The global Halloween retail ecosystem has become increasingly competitive and data-dependent, with product categories showing different demand and pricing sensitivities. Businesses that employ Halloween 2025 Category-Wise Price Elasticity Data Scraping can identify pricing thresholds, consumer responsiveness, and category-specific profit windows across costumes, décor, candy, and party supplies. This granular approach reveals how small price adjustments impact consumer purchase patterns during seasonal peaks.

Data analysts and retail strategists now Scrape Halloween Product Prices by Category to determine how elastic or inelastic each product line behaves across digital platforms. Costumes often exhibit high elasticity near event dates, while décor and candy maintain moderate to low elasticity as consumers make last-minute purchases.

By applying advanced analytics through Halloween Product Price Elasticity Data Scraping, companies can uncover how regional demand, promotional timing, and brand competition influence cross-category sales. It allows firms to dynamically adjust prices to optimize revenue and reduce stockouts throughout the Halloween period.

Price elasticity measures how sensitive consumers are to changes in price. In the context of Halloween retailing, this concept is critical for balancing profit margins with competitive pricing. Costumes, décor, and candy all respond differently to discounts and markups depending on timing, brand reputation, and availability.

For instance, a 10% discount on premium costumes may generate a 20% increase in sales, whereas a similar discount on bulk candy might only yield a 5% increase. The challenge lies in quantifying these relationships through precise, real-time data collection from multiple marketplaces.

The integration of process to Extract Halloween Product Pricing Trends from Online Stores ensures that analysts can map price elasticity curves by category and track daily adjustments during peak shopping weeks. This real-time tracking capability leads to more efficient price modeling, demand forecasting, and promotional alignment.

Seasonal e-commerce datasets enable detailed elasticity studies that were once impossible using static retail reports. Automated crawlers continuously collect marketplace information—price points, discounts, ratings, and stock availability—across major global platforms such as Amazon, Walmart, Target, and Tesco.

The methodology of Halloween Product Category-Wise Price Analysis revolves around structuring data by category and SKU, normalizing prices across regions, and linking them to consumer interaction metrics. When performed at scale, it helps identify the tipping point where discounts stop driving incremental sales.

By leveraging Web Scraping Halloween Costumes, Décor, and Candy Price Data, research teams can establish accurate elasticity coefficients, simulate pricing scenarios, and predict the impact of promotions on category profitability.

The data scraping framework designed for this research encompasses four major Halloween retail categories—costumes, décor, candy, and party supplies. Each category was analyzed across multiple e-commerce marketplaces to assess its elasticity characteristics.

Primary Steps in the Methodology:

This systematic Web Scraping Price Elasticity Data for Seasonal Categories ensured that datasets captured both temporal and cross-platform pricing behaviors.

| Category | Average Price (USD) | Average Discount (%) | Stock Status | Avg. Rating | Elasticity Coefficient |

|---|---|---|---|---|---|

| Costumes | 32.50 | 12.4 | In Stock | 4.5 | -1.82 |

| Décor | 18.75 | 8.6 | Moderate | 4.6 | -0.97 |

| Candy | 9.40 | 5.2 | High | 4.7 | -0.55 |

| Party Supplies | 14.20 | 10.3 | Limited | 4.3 | -1.25 |

These elasticity coefficients indicate that costume sales are highly sensitive to price changes, while candy exhibits more inelastic demand. Décor and party supplies fall between the two extremes, influenced heavily by stock visibility and discount timing.

