In today’s digital-first travel industry, price competitiveness defines brand success. As online travel agencies (OTAs) like Expedia and Booking.com process millions of searches daily, the ability to Scrape Expedia and Booking com hotel price has become critical for businesses, analysts, and travelers seeking pricing transparency. Using data scraping technologies, one can capture room rates, seasonal variations, and booking trends in real time. To showcase this potential, we explore comparative data from New York and San Diego—two of the most dynamic U.S. hotel markets.

Understanding how pricing fluctuates between these regions reveals not only demand-driven insights but also OTA strategy differences. In this research, we combine pricing analytics, seasonal rate comparisons, and occupancy predictions to illustrate how data scraping empowers decision-making through the New York vs San Diego hotel real time rates data extractor. Moreover, the impact of festive tourism and post-pandemic recovery is analyzed through Holiday Season Expedia data scraping from NYC datasets that reflect evolving consumer behavior.

Hotel pricing across major OTAs changes by the minute, responding to booking volumes, regional events, and competitor adjustments. Price scraping enables analysts to track these dynamic changes. When businesses Extract San Diego top destination data by booking.com, they gain actionable insights into location-based competitiveness, booking patterns, and discount frequency.

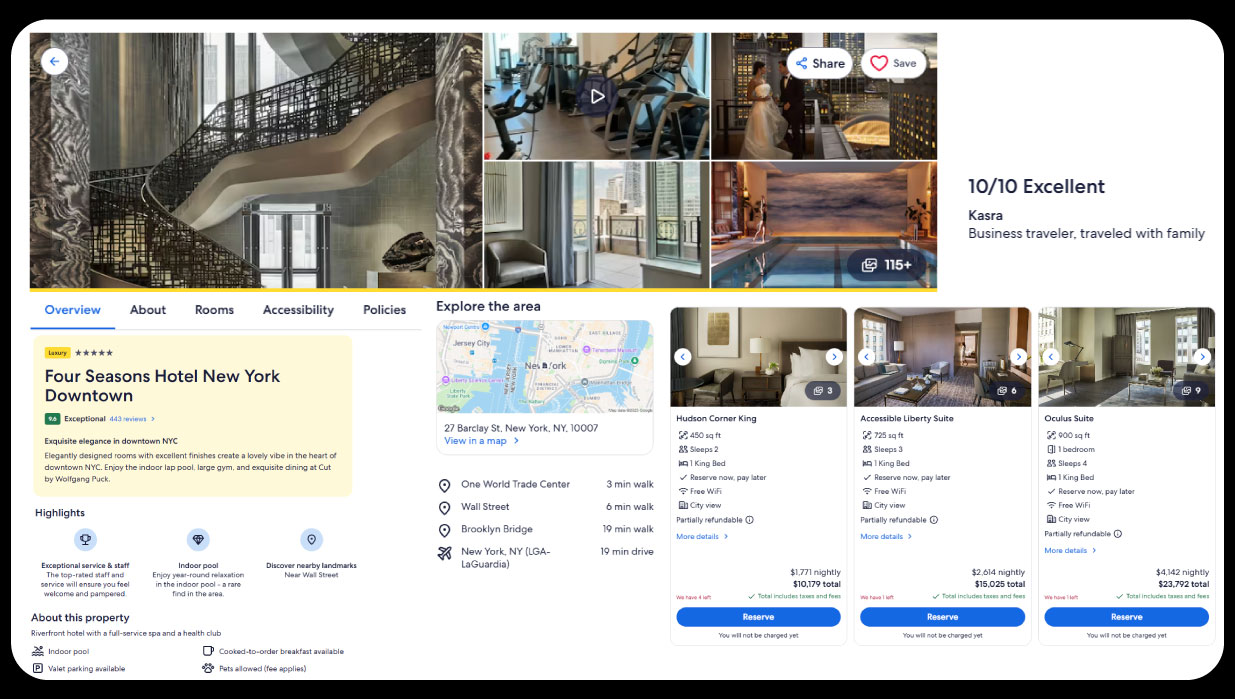

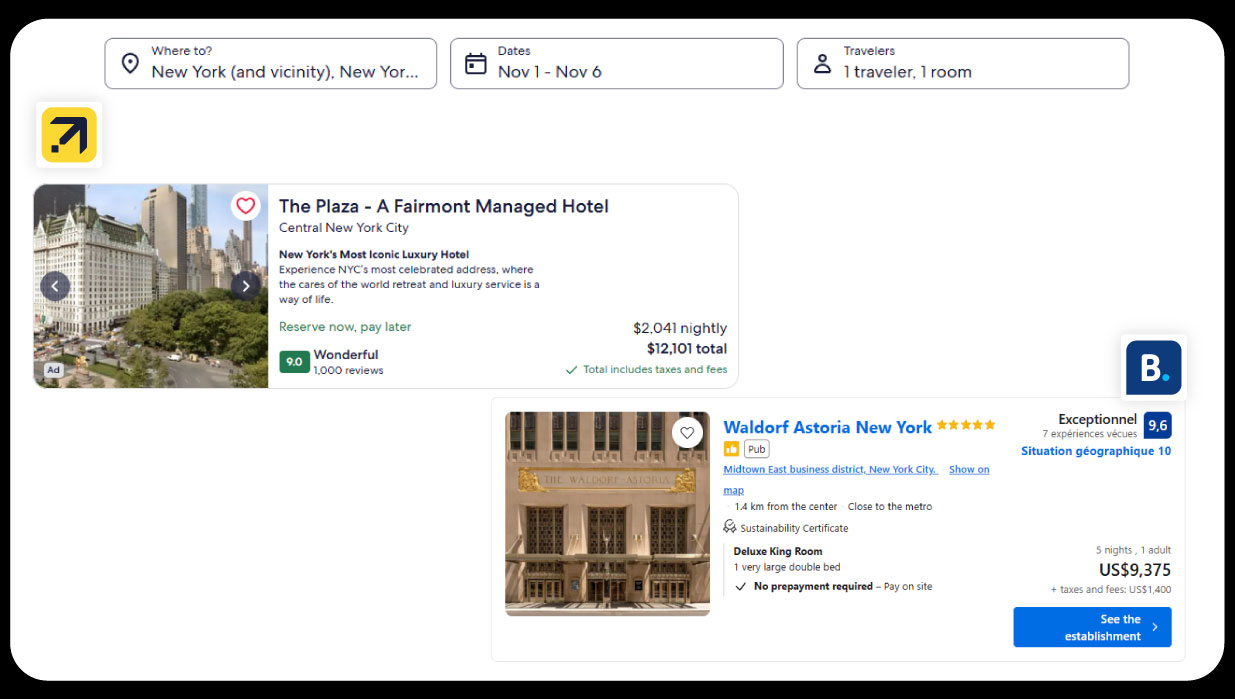

Expedia and Booking.com remain leaders in the OTA landscape, each with unique approaches to rate aggregation and inventory management. Expedia focuses on partnerships with airlines and large hotel chains, while Booking.com emphasizes a vast selection of independent properties. Therefore, comparative data scraping between both reveals micro-differences in rate algorithms and customer pricing transparency.

By leveraging Web Scraping Expedia OTA pricing intelligence, travel analysts and hotel brands can automate rate collection to assess how their listings rank in real-time price competition. The process involves structured scraping pipelines that pull rate, availability, room type, and user review data directly from OTA web structures or APIs.

