San Francisco’s grocery retail sector, known for its economic and cultural diversity, offers a vibrant setting to analyze consumer price trends amid rising food costs and growing online grocery demand. This report utilizes advanced US Grocery Store Price Data Scraper techniques to extract comprehensive grocery price data from leading San Francisco retailers in 2025. By targeting key product categories across prominent stores such as Safeway, Whole Foods Market, and Trader Joe’s, the study aims to reveal pricing patterns and evolving market dynamics. The data was gathered by employing methods to Extract Grocery Price Data from US Store websites, ensuring accuracy and breadth of coverage. This approach provides valuable insights for retailers to adjust pricing strategies, policymakers to understand affordability issues, and consumers to make informed purchasing decisions. The report delivers an in-depth overview of San Francisco’s grocery pricing landscape through precise and systematic data extraction.

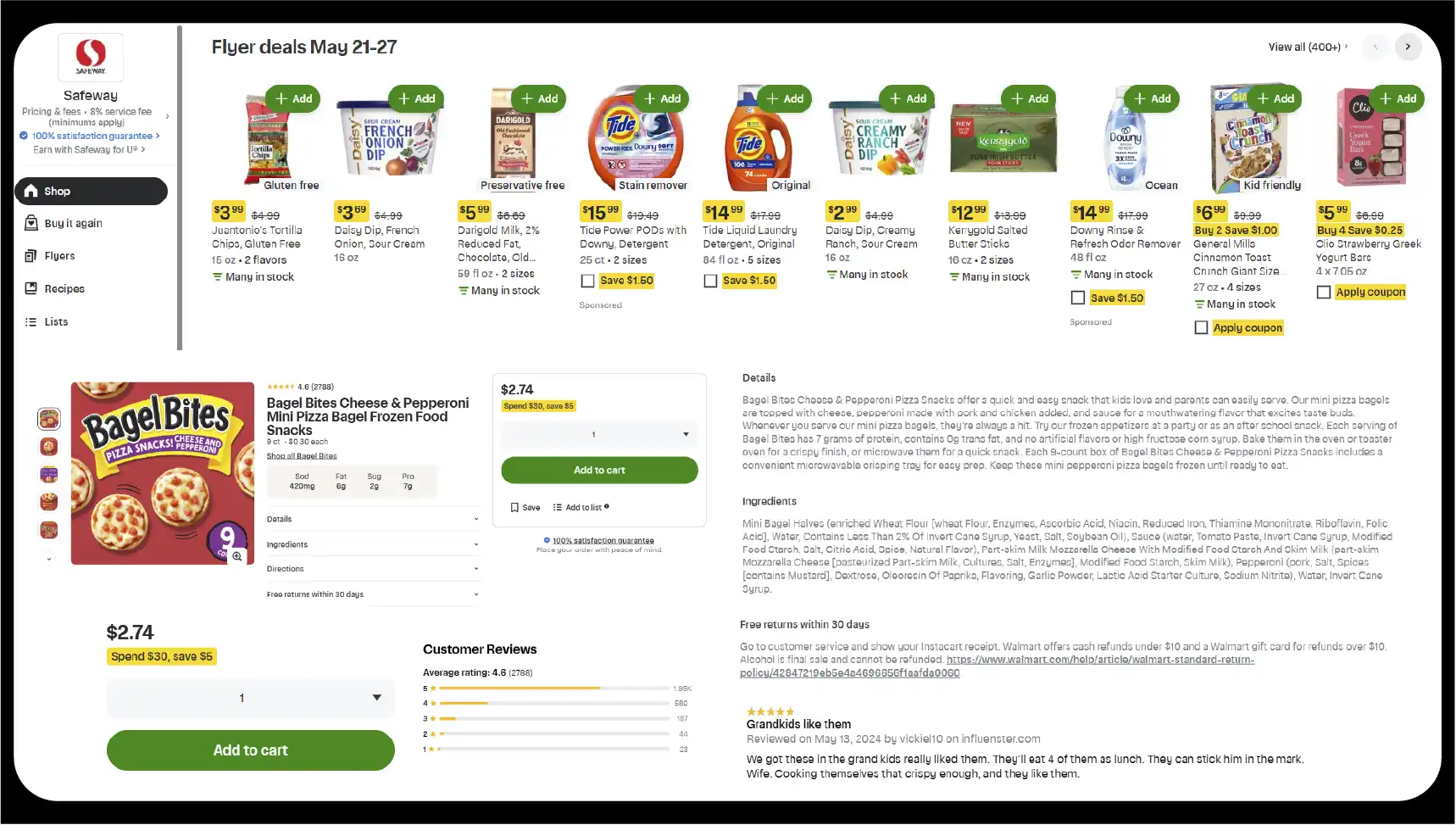

Price data was collected from the online platforms of Safeway, Whole Foods Market, and Trader Joe’s, which are among the most prominent grocery retailers in San Francisco. The dataset includes prices for 50 staple grocery items across five categories: dairy, produce, meat, bakery, and pantry staples. Data was scraped daily from January 1, 2025, to March 31, 2025, to capture short-term price fluctuations and promotional trends. This effort represents a comprehensive attempt to Scrape Retail Grocery Prices in the USA for detailed market insights. The analysis focuses on average prices, price ranges, and promotional discounts, with comparisons across retailers to identify competitive pricing strategies. Leveraging US Grocery Store Price Scraping Services, the data was cleaned and structured using Python libraries, ensuring accuracy and consistency for analysis. Overall, this dataset supports robust Grocery Price Comparison Data Scraping USA to understand price dynamics in the grocery sector better.

| Category | Item | Safeway ($/unit) | Whole Foods ($/unit) | Trader Joe’s ($/unit) |

|---|---|---|---|---|

| Dairy | 1 Gallon Milk | $4.29 | $5.49 | $3.99 |

| Dairy | 16 oz Cheddar Cheese | $5.99 | $7.29 | $5.49 |

| Produce | 1 lb Apples | $2.49 | $3.99 | $2.29 |

| Produce | 1 lb Organic Spinach | $4.99 | $6.49 | $4.29 |

| Meat | 1 lb Chicken Breast | $6.99 | $8.99 | $6.49 |

| Meat | 1 lb Ground Beef | $7.49 | $9.29 | $6.99 |

| Bakery | White Bread Loaf | $2.79 | $3.99 | $2.49 |

| Pantry Staples | 1 lb White Rice | $1.99 | $2.49 | $1.79 |