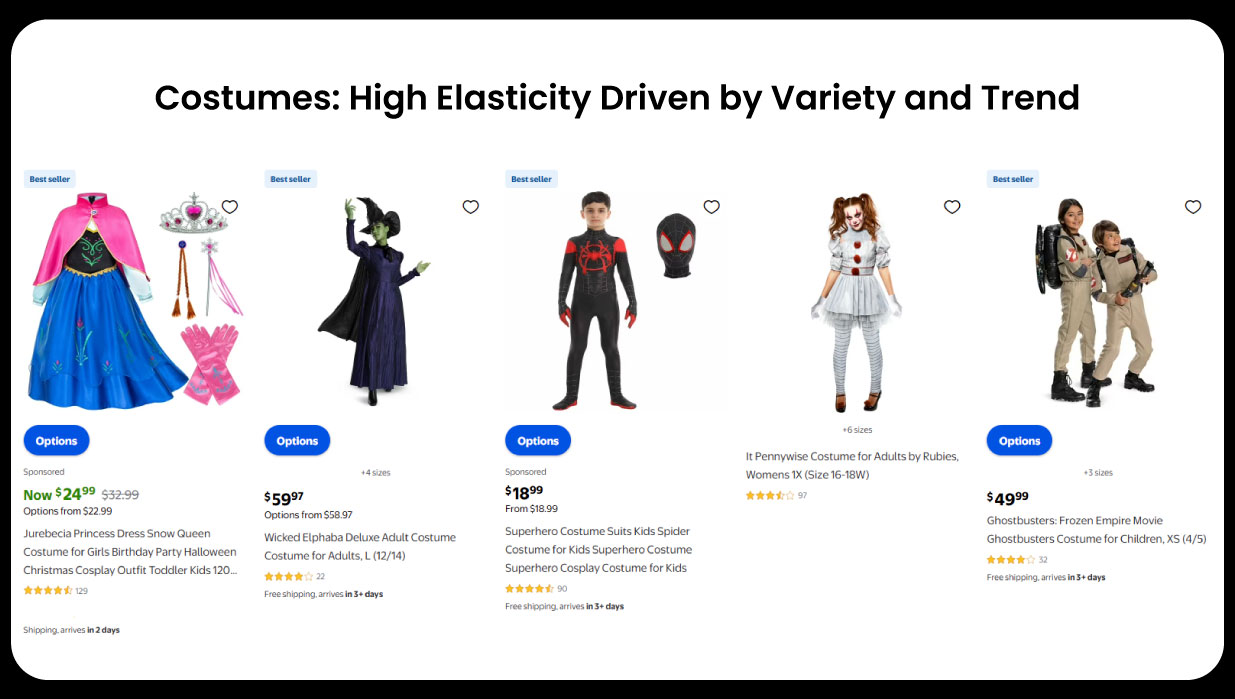

Among all categories, costumes demonstrate the highest price elasticity. Consumers are highly responsive to markdowns due to variety, fashion trends, and social media influence. Price reductions of even 5–10% can cause substantial shifts in sales volume.

Through Halloween Product Price Elasticity Data Scraping, analysts observed that early October promotions increase costume sales sharply, while late October sees diminishing returns. This trend reflects time-sensitive buying behavior, where consumers finalize purchases as Halloween approaches.

The insights derived from Price Elasticity Data Extraction for Candy, Décor, and Costumes further reveal that premium or licensed costumes show lower elasticity compared to generic alternatives. Families and group buyers often seek coordinated themes, leading to larger basket sizes when discounts align with trending characters.

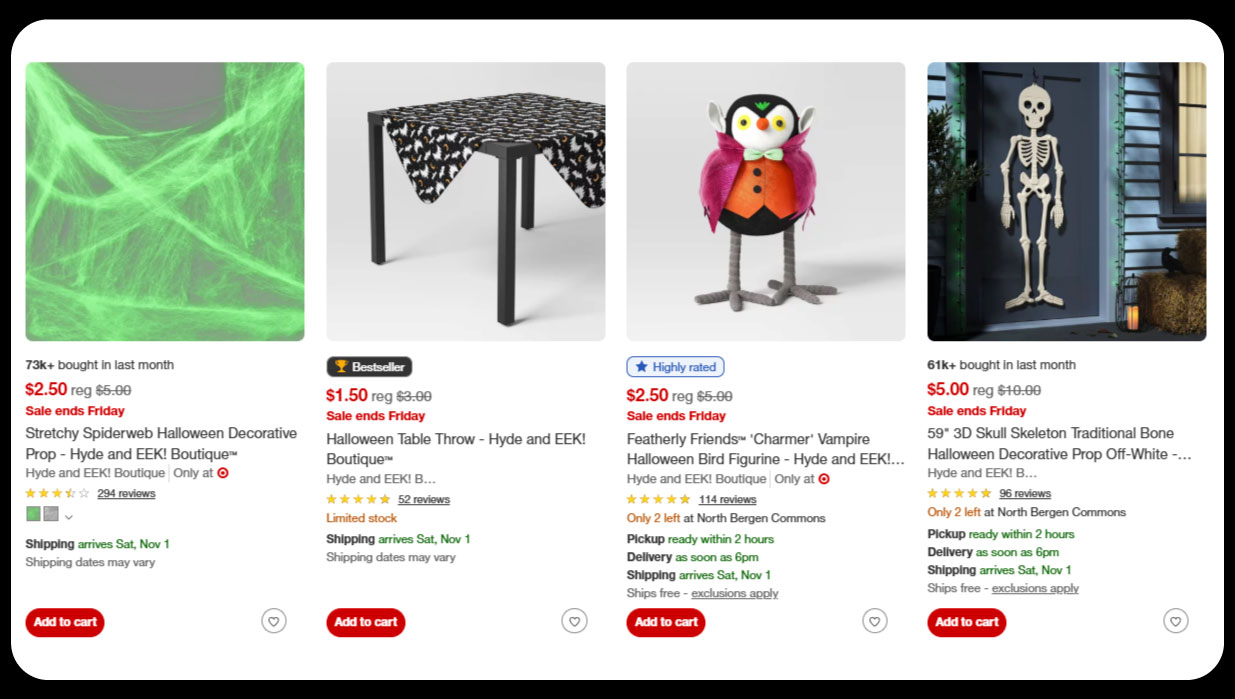

Halloween décor, including lighting, inflatables, and home ornaments, shows medium elasticity. Price reductions can encourage impulse purchases, particularly in mid-September when homeowners begin preparing themed displays.

