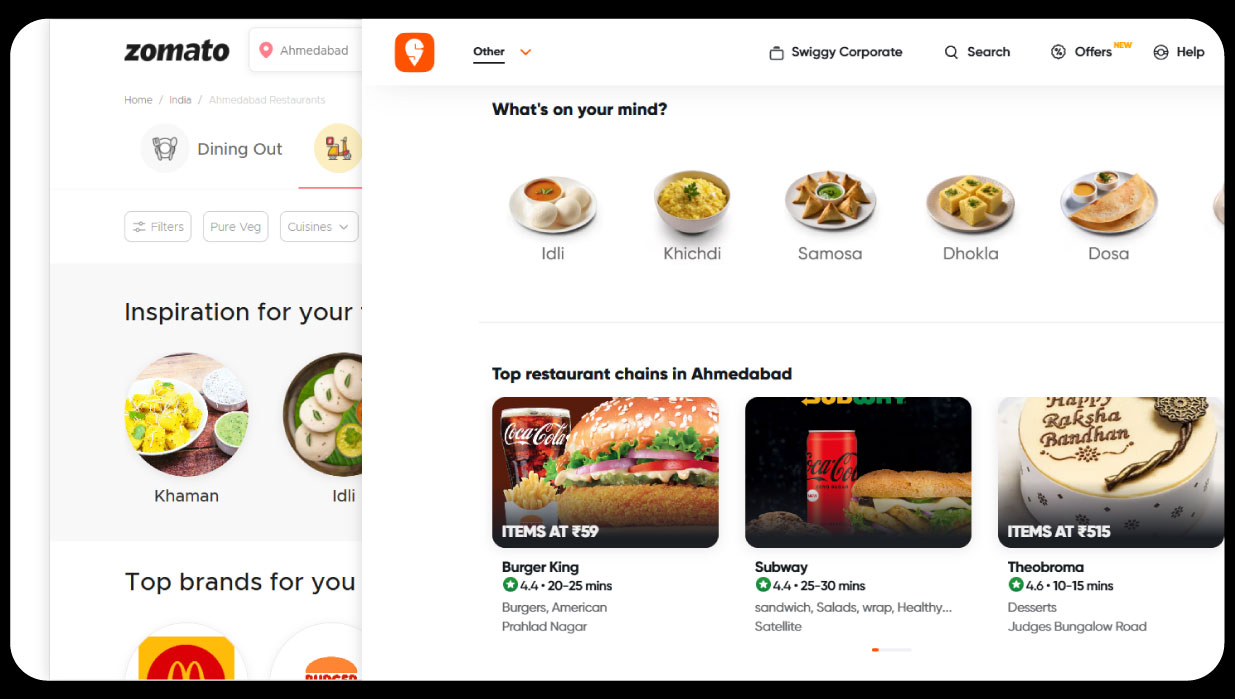

India’s food delivery industry has seen a paradigm shift in recent years, with Tier 2 cities emerging as significant contributors to growth. As urbanization spreads beyond metros, platforms like Zomato and Swiggy are witnessing rising adoption rates in cities like Bhopal, Jaipur, Coimbatore, Lucknow, and Bhubaneswar. These regions showcase unique consumption patterns, price sensitivities, and cuisine preferences that are vastly different from those in Tier 1 cities. Businesses seeking to stay competitive and hyperlocal must Extract Food Delivery insights from Tier 2 cities India to stay ahead of evolving food habits.

The evolving preferences and digital behavior of consumers from Tier 2 locations reveal a promising market. By Scraping Food Behavior from India Tier 2 Cities, businesses, restaurant chains, and cloud kitchens can decode consumer intent, regional taste inclinations, and growth opportunities in real time. With the growing popularity of mobile food delivery and increased trust in digital payments, platforms like Zomato and Swiggy have become indispensable data sources for behavioral analysis.

To better understand this market, it’s essential to Scrape Food Ordering Trends in Tier 2 Indian Cities, highlighting differences in delivery times, average order value, preferred cuisines, and the impact of discounts or seasonal campaigns.

