In the dynamic world of finance, making data-driven decisions is a fundamental pillar of success. The effective collection, analysis, and interpretation of financial data have become crucial advantages for investors and analysts. Web scraping stock market data, an automated method for extracting information from websites, has emerged as a powerful tool for obtaining real-time stock prices and supporting the development of predictive models. This article delves into the significant role of predictive analytics and web scraping stock data for stock price modeling in stock price analysis, highlighting its use in extracting data from reputable sources like Bloomberg and Yahoo Finance and its contribution to building predictive models.

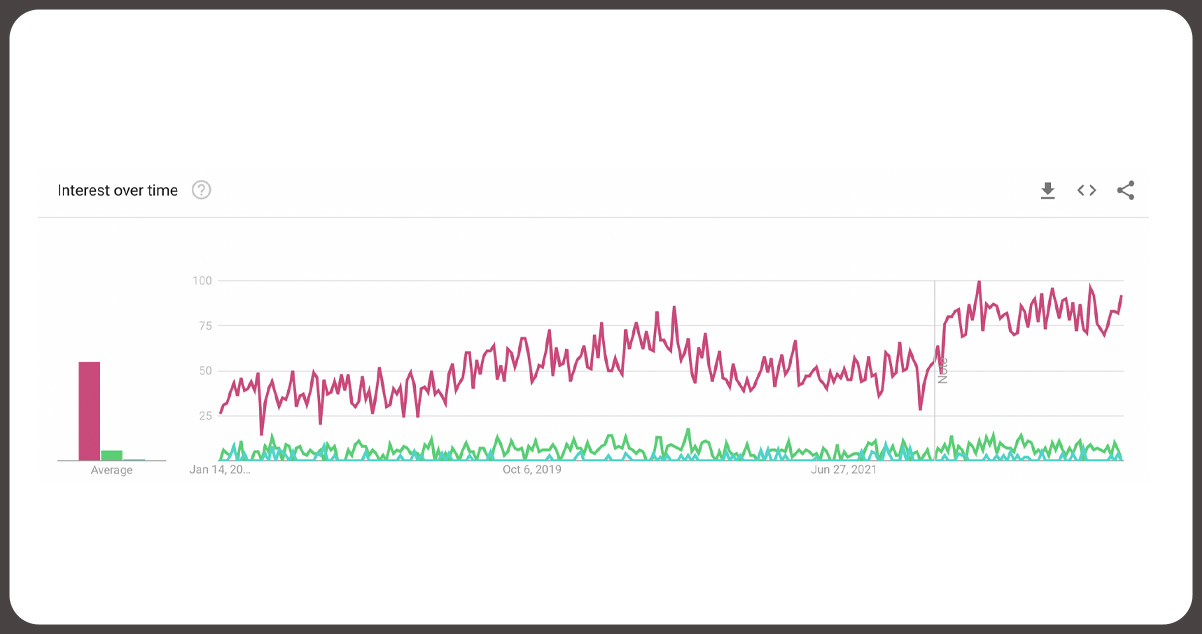

Predictive analysis involves examining existing data to identify patterns and make forecasts about future outcomes or trends. While it cannot guarantee future predictions, it offers valuable insights into likely probabilities. This approach finds applications across various sectors, including business. Based on extensive historical data analysis, predictive analysis is employed to explore and understand customer behavior, product trends, and other factors to evaluate risks and opportunities.

