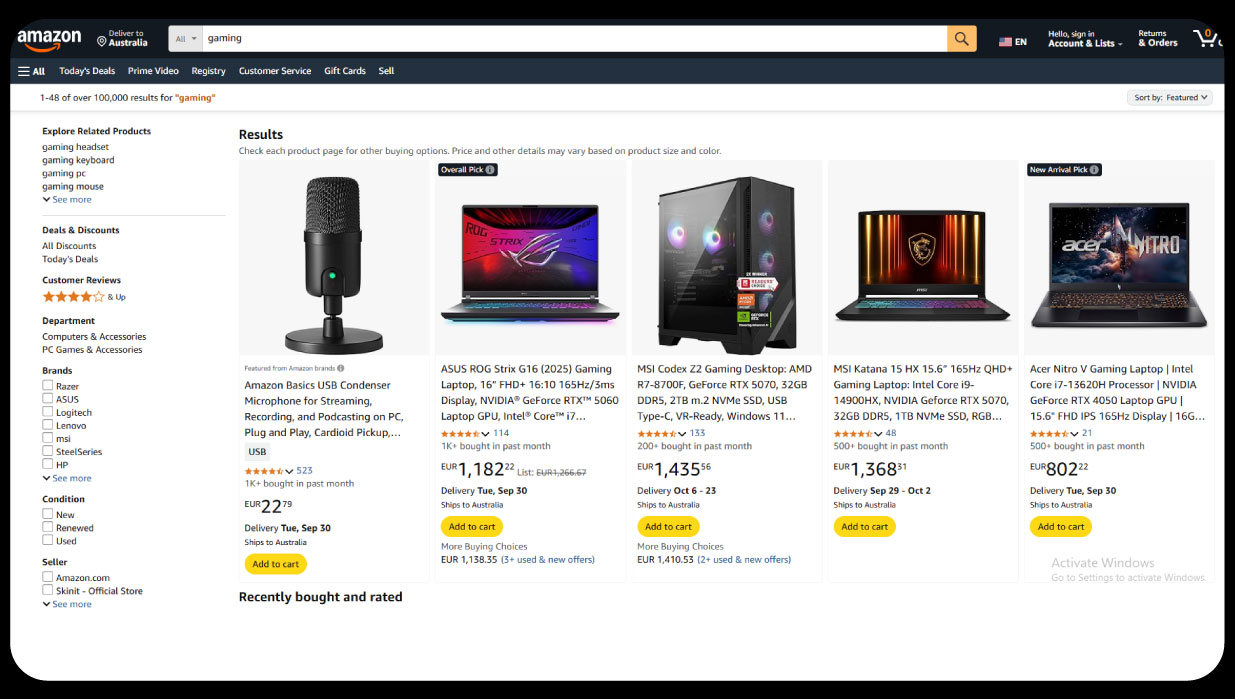

E-commerce thrives on data, fueling strategies for businesses, researchers, and analysts. Datasets from leading platforms, such as Amazon, eBay, and Walmart, reveal distinct insights into consumer behavior, pricing, and market trends. Comparing Amazon, eBay, and Walmart Dataset for Market Research highlights how each platform’s data aligns with its business model. Amazon’s vast product catalog supports deep consumer analytics, eBay’s auction-driven system uncovers dynamic pricing and niche markets, and Walmart’s omnichannel presence bridges online and in-store trends.

This report evaluates these datasets to identify which offers the most actionable insights for market research, competitive analysis, and product development. Amazon vs eBay vs Walmart Data Scraping Insights emphasize ethical data extraction via APIs or compliant web scraping to unlock real-time value. Amazon’s datasets, rich in metadata such as product identifiers and images, excel in AI applications, while eBay captures seller-buyer interactions, revealing negotiation patterns absent in Walmart’s standardized listings.

Scraping Amazon, eBay, Walmart Data for Business Intelligence navigates technical and ethical challenges, such as anti-bot measures, to deliver high-quality data. These platforms account for over 50% of U.S. e-commerce sales, with Amazon holding a 40% market share. Drawing from public datasets, academic studies, and industry reports, this analysis assesses data volume, quality, and applicability. Amazon eBay Walmart seller dataset analyses show Amazon hosts over 2 million active sellers, eBay around 1.7 million, and Walmart over 150,000, each offering unique metrics like seller ratings and fulfillment efficiency.