Expedia and Booking.com dominate the global OTA market with distinct operational frameworks. Expedia operates through multiple sub-brands like Hotels.com and Orbitz, while Booking.com primarily functions under its single brand. However, their price-setting algorithms differ — Expedia’s dynamic pricing is often influenced by partner deals, while Booking.com prioritizes merchant rates and regional demand patterns.

In analyzing Scraping Booking.com New York hotel price trends data, it becomes evident that Booking.com adjusts more frequently based on occupancy triggers, particularly during weekends and major city events. Expedia, on the other hand, maintains a steadier rate but modifies aggressively during high booking surges.

A combination of rate scraping and predictive analytics helps decode this difference. The more datasets collected, the stronger the model becomes for identifying hidden opportunities like last-minute booking price drops or premium surge pricing windows.

The U.S. travel sector exhibits significant variation between east-coast and west-coast destinations. Using structured data scraping, rates can be compared across multiple travel dates and property categories.

Below is Table 1, illustrating real-time data extracted via scraping from Expedia and Booking.com for mid-range (3-star) and premium (4-star) hotels in both cities:

| City | OTA Platform | Hotel Category | Avg. Weekday Rate (USD) | Avg. Weekend Rate (USD) | Avg. Occupancy (%) |

|---|---|---|---|---|---|

| New York | Expedia | 3-Star | 238 | 282 | 86% |

| New York | Booking.com | 3-Star | 231 | 275 | 84% |

| New York | Expedia | 4-Star | 345 | 392 | 88% |

| New York | Booking.com | 4-Star | 338 | 385 | 86% |

| San Diego | Expedia | 3-Star | 175 | 198 | 79% |

| San Diego | Booking.com | 3-Star | 169 | 192 | 78% |

| San Diego | Expedia | 4-Star | 265 | 298 | 81% |

| San Diego | Booking.com | 4-Star | 259 | 293 | 80% |

The above data illustrates how Expedia maintains a slightly higher price margin across both destinations compared to Booking.com. New York’s high demand keeps occupancy levels above 85%, while San Diego’s coastal tourism moderates rates slightly below 80%. These figures, derived from scraping pipelines, enable pricing analysts to monitor elasticity and develop pricing optimization strategies.

