Indian festivals are more than just celebrations—they're also the perfect time for e-commerce giants to roll out mega discounts. Platforms like Myntra, Ajio, and Flipkart compete head-to-head, offering flashy deals to capture consumer attention. But who truly offers the best discounts during these festive sales? The answer lies in data. By using smart scraping techniques, one can Extract Festival Discounts from Myntra, Ajio, and Flipkart and compare them in real time.

Understanding this competitive landscape requires structured and accurate data. Comparing festival pricing across platforms during peak sales—like Diwali, Dussehra, Holi, and Eid—can uncover price trends, product preferences, and discount strategies. Consumers often assume they're getting the best deal, but how do we verify it? The answer is Festival Sale Price Comparison: Myntra vs Ajio vs Flipkart, driven by automated data extraction. Scraping gives retailers and analysts a powerful lens into real-time product pricing, promotional patterns, and inventory shifts during festival seasons. To do this effectively, one must rely on Scraping Indian eCommerce Sites for Festival Offers, ensuring data is pulled ethically and within legal frameworks for analysis. Now let's explore how web scraping helps break down these e-commerce wars.

During festival seasons, online platforms deploy a range of marketing tactics—from lightning deals and cashback offers to limited-edition product bundles. However, these offers fluctuate rapidly. Manual tracking is nearly impossible for businesses trying to analyze competitors or build price intelligence systems.

Automated scraping helps in:

If you're looking to become a retail analytics leader, this data is gold.

Start leveraging fashion data today—scrape, analyze, and outperform your competition with our expert fashion data scraping services!

Here's a simplified scraping pipeline designed for this exact use case:

1. Define Target Categories

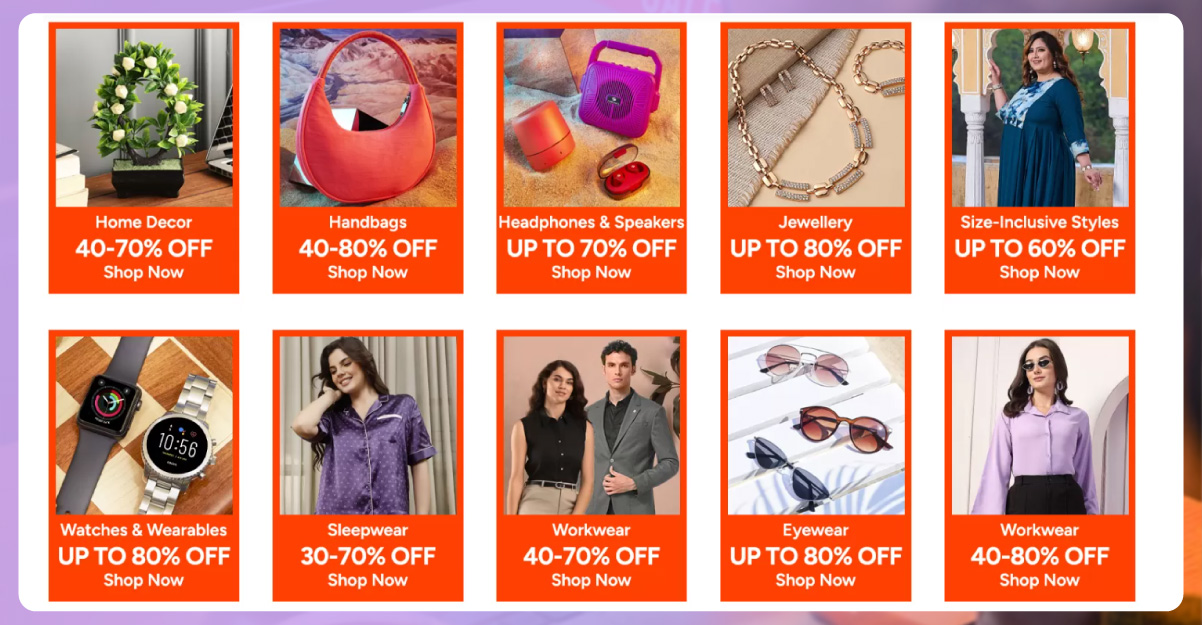

Start by identifying high-value categories where customers are most price-sensitive during festivals: ethnic wear, footwear, electronics, and accessories.

