The real estate sector continues to evolve rapidly, shaped by economic recovery patterns, demographic shifts, and emerging data intelligence systems. In this report, we present a detailed overview of global real estate market data analysis, supported by reliable forecasts, analytical methodologies, and data-driven insights for 2026. By integrating advanced algorithms to Scrape real estate market analysis data, the study emphasizes predictive accuracy and actionable insights for investors, developers, and policymakers worldwide. Furthermore, tools like a global property data Extractor have allowed researchers to compile, clean, and evaluate large-scale housing and commercial property records with remarkable precision.

The core objective of this report is to provide a well-structured forecast of the global real estate market up to 2026 using quantitative data, predictive modeling, and comparative analytics. The methodologies applied include:

The real estate market forecast 2026 suggests moderate but steady growth across global regions, led by rising housing demands and infrastructural development in Asia-Pacific and North America. Inflation-adjusted property prices are expected to increase by 7.5% globally, with emerging cities outperforming traditional hubs.

Key Drivers:

Conversely, high interest rates and tightening monetary policies may slightly dampen affordability in 2025–2026, particularly across Western Europe and parts of the U.S.

Using advanced housing market data analytics, several patterns have emerged:

| Region | Average Annual Price Growth (2022–2026) | Primary Growth Factors | Forecasted Median Price (USD/sq.m) |

|---|---|---|---|

| North America | 6.8% | Suburban expansion, tech migration | $3,150 |

| Europe | 4.5% | Energy-efficient renovations, migration inflow | $3,480 |

| Asia-Pacific | 9.3% | Urbanization, infrastructure investment | $2,620 |

| Middle East | 7.1% | Luxury developments, foreign capital inflow | $2,950 |

| Latin America | 5.9% | Tourism and rental yield demand | $1,870 |

Interpretation:

Asia-Pacific’s dominance underscores the importance of affordability, rapid development, and high rental yields. North America maintains its stability through tech-driven suburban growth, while Europe’s focus on eco-friendly building technologies continues to attract investment.

Analysts continue to Extract real estate trends 2026 to understand post-pandemic transformations. Data scraping revealed that rental occupancy rates, previously volatile in 2020–2022, are now stabilizing with a 12% increase in long-term leasing in major cities like Toronto, Berlin, and Tokyo.

Key Emerging Trends:

Predictive insights show that digital adoption and environmental consciousness will remain the dual pillars of real estate market sustainability in 2026.

Comparative studies of residential vs. commercial data insights reveal diverging performance metrics between these two major asset classes. The residential segment continues to outperform due to consistent demand, whereas commercial real estate faces mixed recovery patterns in urban areas.

| Property Type | Global Growth Forecast (2022–2026) | Investment Return (Avg.) | Risk Index |

|---|---|---|---|

| Residential | 8.4% | 7.9% | Low |

| Commercial | 5.2% | 6.3% | Medium |

| Industrial | 6.7% | 8.1% | Medium |

| Retail | 3.9% | 5.5% | High |

Interpretation:

Residential markets in emerging economies will continue leading returns, supported by demographic demand and favorable financing conditions. Industrial spaces, particularly warehouses for e-commerce logistics, show strong promise as well. Retail remains the weakest performer due to digital commerce substitution.

The use of property valuation data scraping tools has transformed traditional appraisal methodologies. Automated valuation models (AVMs) now process real-time scraped data, satellite imagery, and consumer sentiment analytics to generate accurate value estimates. This transition reduces bias, improves speed, and allows global investors to assess opportunities without relying solely on human expertise.

Moreover, data scraping platforms now integrate with financial APIs, geolocation mapping, and legal documentation datasets, ensuring holistic valuation insights for both buyers and institutional investors.