When applying Expedia San Diego hotel rate Extraction, analysts can trace how coastal seasonality impacts rate adjustments, especially in the post-summer lull and pre-holiday uptick.

To understand broader market fluctuations, seasonal pricing trends are analyzed over three major travel windows: summer, fall, and holiday season. Using advanced scrapers, the datasets were collected from both Expedia and Booking.com for the same hotel segments.

Below is Table 2, showcasing rate variations across these seasonal windows:

| City | Season | Platform | Avg. Rate (USD) | Rate Change vs. Previous Season (%) |

|---|---|---|---|---|

| New York | Summer 2025 | Expedia | 332 | — |

| New York | Fall 2025 | Expedia | 305 | -8.1% |

| New York | Holiday 2025 | Expedia | 376 | +23.2% |

| San Diego | Summer 2025 | Expedia | 259 | — |

| San Diego | Fall 2025 | Expedia | 244 | -5.8% |

| San Diego | Holiday 2025 | Expedia | 288 | +18.0% |

| New York | Summer 2025 | Booking.com | 326 | — |

| New York | Fall 2025 | Booking.com | 298 | -8.6% |

| New York | Holiday 2025 | Booking.com | 370 | +24.1% |

| San Diego | Summer 2025 | Booking.com | 254 | — |

| San Diego | Fall 2025 | Booking.com | 239 | -5.9% |

| San Diego | Holiday 2025 | Booking.com | 282 | +18.1% |

This data reveals that both OTAs react similarly to seasonal peaks, but Expedia maintains a slightly higher average during the holidays—reflecting its corporate tie-ups and package-driven pricing. During Holiday Season Expedia data scraping from NYC, the data confirms a clear surge of over 23% in rates, aligning with pre-Christmas and New Year booking trends.

By contrast, Booking.com’s rates rise by 24.1% during the same period but from a slightly lower base. Such micro-variations matter for travel marketers and hotel chains optimizing OTA placement strategies.

The predictive modeling of hotel rates depends on accurate historical data collection. By continuously scraping Expedia and Booking.com, analysts can construct regression models that factor in seasonal elasticity, occupancy patterns, and event-based surges.

When you Scrape seasonal pricing pattern data of Expedia and Booking com, the time-series output helps forecast high-demand periods like summer holidays, local festivals, and conferences. For instance, New York hotel prices spike during global events such as New Year’s Eve and the UN General Assembly, whereas San Diego experiences seasonal lifts during Comic-Con and coastal festival months.

These insights aid hotels in dynamic pricing—adjusting rates automatically based on anticipated demand. OTAs, too, leverage scraped competitor data to balance visibility and margins across listings.