Systems that Scrape Historical Pricing Data for Holiday Products demonstrate that décor items maintain steady pricing until demand accelerates in the last two weeks of October. At this stage, discounts increase but have limited effect due to declining stock.

Consumers are motivated more by creativity and availability than price sensitivity in this category, making timely promotions more effective than deep discounts.

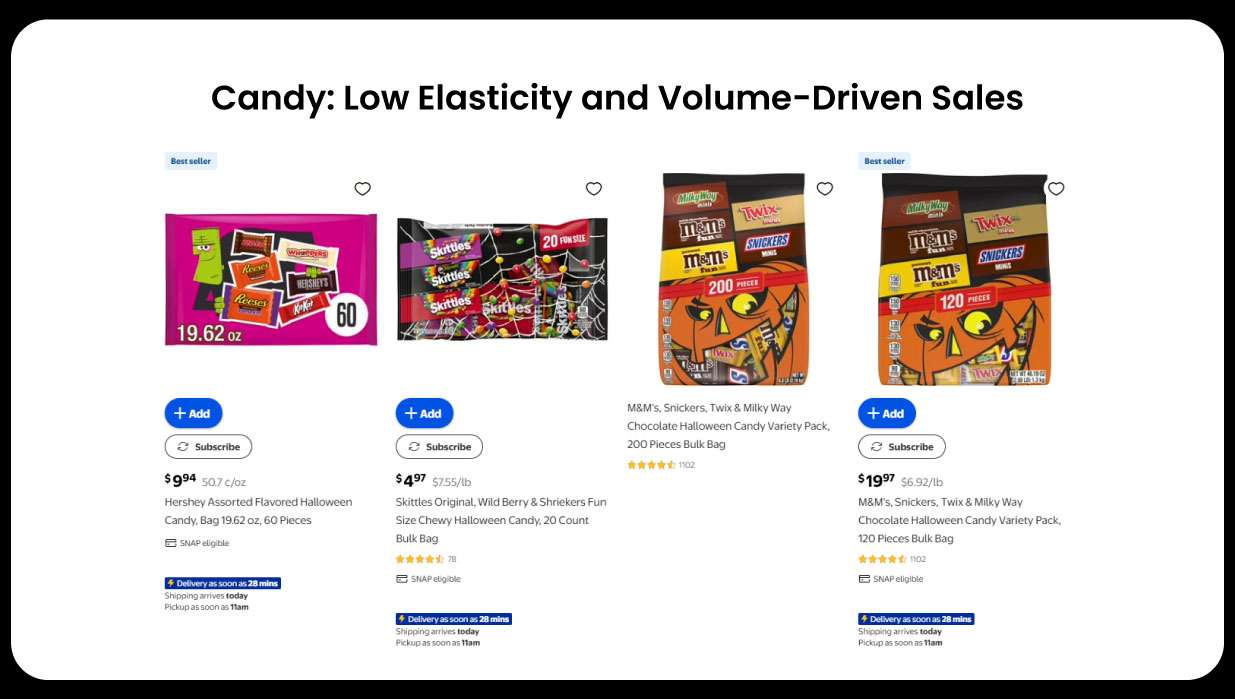

Candy remains the least elastic category within Halloween retail. Purchases are volume-driven and dominated by household necessity rather than discretionary spending. Even when prices increase slightly, demand remains stable due to strong cultural associations and gifting traditions.

In E-Commerce Product Datasets, candy price elasticity values consistently hover near -0.5, confirming low responsiveness to pricing shifts. Retailers focus on bundling and packaging variety rather than discount depth to increase overall unit sales.

Interestingly, large retailers use candy as a traffic driver—keeping prices stable while promoting complementary categories like décor or costumes. This balanced approach maximizes store visits and overall basket value.

