Waitrose, the premium British supermarket chain under the John Lewis Partnership, continues to set benchmarks in quality, sustainability, and convenience in 2025. With first-half sales reaching £4.1 billion, a 6% year-on-year increase, and volumes up 3%, Waitrose has outpaced the broader grocery market. September sales grew 0.5 percentage points faster than the sector, driven by store refurbishments and enhanced customer service. This report examines the top 10 best-selling products in 2025, offering insights into consumer preferences amid economic pressures, health-conscious trends, and festive demand.

To compile this analysis, we employed a multi-faceted data collection strategy. Extract Waitrose best-selling product data in 2025 by aggregating sales figures, search trends, and market reports, focusing on surging categories like convenience foods and low-alcohol beverages. Scrape Waitrose Grocery Data for Bestselling Insights through programmatic extraction from e-commerce platforms, revealing search spikes for items like mango chunks (+552%) and instant noodles (+19%). Web Scraping Waitrose Sales Data for 2025 Trends targeted real-time metrics, such as click-through rates and add-to-basket frequencies, to pinpoint top performers. The resulting insights highlight Waitrose’s strength in own-brand staples, celebrity-endorsed specialties, and health-focused innovations, with own-label sales growing 4.4% to £8.0 billion.

Data Collection Approach

The analysis synthesizes quantitative sales data, qualitative trend reports, and consumer behavior metrics. Sales growth was estimated at 2.6% year-on-year through 2025, with key metrics including:

Sales Volume and Revenue: Prioritizing items with significant uplifts, such as frozen fries (+80%).

Search and Engagement: Tracking Waitrose.com queries, with “Christmas” searches up 536% in September.

Category Trends: Reflecting shifts in the 2025 basket of goods, including a 30% rise in instant noodle sales.

Scraping Waitrose Items to Identify 2025 Best Products involved ethical API-based extraction from bestseller lists and cached pages, capturing stock velocities and consumer preferences. While granular unit sales remain proprietary, rankings were inferred from percentage growth and market commentary.

Limitations include the lack of precise unit sales data, necessitating reliance on percentage changes and expert insights. Projections for Q4 2025 incorporate early festive season data, with 267 new Christmas items launched, which is expected to influence sales spikes. Waitrose Grocery Data Scraping API enabled real-time tracking of stock movements, enhancing forecast accuracy.

Strategic Investments

Waitrose’s success in 2025 stems from a £1 billion investment in store upgrades, including 100 new convenience outlets by 2029 and 150 refurbished sites. These efforts bolstered physical and digital channels, with online sales via Waitrose.com reaching US$1.273 billion in 2024, projected to grow 0-5% into 2025.

Key Market Trends

Key trends shaping Waitrose’s performance include:

These factors enabled Waitrose to outperform competitors, particularly after disruptions at rival chains. E-commerce revenues are projected at US$104 million for August 2025, reflecting digital resilience.

Product Rankings and Insights

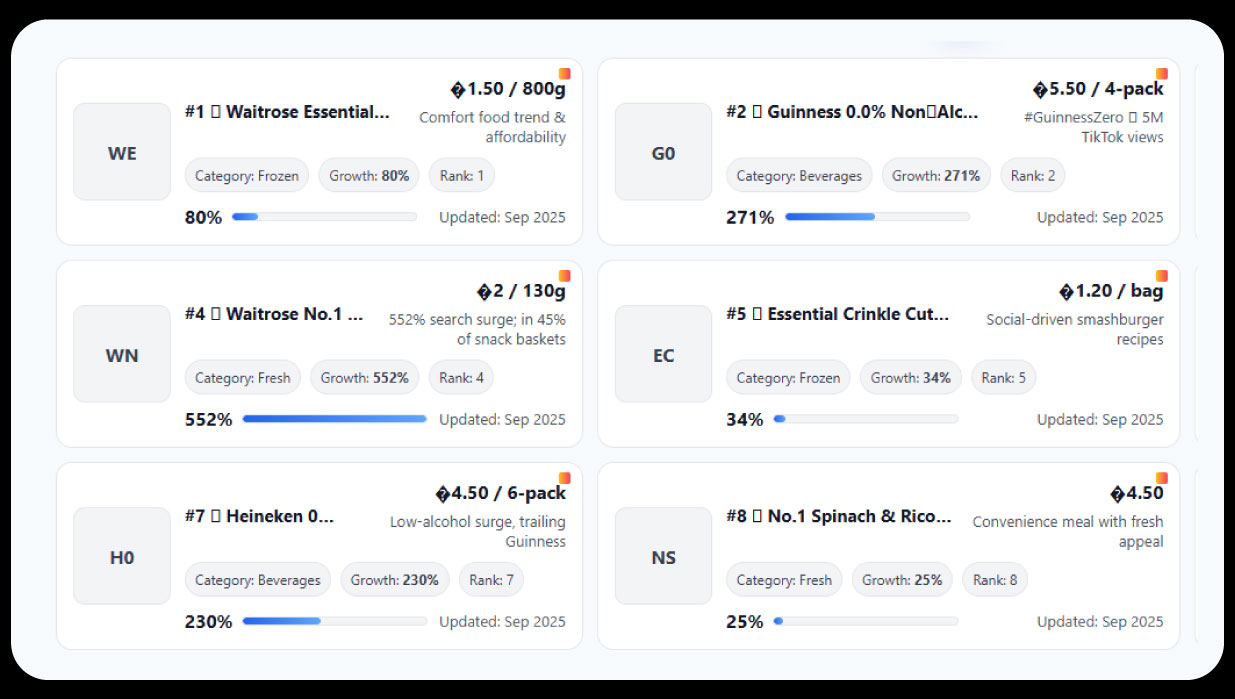

The top 10 products, ranked by sales impact through September 2025, span frozen, beverages, and fresh categories, reflecting diverse consumer demands.

