In the modern quick commerce landscape, where consumers expect instant delivery, monitoring inventory at the dark store level is critical. Our study focuses on Dark store ice cream availability insights to evaluate stock performance. It emphasizes premium ice cream brands through Naturals NIC ice cream stock tracking. Data was collected across Blinkit and Instamart platforms for analysis. By leveraging grocery SKU-level Ice Cream availability data, businesses can assess availability, identify stock-outs, and optimize replenishment strategies. Quick Commerce Datasets enables platforms and brands to gain a competitive edge by analyzing real-time stock levels, predicting demand, and improving service efficiency.

This report examines stock patterns, temporal fluctuations, platform differences, and operational implications of SKU-level ice cream availability, providing a granular understanding of the Q-commerce ice cream category.

The study is designed to provide actionable insights for Naturals NIC ice cream stock tracking by:

To provide accurate Dark store ice cream availability insights, a robust research methodology was applied:

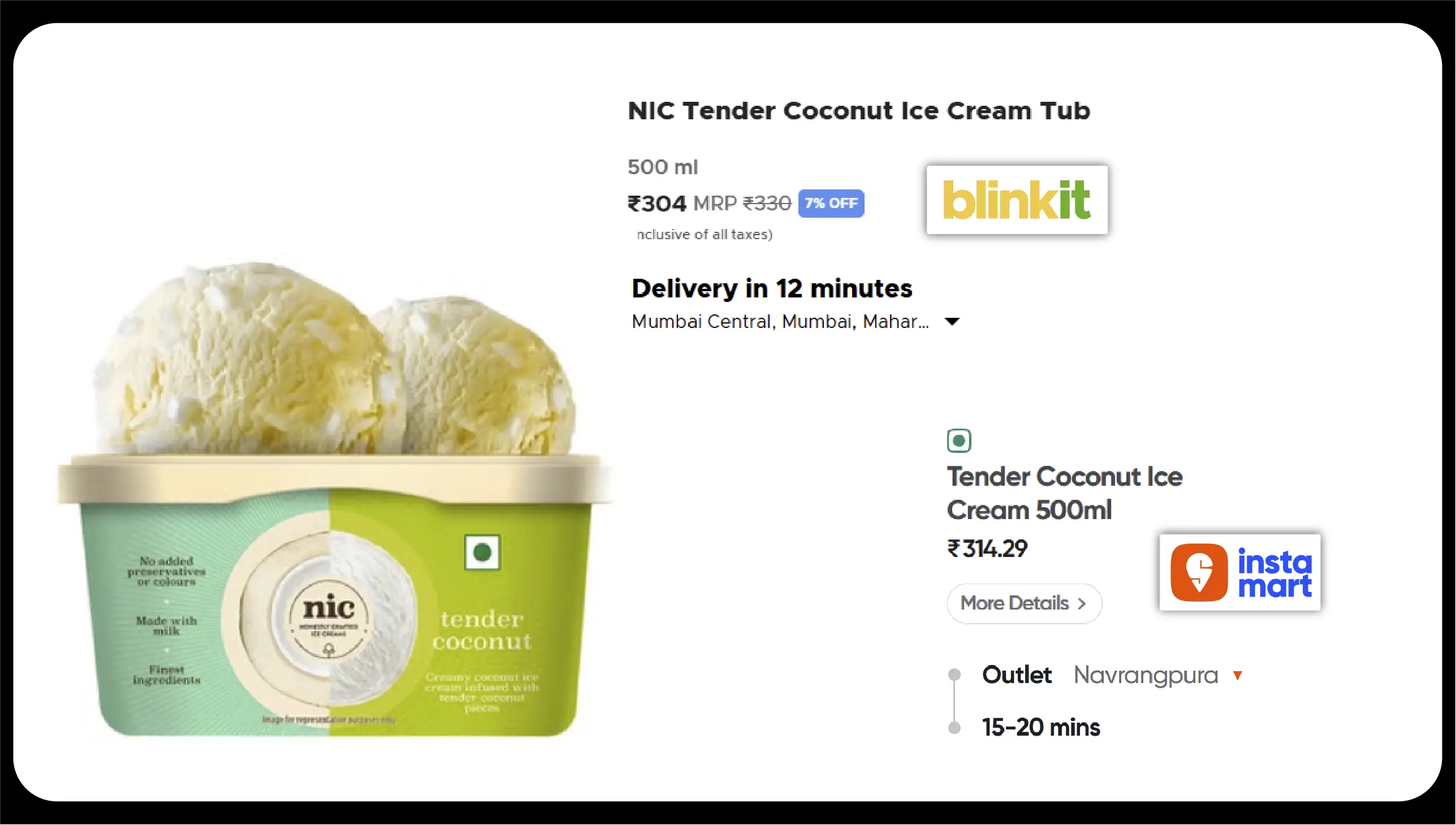

The study relied on Blinkit Grocery Datasets to analyze SKU-level availability in dark stores. It also utilized Instamart Grocery Datasets to track real-time inventory updates and stock patterns.

| Platform | Data Type | Frequency | Key Insights |

|---|---|---|---|

| Blinkit | Grocery Datasets | 30–60 mins updates | SKU-level availability, stock-outs, replenishment gaps |

| Instamart | Grocery Datasets | Multiple daily updates | Inventory consistency, peak demand fulfillment, SKU distribution |

This dataset allows for granular analysis of NIC ice cream stock intelligence across multiple dark stores.

