In recent years, the UK has experienced a remarkable shift in its beverage culture, transitioning from a nation known for its traditional tea-drinking habits to one of Europe's foremost consumers of coffee. This shift has propelled the UK into the spotlight as the continent's largest branded coffee shop market. For stakeholders across the industry spectrum, understanding the England’s market positioning and geographical distribution of the leading coffee shop chains in the UK by Scraping UK's Leading Coffee Hub Data holds immense significance. By delving into these insights, businesses can gain a nuanced understanding of consumer preferences, market dynamics, and competitive landscapes, informing strategic decision-making and fostering innovation within the thriving coffee industry.

By using data scraping services from coffee chains, this report embarks on a meticulous exploration of the coffee scene in the United Kingdom, specifically focusing on Greggs, Costa Coffee, and Starbucks. Covering the entirety of the UK, including England, Wales, and Scotland, our investigation zooms in on major cities within these regions. By meticulously analyzing data and trends, this report aims to shed light on the intricate dynamics shaping the coffee chains in the UK, offering actionable insights for businesses navigating this dynamic market landscape.

In the ensuing sections, we conduct a comprehensive analysis of the leading coffee chains in the UK. This examination provides an in-depth look at the geographic distribution and market reach of Greggs, Costa Coffee, and Starbucks. Through meticulous scrutiny, we aim to unveil how these chains strategically position themselves across the UK to cater to diverse consumer preferences and drive sustained growth.

Diving deeper into our analysis, we aim to unveil the spatial distribution of Costa Coffee, Greggs, and Starbucks across the United Kingdom. Understanding the footprint of these prominent coffee chains offers invaluable insights into their market penetration and strategic expansion efforts.

Our investigation delves into the geographical spread of Costa Coffee, Greggs, and Starbucks, dissecting the density and coverage of their respective store networks. Through visual mapping, we illuminate the presence of these brands, shedding light on their reach across different regions and urban landscapes.

Moving beyond the national scale, we individually zoom in on England, Wales, and Scotland, dissecting the concentration of coffee chain outlets in each region. By highlighting areas of dense clustering, we identify hotspots where these brands have established a firm foothold, providing nuanced insights into regional consumer preferences and market dynamics.

Furthermore, our analysis zooms in on critical cities where Costa Coffee, Greggs, and Starbucks have concentrated most heavily. By examining the distribution patterns within urban centers, we uncover strategic placement strategies and competitive landscapes, offering valuable guidance for businesses seeking to navigate these bustling markets.

Through these in-depth investigations, we aim to provide a comprehensive understanding of the geographic footprint and consumer trends shaping the coffee shop landscape in the UK.