2. Set Up Crawlers

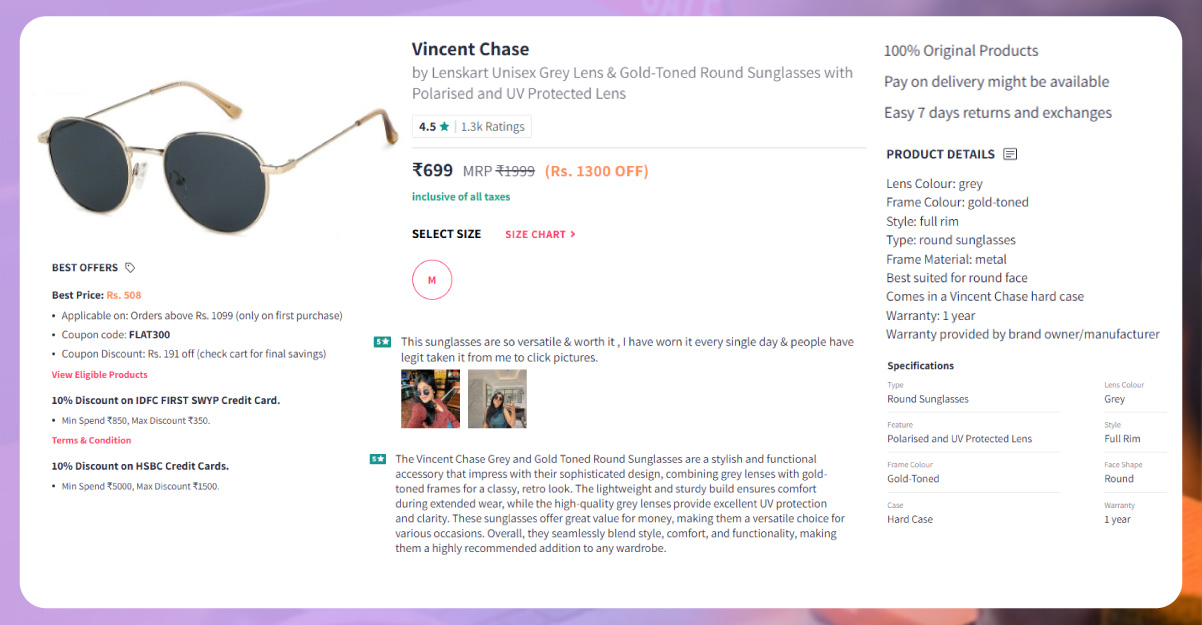

Build or use tools like Scrapy, BeautifulSoup, or Puppeteer to collect data such as:

3. Normalize the Data

Each platform might use slightly different data structures. Once scraped, standardize formats so data from Myntra, Ajio, and Flipkart can be compared seamlessly.

4. Calculate Discount Percentages

Apply formulas to derive the actual discount offered (Original Price – Sale Price / Original Price * 100).

5. Visualize and Compare

Dashboards and visualizations can highlight which platforms offer deeper discounts on similar products.

Festival price monitoring requires efficient scraping tools that can scale, rotate IPs, and bypass basic bot protections.