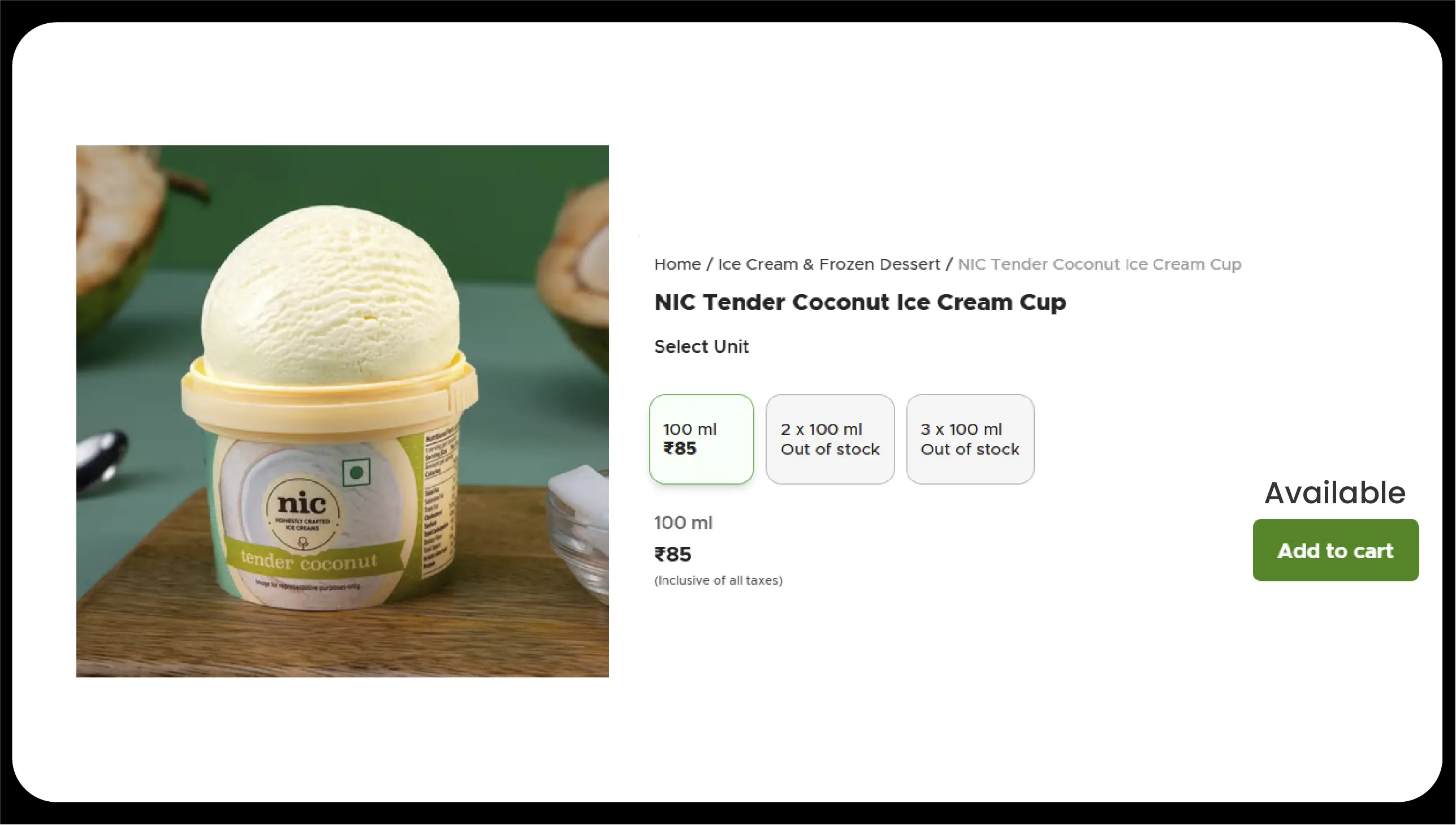

Scrape Naturals ice cream availability data for precise insight into individual products, highlighting which flavors and pack sizes are frequently available or at risk of stock-out.

Table 1: Ice Cream SKU Availability Snapshot

| Brand | Platform | Dark Store ID | SKU | Flavour | Stock Status | Last Replenished | Replenish Interval (hrs) |

|---|---|---|---|---|---|---|---|

| Naturals | Blinkit | DS-BLK-001 | 500ml Choco Fudge | Chocolate | In Stock (12) | 09:15 AM | 4 |

| NIC | Blinkit | DS-BLK-001 | 400ml Rich Butterscotch | Butterscotch | Out of Stock | 07:40 PM | N/A |

| Naturals | Instamart | DS-INS-023 | 750ml Tender Coconut | Coconut | Low Stock (3) | 01:55 PM | 8 |

| NIC | Instamart | DS-INS-023 | 500ml Royal Almond | Almond | In Stock (7) | 10:30 AM | 6 |

Values in parentheses indicate quantity available at the time of extraction.

Insights:

Brand-wise Availability Insights

Focusing on Naturals NIC ice cream stock tracking allows brands to align inventory with peak demand periods and reduce lost sales.

Monitoring dark store inventory at different times allows understanding of dynamic stock trends:

This demonstrates the value of quick commerce ice cream availability data scraping for proactive inventory management.

Blinkit:

Instamart:

Monitoring Blinkit dark store data scraping and Instamart inventory data extraction allows Q-commerce operators to allocate high-demand SKUs efficiently.

Tracking grocery SKU-level Ice Cream availability data at the flavor level reveals:

Table 2: Daily Stock Performance by Brand

| Brand | Avg. Stock Availability Morning (%) | Afternoon (%) | Evening (%) | Day Avg (%) |

|---|---|---|---|---|

| Naturals (Blinkit) | 78 | 65 | 42 | 61 |

| NIC (Blinkit) | 72 | 50 | 30 | 51 |

| Naturals (Instamart) | 81 | 74 | 58 | 71 |

| NIC (Instamart) | 68 | 61 | 47 | 59 |

Percentage refers to proportion of stores with >5 units available.

Observation: Instamart dark stores provide better daily coverage for both brands, whereas Blinkit shows higher evening stock-out rates.

This research highlights the critical role of Quick Commerce & FMCG Data Extraction Services in enhancing operational intelligence. By leveragingit, businesses gain:

Deploying Quick Commerce Data Intelligence Services ensures continuous insights across dark stores. Using Q-Commerce Data Scraping API Services helps track SKU-level availability in real time. Leveraging Grocery Data Scraping API Services empowers brands like Naturals and NIC to optimize operations across Q-commerce platforms.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.