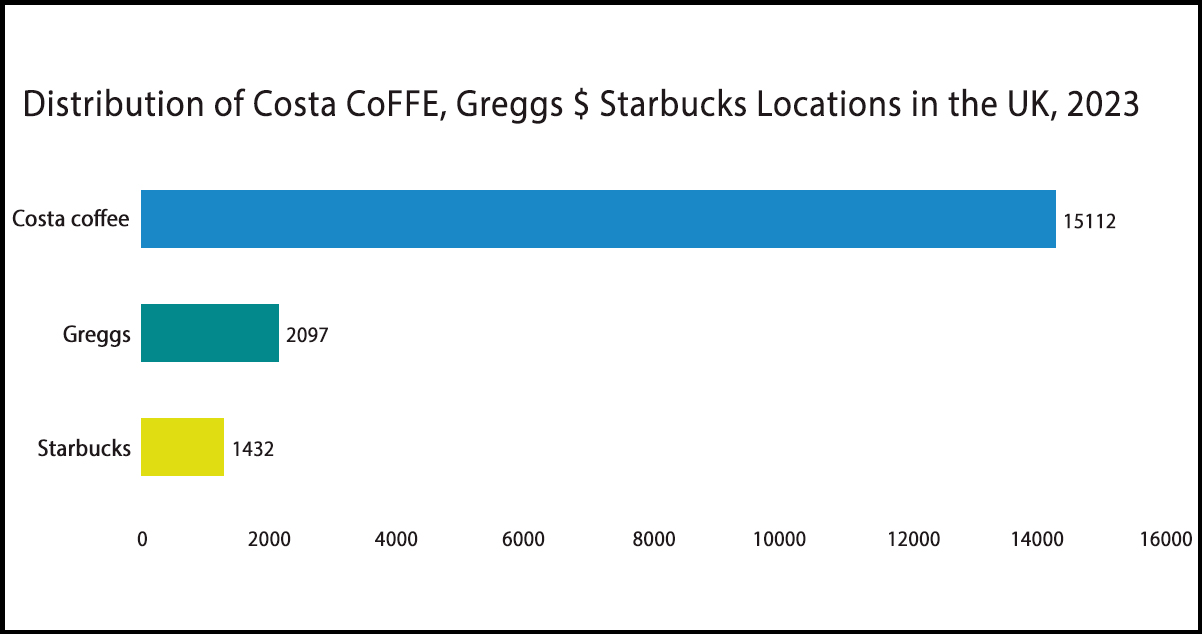

In a notable display of dominance, Costa Coffee emerges as the frontrunner among the three brands, boasting an impressive network of 15112 outlets across the UK. This staggering figure solidifies Costa Coffee's position as the undisputed leader in the coffee chain market, showcasing its widespread presence and unparalleled reach.

Following closely behind, Greggs claims the second position with a respectable count of 2097 outlets nationwide. While significantly fewer than Costa Coffee's establishments, Greggs' substantial presence underscores its status as a formidable player in the UK's coffee shop landscape, particularly renowned for its bakery offerings alongside coffee.

Starbucks maintains a notable presence in the third spot, with 1432 locations in the UK. Despite trailing behind Costa Coffee and Greggs in outlet numbers, Starbucks remains a significant contender, renowned for its premium coffee offerings and global brand recognition.

This data unveils a clear hierarchy among the leading coffee chains in the UK, offering valuable insights into consumer preferences and market strategies. Understanding the distribution patterns of these giants provides stakeholders with essential information regarding market saturation, consumer behavior, and regional dynamics. With this knowledge, businesses can make informed decisions regarding expansion plans, marketing initiatives, and strategic partnerships to capitalize on the evolving landscape of the UK's coffee industry.