With U.S. e-commerce sales projected to surpass $600 billion by 2027, robust data strategies are critical. This report includes two tables: one comparing seller data volumes and another on price variances across categories. Through this lens, we determine which dataset drives the most profound insights for retail stakeholders.

Structure and Availability

Amazon’s dominance in e-commerce is mirrored in its expansive datasets, where Amazon Product Datasets excel in depth and structure. Public datasets, such as the UCSD Amazon Reviews dataset, comprise 233 million reviews spanning from 1996 to 2024, encompassing ratings, text, product descriptions, prices, and categories. These are ideal for sentiment analysis, with features like helpfulness votes, enabling nuanced studies of consumer behavior. Commercial datasets provide millions of records, including product identifiers, seller details, brands, price histories, availability, and review counts. Public Kaggle datasets, such as those with over 1,000 product ratings, provide accessible entry points, while cloud marketplaces deliver enriched datasets for enterprise use.

Applications and Insights

Amazon’s data supports scalability. With 142.8 million deduplicated reviews, analysts can build co-purchasing graphs to uncover “also bought” patterns, driving 35% of sales through upselling. A 2025 academic study notes Amazon reviews’ “detailed narratives with polarized emotions,” making them superior for qualitative insights compared to competitors’ shorter feedback. Image data enables computer vision applications, such as duplicate detection or style recommendations.

Structure and Availability

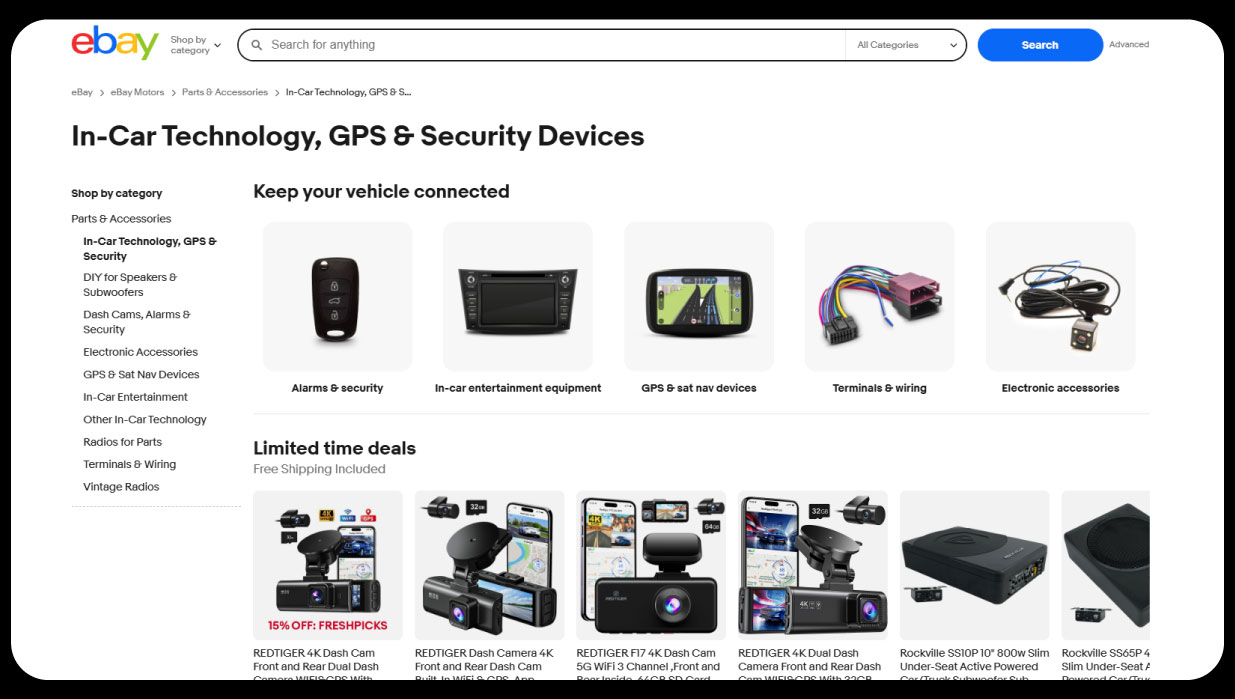

eBay’s auction-driven model generates datasets rich in transactional dynamics, where eBay Product Datasets capture pricing volatility and user interactions. Public repositories, such as GitHub, offer datasets with over 1,000 records per category, including product specifications, final prices, and seller ratings—ideal for analyzing the markets for refurbished or collectible items.