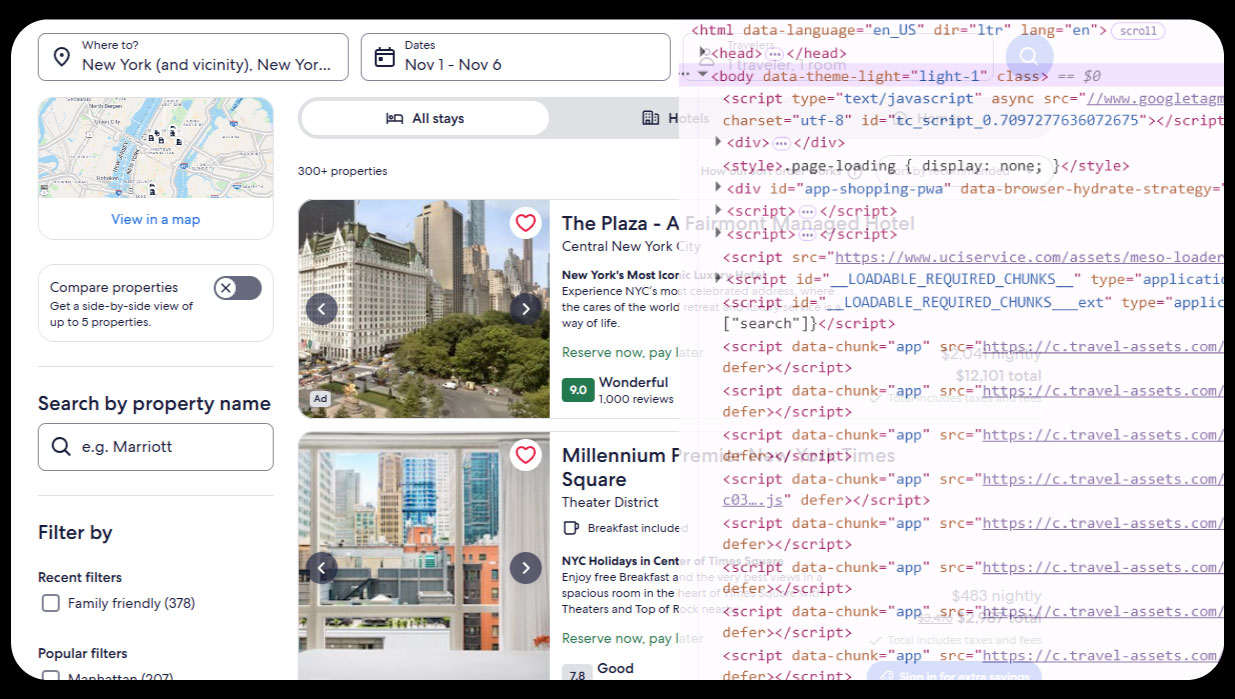

The process of data extraction requires a combination of crawling, parsing, and normalization tools. Modern scraping systems utilize AI-based selectors to navigate dynamic content loaded via JavaScript and AJAX requests.

Expedia travel data scraper tools rely on structured HTML parsing or API integration for seamless extraction of hotel details such as room category, cancellation policy, and average rating.

Similarly, a Booking.com Hotel Pricing Data Scraper uses browser automation frameworks like Playwright or Puppeteer to handle infinite scrolling and user interaction-based content loading. Data is then stored in a relational database for analysis using visualization platforms or Python-based dashboards.

Ethically, scraping should comply with robots.txt directives, respect request limits, and anonymize traffic to prevent rate manipulation or server overload.

After extracting large datasets, analysts convert raw numbers into meaningful visuals like trend lines and heatmaps. These visuals reveal pricing spikes and dips.

In our comparison:

Such insights derived from Expedia Travel Dataset help hoteliers make data-driven pricing decisions. Similarly, Booking.com Travel Dataset supports strategic planning for both independent hotels and corporate chains.

a. For Hotel Revenue Managers:

Hotels can set optimal room prices by analyzing competitor rates daily. Using scraped data, they ensure they never underprice during demand peaks or overprice during low occupancy.

b. For Travel Agencies:

Agencies use rate data to recommend best-value destinations or design seasonal tour packages for budget travelers.

c. For Data Analysts:

Continuous scraping of Expedia and Booking.com supports time-series forecasting models for travel demand.

d. For Tourists:

Consumers benefit indirectly when OTAs use scraped data to improve transparency and offer more competitive prices.

When Holiday Season Expedia data scraping from NYC was conducted, it revealed key insights:

This data suggests travelers increasingly pre-book through mobile apps, and both OTAs incentivize earlier bookings through reward point multipliers. In San Diego, the pricing momentum starts slower but peaks a week before Christmas.

Elasticity models built on scraped data show that a 10% rise in room price in New York typically reduces booking probability by 3.4%, while in San Diego, it drops by 2.1%. This implies NYC’s hotel market is more price-sensitive due to broader accommodation alternatives.

Continuous scraping ensures models stay updated, making rate recommendation systems smarter and more responsive to real-world shifts.

Once datasets are established, automation through APIs allows real-time updates into hotel management systems. APIs enable direct connections between OTA databases and pricing dashboards, reducing manual data refresh cycles.

By connecting the Expedia Travel Dataset with hotel property management software, pricing synchronization becomes seamless. Similarly, linking Booking.com Travel Dataset ensures consistent visibility across both platforms.

Machine learning models built on scraped OTA data allow predictive rate management. Algorithms identify historical trends, forecast demand, and recommend pricing tiers that optimize revenue.

For example, using Scrape Booking.com Travel Data, a model can predict likely rate changes during upcoming holiday weekends. Similarly, by analyzing Expedia Travel Dataset, it can forecast future seasonal surges or occupancy dips.

This approach benefits hotel operators by combining scraped data with weather patterns, flight arrivals, and local event schedules for more robust predictive accuracy.

The power to Scrape Expedia and Booking com hotel price lies in unlocking real-time visibility across one of the world’s most competitive industries. Whether used by hoteliers, data scientists, or travel platforms, scraped datasets offer granular insights into pricing, demand, and regional competitiveness.

By employing advanced data pipelines, businesses can Scrape Expedia Travel Data to track the evolving landscape of hospitality pricing more effectively. The ability to extract, clean, and analyze this data provides an unmatched strategic advantage.

With automation and integration tools to Extract Expedia Travel Data API, pricing intelligence can operate continuously, feeding dashboards and models that guide market response. Parallelly, Extract Booking.com Travel Data API to ensure businesses maintain parity across platforms—enhancing customer satisfaction and profitability in equal measure.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.