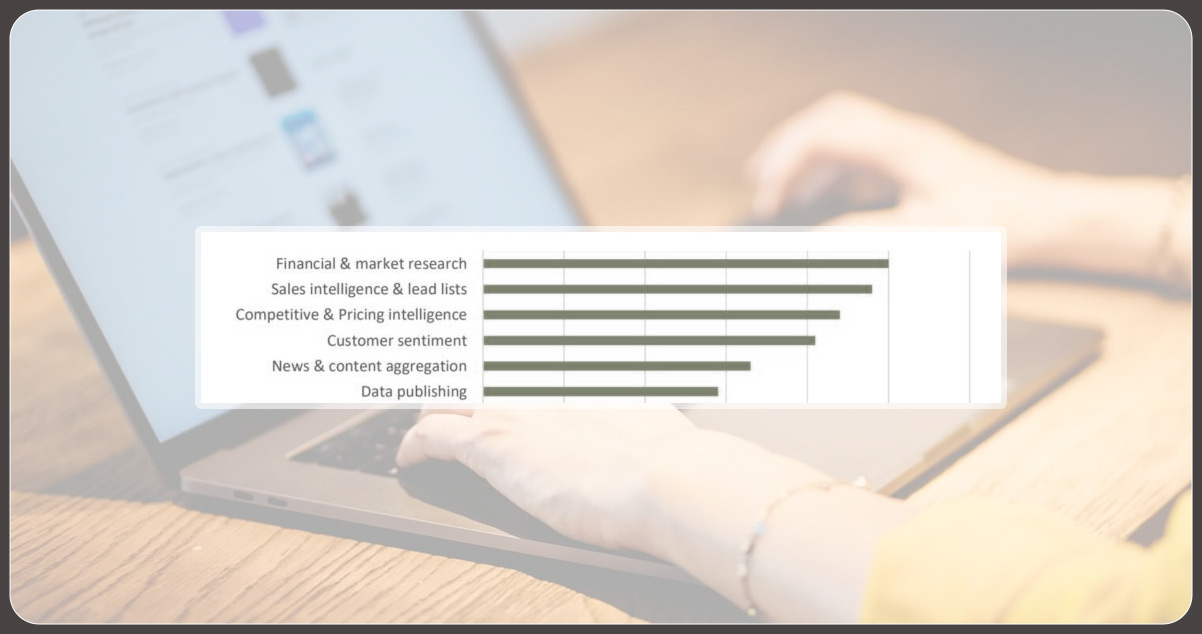

For businesses, leveraging predictive analytics is essential for competitiveness. Predictive analytics, a component of business intelligence, focuses on high-quality data examination, primarily for forecasting and modeling. It's a versatile method with finance, healthcare, insurance, and more applications. Integrating web scraping with predictive analytics is commonly used in credit evaluation.

Anticipating a company's and market's future using past data is crucial for modern organizations. Business intelligence empowers marketing teams to prepare for customer needs proactively. Web scraping uncovers demographic data, often overlooked, aiding in marketing platform and strategy decisions. Employing web scraping and predictive analytics together, managers can aim to boost sales while optimizing costs. Ultimately, businesses aim to minimize losses and maximize profits, making web scraping and predictive analysis vital online or offline tools.

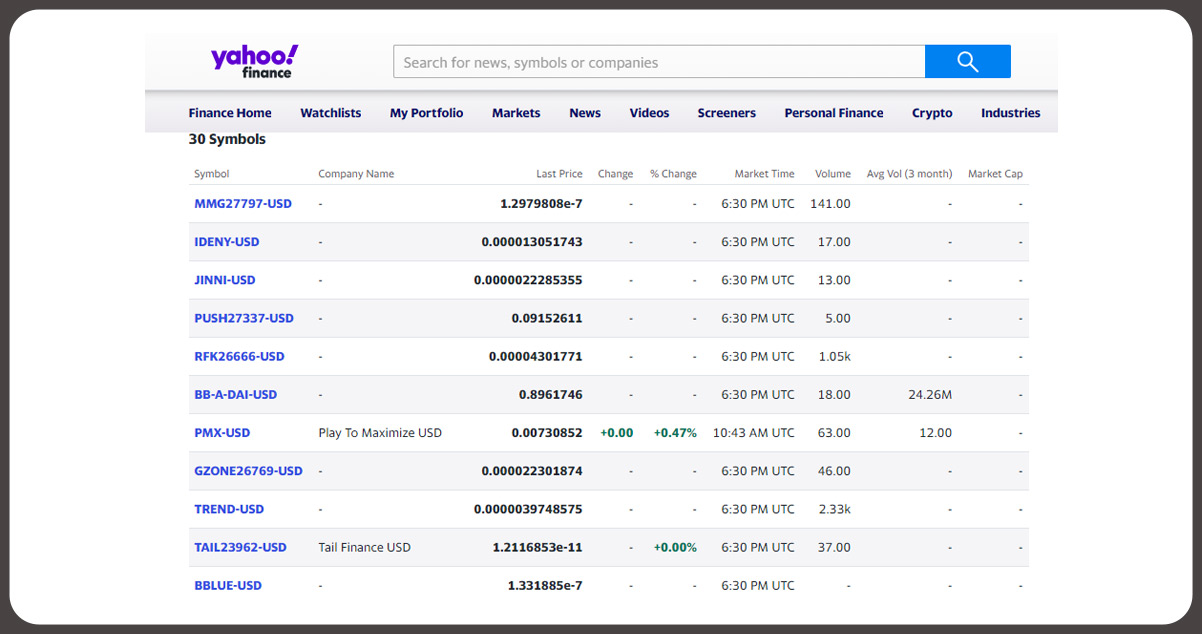

Web scraping involves the automated retrieval of data from websites, providing professionals with the capability to amass extensive datasets that drive analysis and well-informed decision-making. In analyzing stock prices, web scraping finance data empowers investors and analysts to access the latest stock prices, market trends, and financial metrics from various sources, including Bloomberg and Yahoo Finance. This immediate access to data plays a pivotal role in facilitating wise investment decisions and the creation of precise predictive models.

Stock trading fundamentally involves predicting a stock's future performance. Traditionally, traders rely on fundamental and technical analysis to anticipate a stock's near-future behavior by assessing its current status and historical price movements.