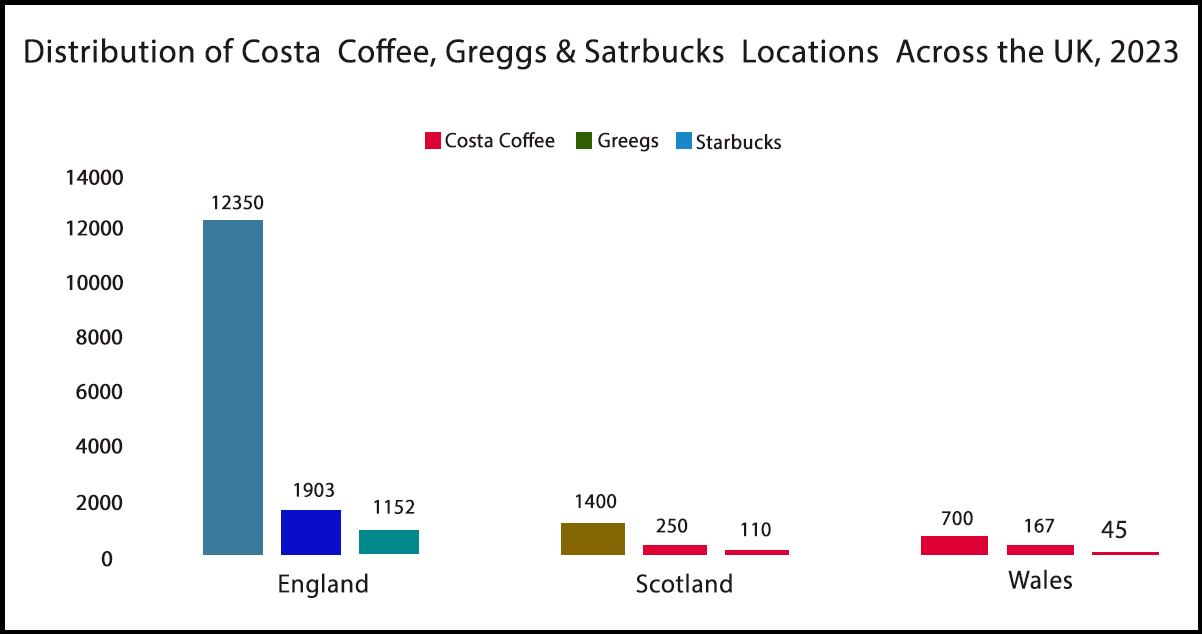

To understand the scale and influence of Costa Coffee, Greggs, and Starbucks, it is essential to examine their geographical distribution across England, Scotland, and Wales. The following map visually represents each brand's stronghold in these regions, offering insights into their regional dominance and market penetration strategies.

Costa Coffee asserts its dominance across all three nations of the UK—England, Scotland, and Wales, solidifying its status as the premier coffee chain leader nationwide. It underscores its market prowess and its adeptness at tailoring strategies to cater to diverse regional markets within the UK. Greggs secures second place consistently across these regions, showcasing a robust footprint that extends beyond traditional coffee chains, particularly notable in England. Starbucks follows closely in third place, maintaining a steady presence across urban centers in these nations.

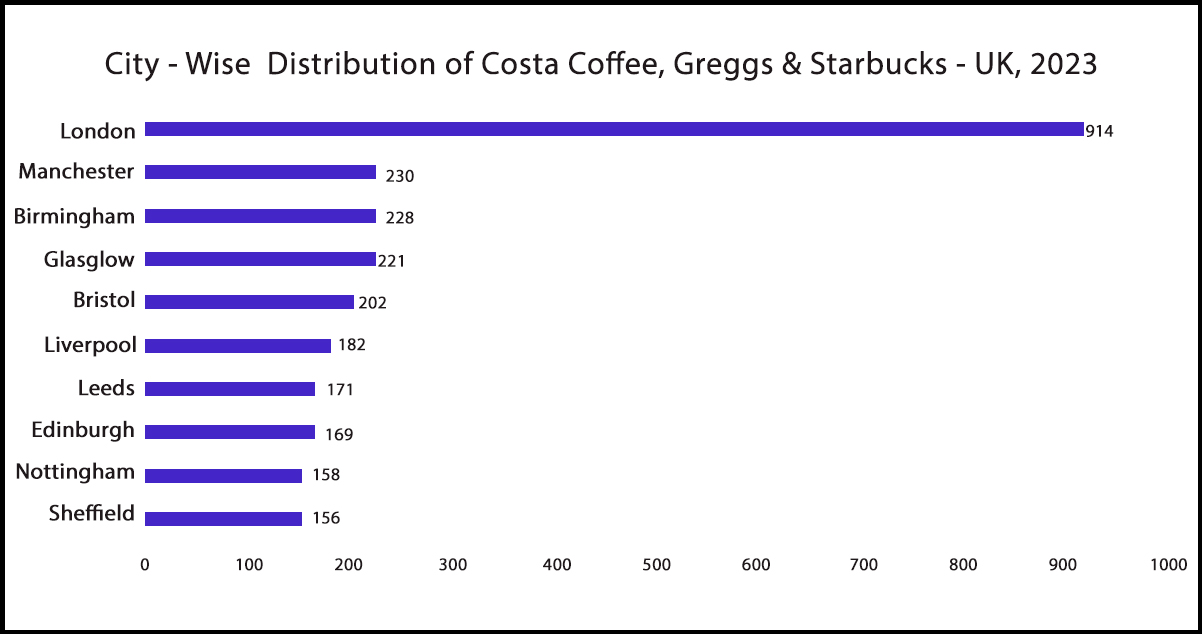

Transitioning from national to city-level analysis, we delve deeper into the distribution of leading coffee shop chains across the UK. This meticulous examination offers insights into localized patterns, shedding light on how Costa Coffee, Greggs, and Starbucks have strategically positioned themselves within various urban hubs. The accompanying map provides a detailed breakdown of these distribution dynamics, facilitating a nuanced understanding of geographical nuances and market penetration strategies at the city level.