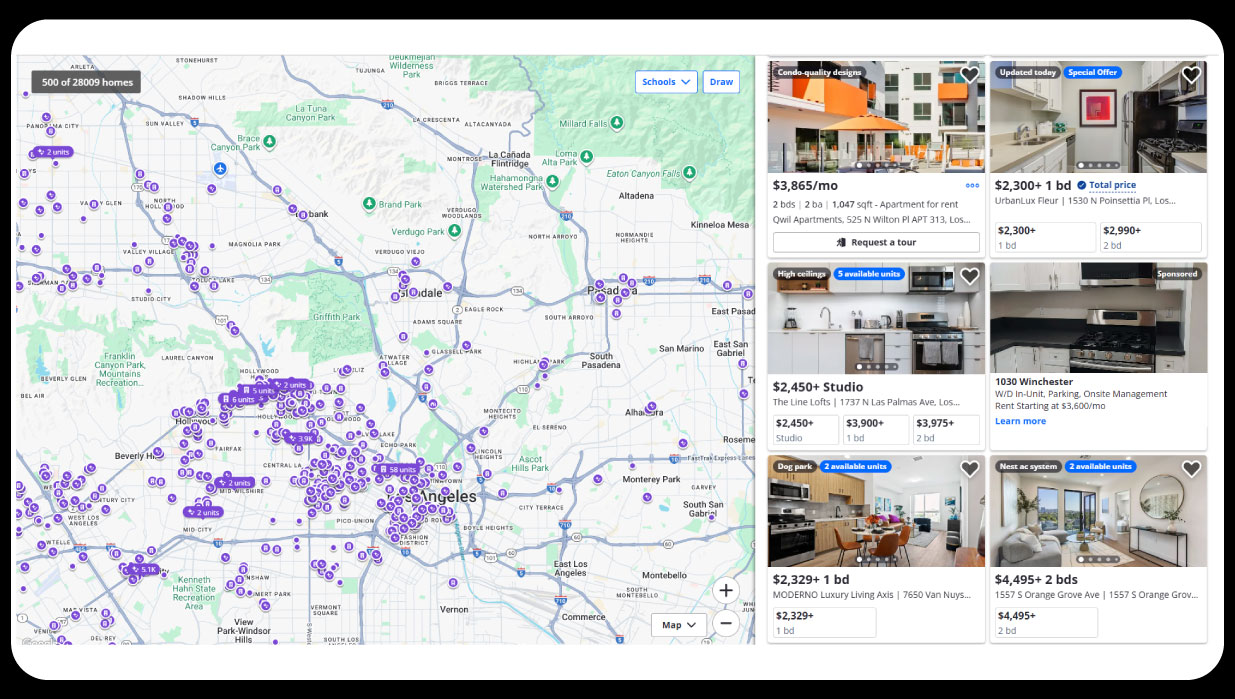

To ensure comprehensive coverage, analysts have utilized Scraping global property price data from multiple sources — including MLS platforms, public government registries, and real estate listing aggregators. The automation process involves the extraction of:

Advanced real estate data scraping systems were applied to clean and structure the data, ensuring consistency across countries. This standardization facilitates accurate cross-border comparison and AI-based pattern recognition, making it indispensable for institutional research.

From the analyzed data, several crucial findings have been extracted:

These observations reveal that the real estate market is becoming more data-dependent, transparent, and sustainability-focused than ever before.

The 2026 outlook indicates that predictive analytics, cloud-based datasets, and AI forecasting tools will redefine the strategic operations of global developers and investors. The next-generation real estate market will rely heavily on real-time intelligence derived from integrated scraping technologies.

In summary, the Real Estate Market Forecast 2026 highlights a transformative shift toward data-centric decision-making, sustainability, and digital innovation. The fusion of advanced analytics and automation will continue to guide investors and policymakers across borders. Integrating Real Estate Property Datasets with AI tools will enable predictive precision in valuation and demand forecasting. Through APIs such as the Real Estate Data Scraping API, enterprises can instantly access structured property data, pricing insights, and transaction trends. Finally, leveraging Real Estate Data Intelligence Services ensures competitive advantage, empowering businesses to navigate dynamic markets with clarity, confidence, and comprehensive foresight.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

It’s the process of collecting and analyzing property data worldwide to identify market trends, pricing insights, and investment opportunities.

AI-based forecasting models analyze global property data to predict pricing trends, investment returns, and demand shifts with high accuracy.

Real estate data scraping automates data collection from listings, helping analysts compare property prices, rents, and market performance.

Trends include green property growth, AI-driven valuations, and urban affordability challenges across major global cities.

Property data APIs provide structured, real-time insights for investors to assess risks, track pricing, and optimize global portfolios.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.