Aggregated datasets include seller directories with tens of thousands of entries across global marketplaces, encompassing metrics such as merchant IDs and review counts. Seller tools integrated into eBay’s platform analyze supply-demand trends, optimizing auction pricing.

Applications and Insights

eBay’s data excels in personalization. Reviews are concise, as per the 2025 sentiment study, which suits rapid sentiment scoring. Public Kaggle datasets include user-item interactions, which support recommendation engines through collaborative filtering. eBay’s market shrinkage—down $4 billion since 2022—limits its datasets to niche applications, particularly in high-value categories like luxury goods, where margins can reach 50%.

Structure and Availability

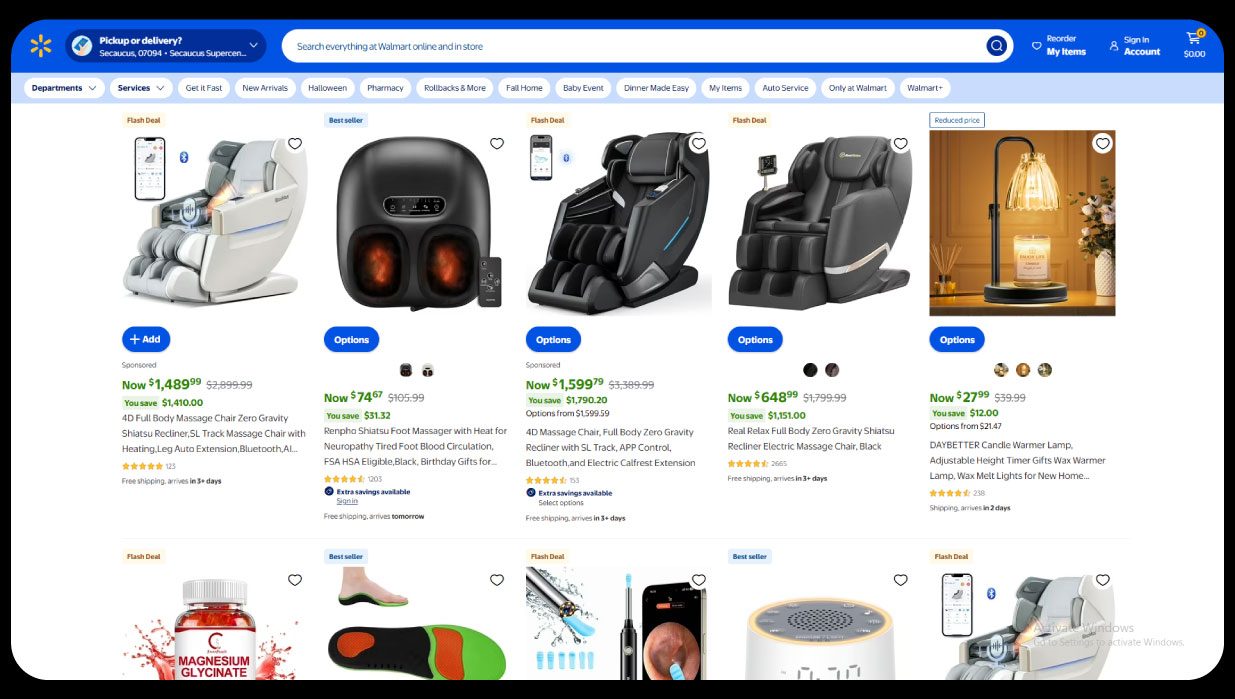

Walmart’s datasets bridge online and physical retail, with Walmart Product Datasets emphasizing affordability and omnichannel insights. Scraped datasets include SKUs, prices, images, ratings, and seller details, updated frequently for real-time monitoring. Industry reports highlight Walmart’s strength in budget categories, like outdoor equipment, with high weekly revenues.