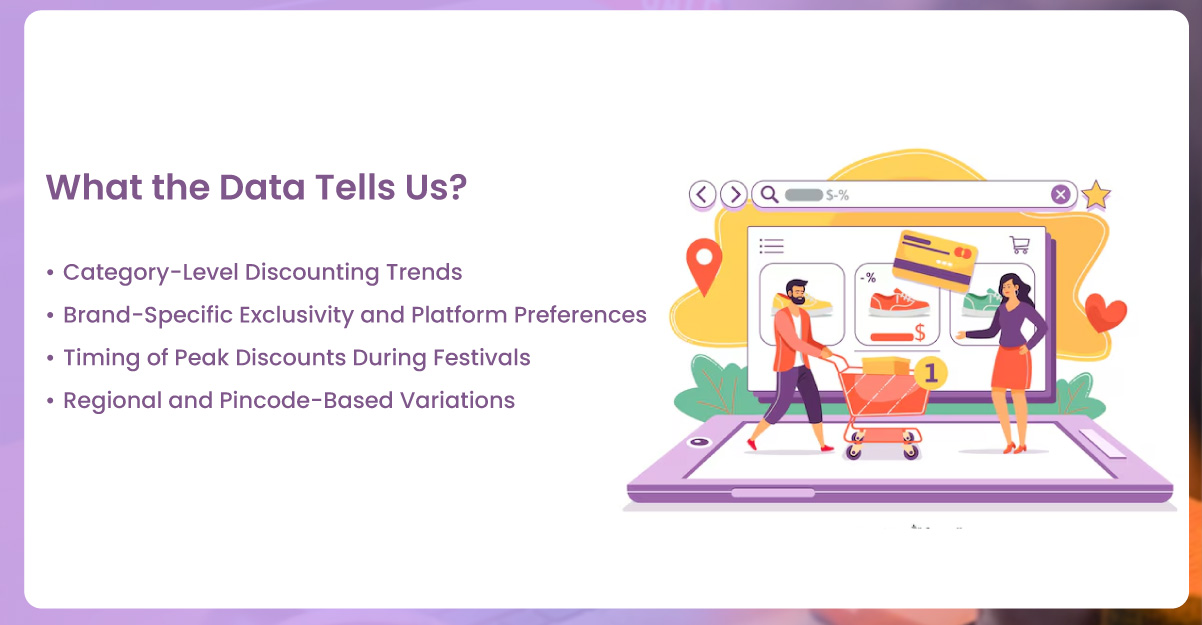

Once you've collected several weeks of data from Myntra, Ajio, and Flipkart during major Indian festivals—such as Diwali, Dussehra, and Independence Day—you'll begin to uncover powerful trends and insights that reveal how these platforms structure their discounting strategies. Here are some of the most valuable patterns:

These comprehensive insights empower multiple departments within a business:

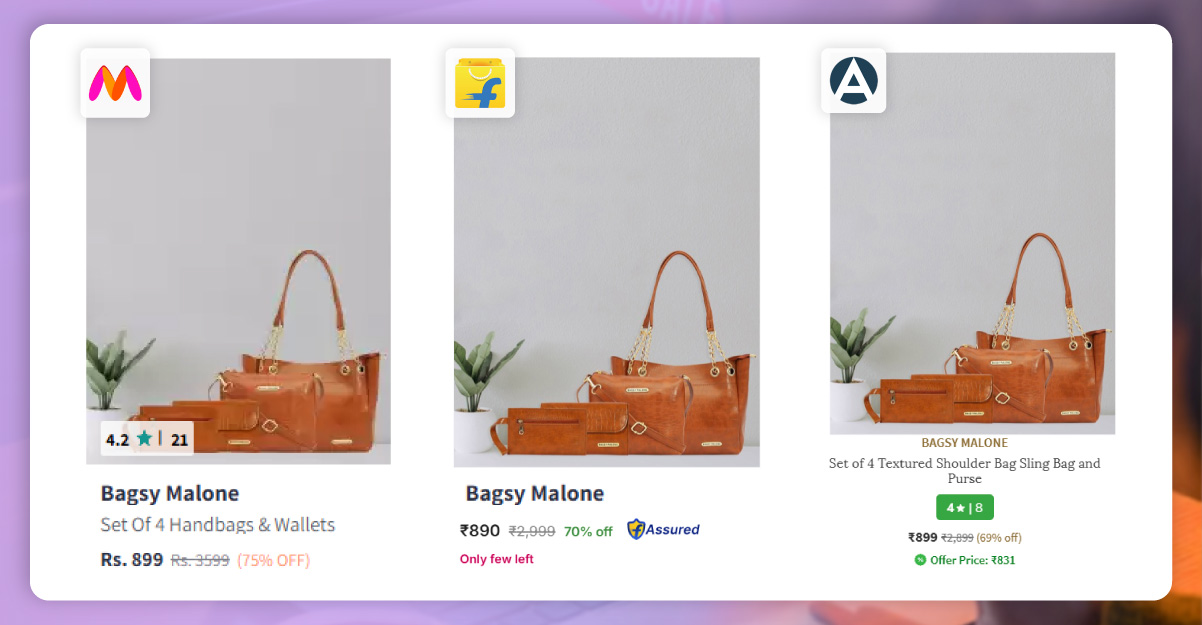

Let's say you scrape 500 women's kurtas from Myntra, Ajio, and Flipkart during the Diwali sale:

Such granular analysis is only possible if you Extract Festival Season Deals Using Scraping in a structured format.

Myntra often has curated festival collections. If you're a fashion aggregator, you'll want to Extract Myntra Product Data , including SKU, festive tags (e.g., Diwali Special), and stock status to track sell-outs in real time.

Ajio is known for aggressive pricing during sales. Businesses focusing on Ajio's private labels, such as "DNMX" or "Fusion," can benefit from Web Scraping Ajio Product Data , which enables tracking of both price elasticity and seasonal performance.

Flipkart combines electronic deals with fashion bundles, creating cross-category sales. Brands and affiliate marketers seeking to optimize their links can benefit from Flipkart Data Scraping Services, which tracks commission-eligible products and prices.

Scraping data during festival sales goes beyond just comparing discounts:

These insights are only possible when you regularly Extract Popular E-Commerce Website Data at scale.