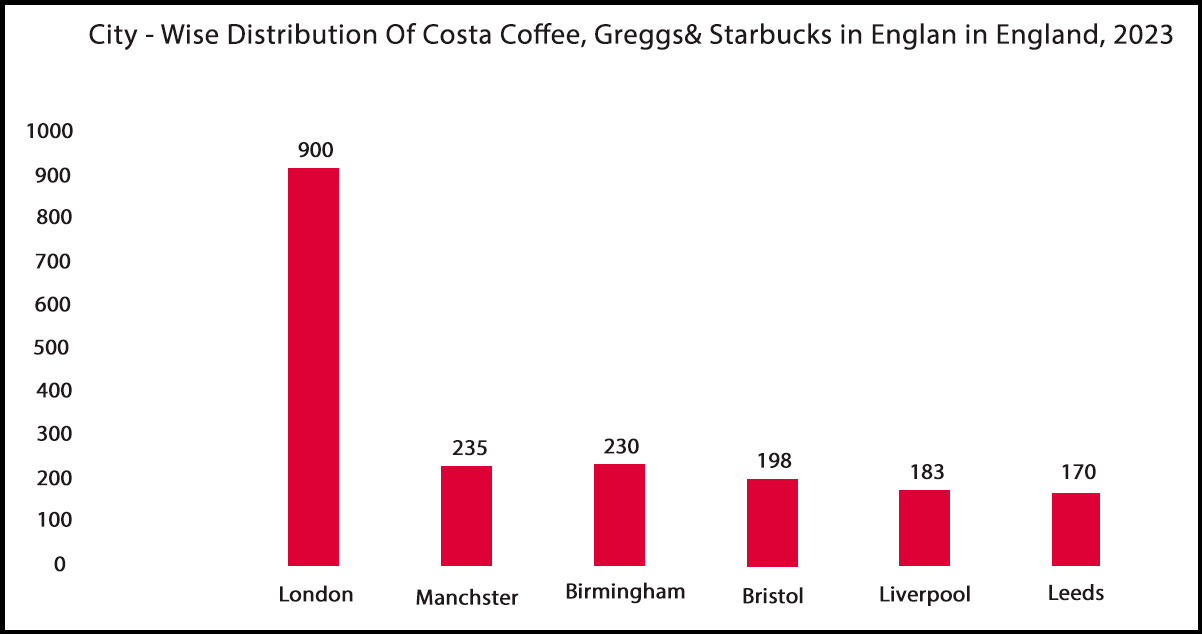

London emerges as the focal point for all three chains, hosting 914 outlets collectively owned by Costa Coffee, Greggs, and Starbucks. This data accentuates London's pivotal position as a cornerstone market for coffee chains in the UK while also signaling intense competition within the capital. Manchester and Birmingham follow London closely, boasting significant numbers with 230 and 228 outlets, respectively, albeit trailing behind London in sheer magnitude. It underscores the notable presence of these chains in major urban centers outside of the capital, contributing to the vibrant coffee culture across the UK.