Between 2020 and 2025, Tier 2 cities in India have seen an exponential increase in food delivery app usage. As per industry data, these cities contributed over 32% of Zomato and Swiggy’s total order volume in 2024. Several factors drive this:

The need to extract Zomato & Swiggy user preferences data from these regions becomes even more vital when launching new products or planning targeted marketing campaigns.

Table 1: Food Ordering Behavior Comparison – Tier 1 vs Tier 2 Cities (Jan–June 2025)

| Metrics | Tier 1 Cities (Metro) | Tier 2 Cities |

|---|---|---|

| Avg. Order Value | ₹440 | ₹295 |

| Delivery Time (Avg.) | 28 minutes | 32 minutes |

| Most Ordered Item | Biryani | Paneer Butter Masala |

| Discount Usage % | 38% | 62% |

| Late Night Orders (Post 11PM) | 18% | 9% |

| Avg. Items per Order | 2.9 | 2.3 |

| Preferred App | Zomato | Swiggy |

The table above showcases key differences in user behavior. While metros have higher average order values, Tier 2 cities exhibit greater sensitivity to discounts and slightly longer delivery times. The most interesting insight is that Swiggy has gained a slight edge in Tier 2 cities due to its hyperlocal partnerships and faster onboarding of local vendors.

While both Zomato and Swiggy have deep market penetration, their growth strategies differ across Tier 2 cities.

Zomato

The need for Zomato & Swiggy data scraping in India arises when businesses aim to measure market reach, user engagement, and pricing strategies across these diverse platforms.

Understanding what people eat is critical to making product and partnership decisions. Tier 2 cities often show strong loyalty to local cuisines, even while exploring mainstream food items.

Most Ordered Items by Region (April–June 2025)

By using a Swiggy vs Zomato order trend data scraper, brands can track not only what’s trending but also how food preferences shift during festivals, weather changes, or promotional campaigns.

Table 2: Popular Cuisine Categories by Order Volume – Tier 2 (April–June 2025)

| Cuisine Category | % Share in Orders | Most Active City |

|---|---|---|

| North Indian | 29% | Jaipur |

| South Indian | 21% | Coimbatore |

| Chinese | 18% | Lucknow |

| Fast Food (Burgers) | 12% | Indore |

| Street Food | 10% | Patna |

| Bakery/Desserts | 6% | Bhopal |

| Others | 4% | Bhubaneswar |

These data points offer actionable insights for anyone developing menus or marketing campaigns. Businesses can use Swiggy Food Delivery App Datasets to analyze which food segments are gaining traction and what time slots show the highest delivery frequency.

To gather data effectively from Zomato and Swiggy, scraping tools are deployed with features such as:

Most importantly, Restaurant Data Scraping Service solutions must remain compliant with each platform’s terms of service and ensure ethical use of data.

Despite these hurdles, the volume and variety of Tier 2 food delivery data make it a high-value asset for brands looking to localize offerings and grow efficiently.

A cloud kitchen brand planning to expand to Tier 2 cities used scraped data from both platforms to assess viability. The insights helped the brand:

This approach cut their entry cost by 30% and increased order volume in new cities by 45% within 90 days.

India’s Tier 2 cities present an untapped goldmine of food delivery insights. The rising order volumes, regional food preferences, and evolving consumer expectations make it critical for stakeholders to invest in continuous data extraction and trend analysis. Whether you're a food aggregator, brand, or restaurant chain, using data to understand these markets is no longer optional—it's essential.

Food Delivery Data Intelligence Services now play a pivotal role in helping businesses act on real-time insights. These services support expansion planning, dynamic pricing, and localized marketing. Similarly, Restaurant Data Intelligence Services empower chains and aggregators to refine offerings, monitor partner performance, and innovate menus in sync with regional preferences.

With access to accurate Food Delivery App Menu Datasets , businesses can monitor what’s being served, what’s being ordered, and what trends are emerging next—making them future-ready in the competitive Tier 2 food delivery ecosystem.

Experience top-notch web scraping service and mobile app scrapingsolutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.