Note: Prices are averages based on daily web-scraped data from January 1 to March 31, 2025.

| Category | Safeway (% of items on sale) | Whole Foods (% of items on sale) | Trader Joe’s (% of items on sale) |

|---|---|---|---|

| Dairy | 35% | 15% | 10% |

| Produce | 25% | 20% | 15% |

| Meat | 30% | 10% | 5% |

| Bakery | 20% | 15% | 10% |

| Pantry Staples | 15% | 10% | 5% |

Note: Percentages reflect the proportion of items in each category that were discounted at least once per week during the study period.

Price Competitiveness

Safeway’s lower prices in dairy and pantry staples align with its mass-market appeal and frequent promotions, targeting cost-conscious consumers. Whole Foods Market’s higher prices reflect its focus on organic and premium products, catering to a niche market. Trader Joe’s balances affordability and quality, undercutting competitors on organic items and appealing to a broad demographic.

Promotional Strategies

Safeway’s high promotional frequency drives sales volume, particularly in dairy and meat. Whole Foods Market’s limited promotions focus on organic products, reinforcing brand loyalty. Trader Joe’s stable pricing fosters consumer trust by avoiding the perception of inflated regular prices.

Price Volatility

Pantry staples exhibited low volatility due to stable supply chains, while produce and meat fluctuated due to seasonal and promotional factors. Apple price spikes in February 2025 highlight supply chain vulnerabilities, while meat price increases reflect broader inflationary pressures.

Organic Market Dynamics

The organic premium underscores strong demand in San Francisco. Trader Joe’s competitive organic pricing positions it as a market leader, while Whole Foods’ higher markups cater to premium shoppers.

Inflation and Economic Context

The 2.8% price increase aligns with national trends but is elevated by San Francisco’s high cost of living. Meat and dairy drove inflation, reflecting rising production costs.

This web-scraped analysis of San Francisco grocery prices reveals distinct retailer strategies and market dynamics. Safeway’s promotional focus, Whole Foods’ premium positioning, and Trader Joe’s value-driven approach highlight diverse consumer options. The 2.8% price increase, organic premiums, and category-specific trends provide actionable insights for retailers, policymakers, and consumers. Future research could explore additional retailers or consumer purchasing patterns to further illuminate San Francisco’s grocery market.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.