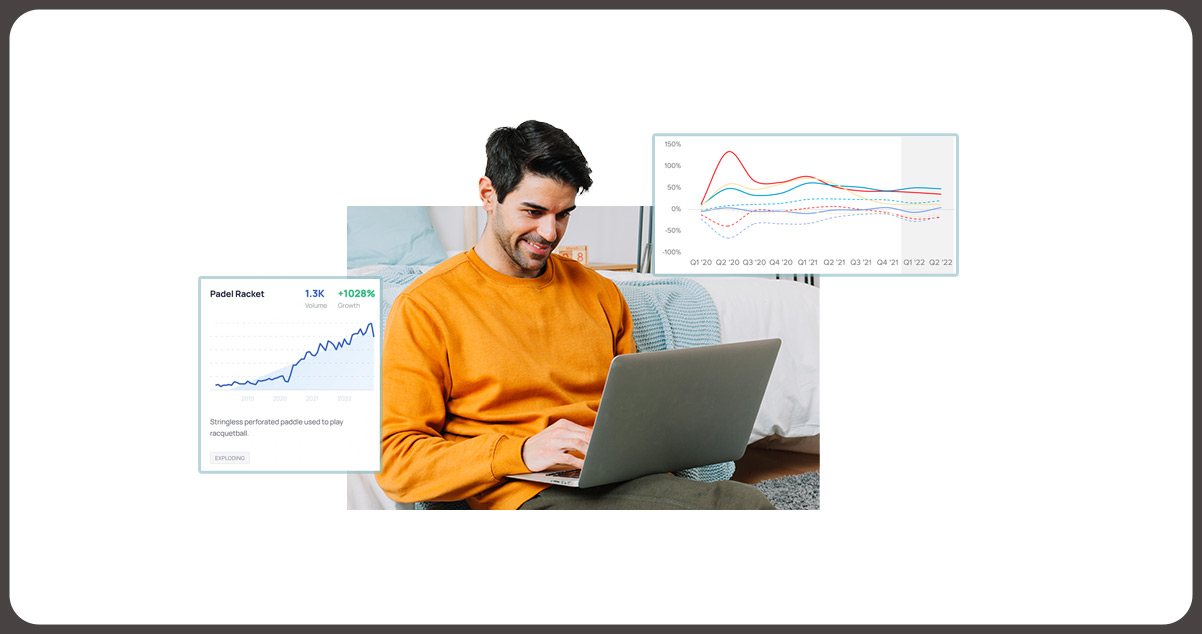

However, the advent of web scraping and alternative data has expanded the available information horizons and accelerated the analysis process. A prime example is monitoring news outlets and financial portals (such as Yahoo Finance) to gather hyper-relevant and timely data.

News significantly impacts a company's stock, so collecting recent news content, including headlines and the initial paragraphs of articles, one can conduct sentiment analysis to gauge whether it will positively or negatively affect their portfolio.

Moreover, assessing brand insight and product demand acts as valuable gages of a stock's failure or success. Scraping online forums and social media concerning a company's brand can help identify perception shifts while analyzing data from sources like Amazon reveals product price fluctuations, customer reviews, and overall product performance.

These are just the basics. Scrape stock data to facilitate the collection of legal and financial information on a large scale (such as SEC filings), saving countless manual hours. Additionally, gathering job data enables forecasts of a company's growth based on hiring trends and the roles they are recruiting for, among other insights.

One of the most significant contributions of web scraping to stock trading is the development of trading models, forever intertwining these two domains.

Prominent financial platforms like Bloomberg and Yahoo Finance offer valuable information, including stock prices, historical data, and market updates. Web scraping makes it possible to extract stock price data from these platforms, eliminating manual intervention and ensuring the accuracy and timeliness of analyses.

The use of finance web scraping tools and libraries like BeautifulSoup and Finance in Python streamlines stock price extraction by systematically navigating these websites' HTML structure. By identifying the specific elements containing stock price information, finance data scraper automates data retrieval. It reduces the time and effort required to gather large datasets and guarantees precision and consistency in data collection.

Once you've gathered stock price data, the stage is to construct predictive models that shed light on future trends and guide investment strategies. Several standard predictive models are regularly available with stock price data, each offering a unique approach:

Conclusion: In the fast-paced world of finance, where timing can determine success and knowledge is power, finance data scraping services have ushered in a significant transformation in how we gather and utilize stock price data. The ability to swiftly extract real-time information from reputable sources like Bloomberg and Yahoo Finance empowers investors and analysts to make informed decisions. Moreover, this data is the foundation for creating predictive models that leverage various techniques, including MA, LSM, WMA, exponential smoothing, Holt-Winters, and ARIMA.

For further details, contact iWeb Data Scraping now! You can also reach us for all your web scraping service and mobile app data scraping needs.