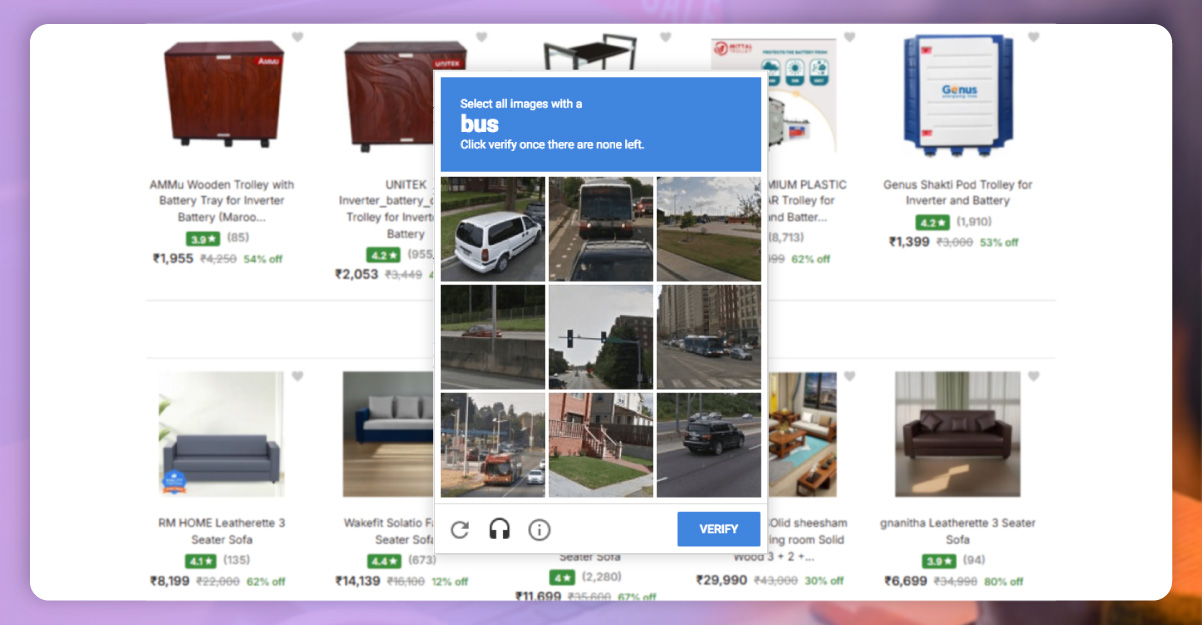

1. Website Restrictions: Myntra and Ajio often update their DOM during sales to prevent scraping.

2. Anti-Bot Mechanisms: Captchas, rate-limiting, and IP blocking are standard.

3. Data Volatility: Prices change hourly. Time-synced scraping is critical.

4. Data Volume: Festival sales include millions of products. Efficient scraping and storage are key.

5. Legal Compliance: It's vital to use scraping for competitive intelligence, not for violating TOS or reselling data.

1. Automated Extraction of Fashion Product Listings

We scrape

fashion product data, including titles, prices, sizes, colors, availability, and images from

platforms like Myntra, Ajio, Flipkart, and more.

2. Trend Monitoring and Discount Tracking

Track seasonal changes

in product popularity, promotional offers, and discounts to identify pricing trends across

various fashion categories and brands.

fashion product data, including titles, prices, sizes, colors, availability, and images from

platforms like Myntra, Ajio, Flipkart, and more.

3. Collect Customer Reviews and Ratings

We gather and structure

user-generated content, such as reviews and ratings, to help brands analyze customer sentiment

and improve product offerings.

4. Competitor Analysis in Real-Time

Our tools enable you to

monitor competitor inventories, new arrivals, and promotional strategies in real time, helping

you stay ahead in the market.

5. Location-Based and Brand-Specific Insights

We offer

pincode-wise availability, regional pricing, and exclusive brand deal data to help businesses

make hyper-targeted marketing and logistics decisions.

Indian festivals are when consumer spending peaks, and e-commerce platforms battle fiercely with discount wars. By scraping data ethically and efficiently, businesses can decode which platform—Myntra, Ajio, or Flipkart—is truly winning the festival game. With tools that Extract Popular E-Commerce Website Data, retail strategists can build dashboards to map market behavior, optimize pricing, and improve conversions. If you're building long-term scraping strategies, integrating the Ecommerce Product Ratings and Review Dataset can offer an even richer context to understand buyer satisfaction. Our ECommerce Data Intelligence Services are designed to help you gather, clean, and interpret product, price, and promotional data from major platforms, enabling you to take smarter business actions. Whether you're a brand, startup, analyst, or digital marketing agency, our E-commerce website scraper solutions are tailored to keep you ahead during every Indian festival rush.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.