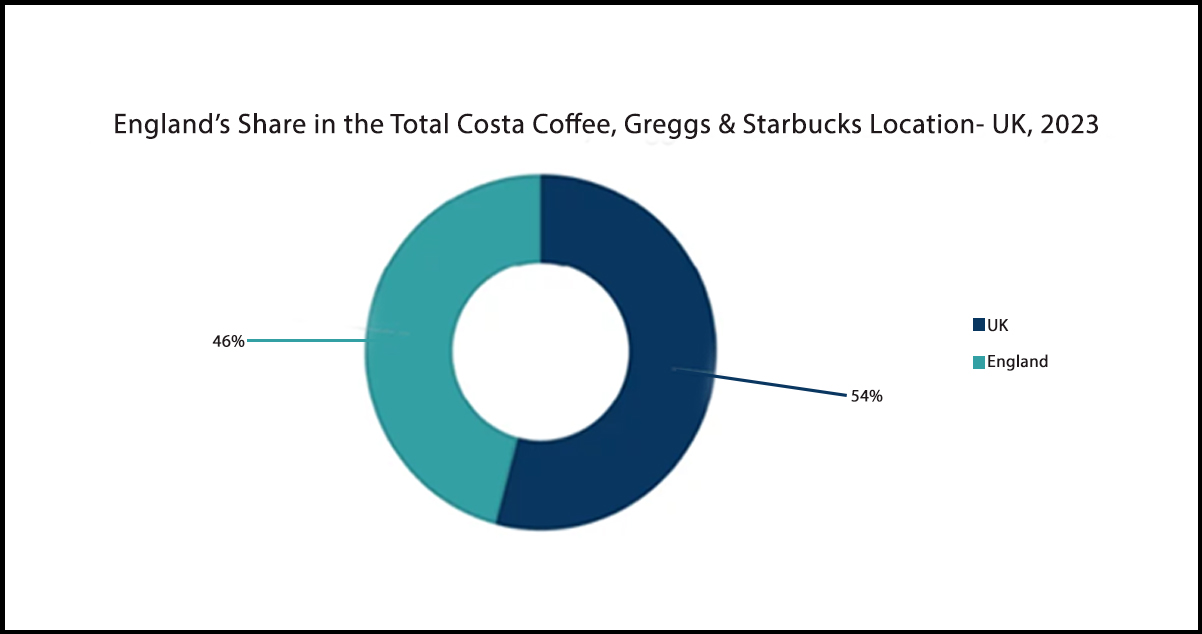

When delving into the landscape of coffee chains in the UK, it becomes evident that England, particularly its capital city, London, holds significant sway. This section zooms in on the pivotal role of London in shaping the distribution and market share of Costa Coffee, Greggs, and Starbucks. Notably, England boasts approximately 48% of the total locations of these three leading coffee shop chains in the UK, highlighting the substantial influence of London as a central hub within the market.

As we dissect England's notable role in shaping the landscape of leading coffee shop chains in the UK, London emerges as a pivotal focal point in this narrative. The city transcends its status as a busy capital to establish itself as a stronghold for Starbucks, Costa Coffee, and Greggs.

H&London, in particular, stands out with an impressive tally of 914 outlets owned by these three chains within England. This concentration not only underscores robust market penetration but also signifies heightened consumer demand within the dynamic urban landscape of the capital city.