Public Kaggle datasets, such as Walmart’s recruiting datasets, cover store-level sales and inventory, while scraped review datasets span multiple countries, offering global sentiment insights. Walmart’s 2024 e-commerce sales growth, outpacing competitors, fuels datasets with hybrid insights.

Applications and Insights

Walmart reviews focus on “affordability,” per cross-platform studies, making them ideal for value-driven segmentation. With over 150,000 sellers in 2025, Walmart’s data supports dynamic pricing, though prices are often 13% higher than Amazon’s overall. Multi-channel analytics tools integrate Walmart, Amazon, and eBay, uncovering arbitrage opportunities.

Data Volume and Quality

Extract E-Commerce Website Data to reveal trade-offs between volume and specificity. Amazon’s datasets lead with 233 million reviews, compared to eBay’s 35 million (up to 2013) and Walmart’s fragmented collections. Amazon’s metadata, including product identifiers and co-purchase graphs, supports advanced machine learning, whereas eBay’s auction data captures pricing volatility that is absent in Walmart’s standardized listings.

Platform-Specific Strengths

For market research, Amazon offers the broadest insights due to its scale; a 2025 industry report positions it as the top choice for sellers. eBay excels in seller-centric analyses, monitoring multiple marketplaces for niche demand. Walmart’s 12.6% year-over-year growth makes its datasets valuable for omnichannel strategies, blending online and in-store trends.

Scraping Challenges

Web Scraping Amazon, eBay, Walmart For Retail Insights involves navigating Amazon’s anti-bot protections with proxies, eBay’s dynamic page loading with JavaScript handling, and Walmart’s filters with URL parameterization. Ethical compliance with GDPR and CCPA is critical, favoring pre-built datasets or API-based extraction.

| Platform | Active Sellers (2025 Est.) | Avg. Reviews per Product | Key Data Points | Sample Dataset Size |

|---|---|---|---|---|

| Amazon | 2,000,000+ | 1,000+ | Product ID, Price History, Images, Ratings | 233M reviews |

| eBay | 1,700,000 | 50-200 | Auction Bids, Seller ID, Categories | 1M+ records (public) |

| Walmart | 150,000+ | 100-500 | SKU, Availability, Pickup Options | 100M+ SKUs (scraped) |

This table, sourced from public data aggregators and platform estimates, illustrates Amazon’s lead in data depth.

| Category | Amazon Avg. Price | eBay Avg. Price | Walmart Avg. Price | Cheapest Platform |

|---|---|---|---|---|

| Baby Supplies | $15.20 | $13.20 | $15.16 | eBay (-13%) |

| Makeup | $12.50 | $9.90 | $14.20 | eBay (-21%) |

| Pet Supplies | $18.80 | $20.10 | $17.50 | Walmart (-7%) |

| Electronics | $45.00 | $42.50 | $48.00 | eBay (-6%) |

This Amazon Walmart eBay Price Comparison dataset, based on a 2024 snapshot of 110 items, highlights eBay’s pricing advantage (6% cheaper than Walmart overall).

Market Research and Competitive Analysis

Amazon’s datasets power recommendation systems, with co-purchase graphs driving 35% of sales. eBay’s data optimizes auctions, boosting margins by 20% via seller tools. Walmart’s datasets reduce stockouts by 15% through inventory syncing.

Sentiment and Trend Analysis

Cross-platform, Amazon’s detailed reviews fuel NLP models, eBay’s concise feedback suits quick polls, and Walmart’s pragmatic reviews support value segmentation. Unified analytics reveal top-sellers, like modular homes generating significant weekly revenue.

Scraping requires compliance with platform terms and data privacy laws. Amazon’s structured APIs, eBay’s auction volatility, and Walmart’s omnichannel complexity demand tailored extraction strategies. Pre-built datasets or APIs mitigate risks, ensuring ethical use.

Amazon’s datasets lead for comprehensive analytics due to their volume and structure, ideal for broad market research. eBay and Walmart complement this with niche and omnichannel insights, respectively. Ecommerce Product Ratings and Review Dataset sources, like the 233M Amazon reviews, unlock sentiments for strategic refinement. Businesses should leverage ECommerce Data Intelligence Services for integrated, compliant analysis. An E-commerce Product Data Scraping API Service offers scalable extraction, ensuring fresh, actionable data. Combining all three platforms maximizes ROI in the $1T+ global e-commerce market.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.