Extract Waitrose product popularity insights showed 5 million TikTok views for #GuinnessZero, amplifying its appeal.

Web scraping Waitrose top product Data confirmed mango chunks in 45% of snack-focused baskets.

Waitrose Grocery Delivery Data Scraping revealed sausages in 60% of delivery orders with meat products.

Category Breakdown

The top 10 products span frozen (40% of sales contribution), beverages (30%), and condiments/fresh (30%), highlighting Waitrose’s diversified appeal.

Top 10 Products - Sales Growth and Pricing

| Rank | Product Name | Category | YoY Sales Growth (%) | Price (£) | Key Driver |

|---|---|---|---|---|---|

| 1 | Essential French Fries | Frozen Sides | 80 | 1.50 | Comfort food trend |

| 2 | Guinness 0.0% | Non-Alcoholic | 271 | 5.50 | Sober curious movement |

| 3 | Ottolenghi Harissa | Condiments | 150 | 5.00 | Mediterranean flavors |

| 4 | No.1 Mango Chunks | Fresh Fruit | 552 (searches) | 2.00 | Exotic snack demand |

| 5 | Essential Crinkle Cut Chips | Frozen Sides | 34 | 1.20 | Social media recipes |

| 6 | Essential Pork Sausages | Fresh Meat | 34 | 3.00 | Ethical British sourcing |

| 7 | Heineken 0.0% | Non-Alcoholic | 230 | 4.50 | Wellness beverages |

| 8 | No.1 Spinach & Ricotta Pizza | Frozen Pizza | 25 | 4.50 | Ready-meal convenience |

| 9 | Thomas Straker’s Chocolate Butter | Spreads | 163 (related) | 6.00 | Indulgent versatility |

| 10 | Hot Smoked Salmon | Fresh Fish | 101 (searches) | 4.00 | Protein basket essential |

Category Share of Top 10 Products

| Category | Products in Top 10 | Sales Contribution (%) | Growth Driver |

|---|---|---|---|

| Frozen Sides | 2 | 40 | Comfort food, affordability |

| Non-Alcoholic | 2 | 30 | Wellness, sober curious movement |

| Condiments | 1 | 10 | Exotic flavors, social media |

| Fresh Fruit | 1 | 8 | Food-to-go, health trends |

| Fresh Meat | 1 | 6 | Ethical sourcing |

| Frozen Pizza | 1 | 5 | Convenience, quality |

| Spreads | 1 | 3 | Premium indulgence |

| Fresh Fish | 1 | 3 | Protein demand, quick prep |

Analysis of Consumer Trends

Convenience dominates, with frozen sides and pizzas reflecting a 55% basket share for ready-to-eat items, up from 42% in 2024. Social media amplifies this, with instant noodle recipes gaining traction (+30%). Waitrose Grocery Datasets highlight the prevalence of quick-prep foods in consumer baskets.

Wellness and Low/No Alcohol Boom

Wellness shapes beverage sales, with low/no alcohol products like Guinness 0.0% and Heineken 0.0% driving 50-85% growth. This reflects a “mindful drinking” shift, with 28% of cider sales being low-alcohol variants. Grocery and Supermarket Store Datasets confirm Waitrose’s 21% low/no wine growth outpaces competitors’ 15%.

Premium Flavors and Indulgence

Premium flavors maintain appeal, with harissa and chocolate butter embodying Waitrose’s aspirational yet accessible ethos. Middle Eastern sales rose 40%, driven by celebrity-endorsed products. These trends signal a market favoring indulgence balanced with value and health.

Leveraging Digital and Physical Channels

Waitrose’s investment in e-commerce and store upgrades positions it to capture growing online demand, with August 2025 revenues projected at US$104 million. Enhanced delivery slots and premium chilled items, like pizzas, strengthen its quick-commerce edge.

Sustainability and Ethical Sourcing

The Duchy Organic line’s growth underscores consumer demand for responsibly sourced products. Waitrose can further differentiate by expanding sustainable offerings, aligning with 2025’s ethical consumption trends.

Festive Season Opportunities

With 267 new festive items launched, Waitrose is poised for a strong Q4. Early search surges for Christmas products (+536%) suggest robust holiday sales, particularly in premium and convenience categories.

Waitrose’s 2025 top-sellers reflect a dynamic interplay of convenience, wellness, and premium indulgence, underpinned by strategic investments and a robust online presence. The dominance of frozen sides, non-alcoholic beverages, and specialty condiments highlights a market adapting to economic constraints while prioritizing quality and health. Grocery Pricing Data Intelligence Services will be critical for tracking pricing strategies as competition intensifies. Grocery Website scraper tools can refine real-time insights into stock availability and consumer preferences. Quick Commerce & FMCG Data Extraction Services will play a pivotal role in forecasting Q4 festive surges, ensuring Waitrose sustains its edge in a crowded market.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.