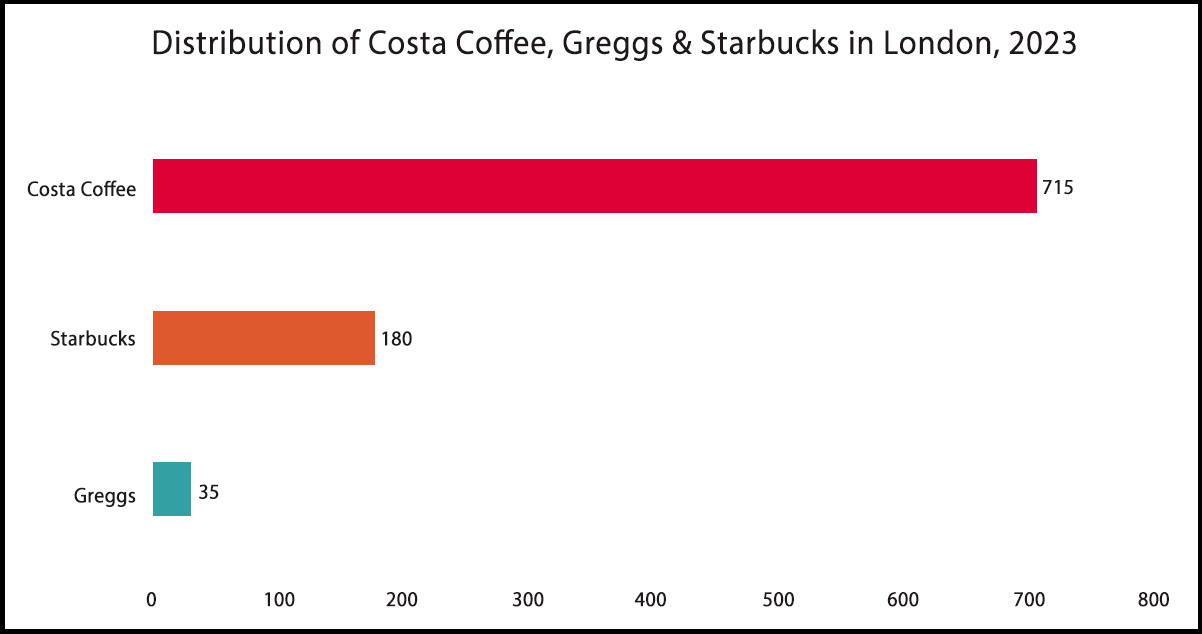

Examining the landscape of prominent coffee shop chains in the UK, it's evident that Costa Coffee, Starbucks, and Greggs each exhibit distinct levels of presence within London's market.

Costa Coffee dominates the London market with an impressive 715 locations, showcasing its extensive reach and market saturation. Starbucks, a globally recognized brand, maintains a substantial yet comparatively smaller footprint with 180 outlets, offering a diverse range of beverages and snacks. With 35 outlets, Greggs holds a modest presence in London's coffee scene.

Analyzing leading coffee shop chains in the UK unveils intricate market dynamics and consumer preferences. Costa Coffee, Greggs, and Starbucks offer unique perspectives, reflecting the diverse tastes of consumers across England and beyond.

As stakeholders navigate this multifaceted market, understanding distribution patterns becomes paramount. Insight into the presence of crucial coffee chains facilitates a deeper understanding of market saturation, consumer behavior, and regional nuances. With this knowledge, businesses can craft strategic approaches and make informed decisions to thrive in the competitive coffee industry.

Discover England's coffee market dynamics through our advanced data solutions, featuring retail store location data scraping. Gain actionable insights into consumer preferences and market trends, empowering strategic decision-making. With our expertise, unravel the complexities of the UK's coffee industry, including analysis of major chains like Greggs, Costa Coffee, and Starbucks. Stay ahead of the competition by leveraging our comprehensive data insights to identify growth opportunities and tailor marketing strategies. Contact us now to revolutionize your approach and thrive in the dynamic landscape of the UK's coffee market!

The coffee chain with the broadest presence in the UK is Costa Coffee. With an extensive network of 15112 outlets spanning England, Scotland, and Wales, Costa Coffee asserts its dominance as the largest coffee chain in the country.

The popularity of coffee shops in the UK is due to factors such as customer loyalty, quality of beverages and food offerings, ambiance, and convenience of locations. While Costa Coffee leads in outlet numbers, factors like brand recognition and customer satisfaction also play significant roles in determining popularity.

Costa Coffee distinguishes itself through its extensive range of beverages, including various coffee blends, teas, and specialty drinks. Additionally, Costa Coffee emphasizes quality and sustainability in its sourcing practices, resonating with environmentally conscious consumers.

Are any emerging coffee chains challenging the dominance of established brands in the UK? Yes, several emerging coffee chains in the UK aim to carve out their niche in the market. While they may still need to rival the scale of Costa Coffee, Greggs, or Starbucks, these newcomers often differentiate themselves through unique offerings, innovative concepts, and localized appeal. Keep an eye out for exciting developments in the UK's coffee scene!

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.