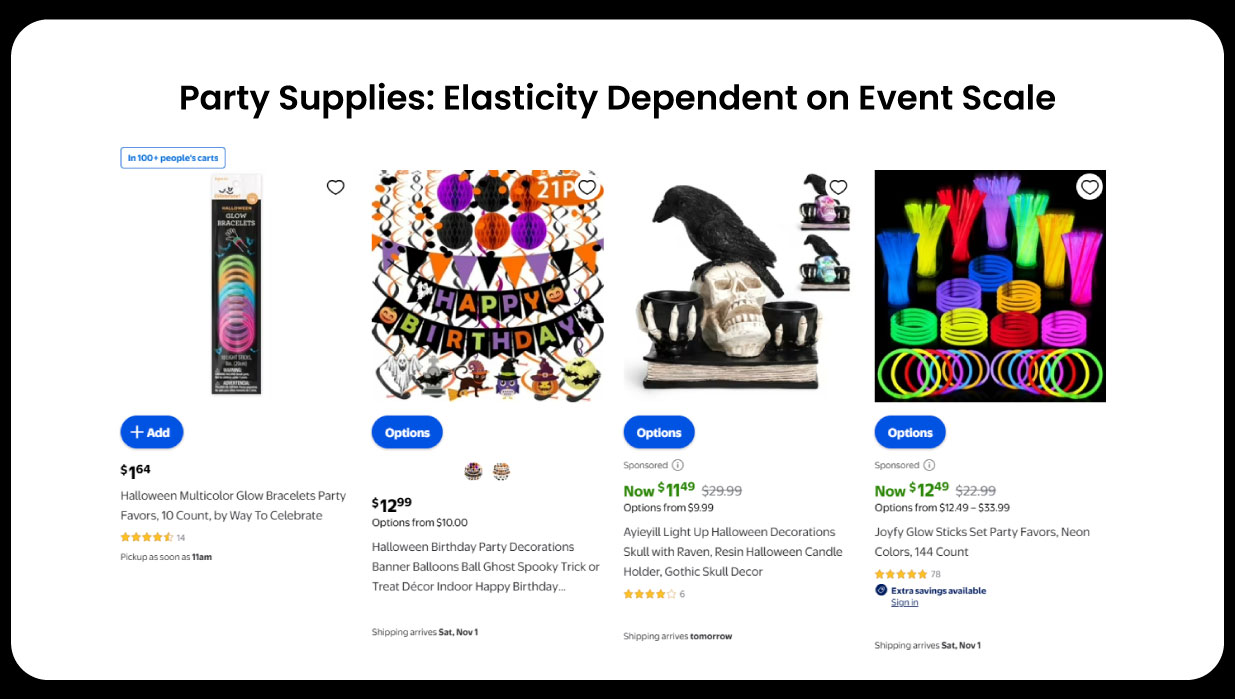

Party supplies such as tableware, balloons, themed décor, and accessories demonstrate variable elasticity depending on the type of consumer—individual, family, or event planner. Elasticity tends to rise closer to Halloween as consumers rush for last-minute purchases.

By integrating eCommerce Data Intelligence Services, analysts discovered that early discounts attract large orders from event planners, while households respond primarily to short-term price drops. Elasticity values vary widely between -1.1 and -1.4, making this segment highly responsive to discount strategy alignment.

Elasticity also varies throughout the shopping cycle. August typically reflects low elasticity as early planners are less sensitive to price. Mid-September to early October exhibits the highest elasticity levels, where consumers actively compare listings. Late October, in contrast, shows reduced elasticity due to time constraints—buyers prioritize availability over savings.

These insights derived from methods to Extract Halloween Product Pricing Trends from Online Stores enable precise timing of promotional campaigns, ensuring higher conversion rates and better inventory management across marketplaces.

| Period | Costumes Elasticity | Décor Elasticity | Candy Elasticity | Party Supplies Elasticity |

|---|---|---|---|---|

| August | -0.9 | -0.6 | -0.3 | -0.8 |

| September | -1.6 | -1.0 | -0.5 | -1.2 |

| Early October | -1.8 | -1.1 | -0.6 | -1.3 |

| Late October | -1.2 | -0.8 | -0.4 | -1.0 |

This temporal table shows that elasticity peaks in early October for all categories except candy, reinforcing the importance of mid-season promotions for optimal sales lift.

Elasticity also varies geographically. U.S. markets show higher responsiveness to price cuts in costumes, while U.K. consumers react more to décor promotions. In Canada, candy promotions drive incremental sales primarily in bulk formats.

European e-commerce platforms exhibit less elasticity due to earlier purchasing cycles and cultural differences in Halloween celebrations. Such regional insights emerge from large-scale Halloween Product Price Elasticity Data Scraping that combines data from multiple platforms under standardized formats.

Price changes in one category often influence others. For example, when costumes experience steep discounts, consumers may reallocate spending from décor or party supplies. Scraping tools enable analysts to quantify these substitution effects using cross-elasticity metrics.

These interdependencies suggest the value of Halloween Product Category-Wise Price Analysis for holistic retail optimization. By understanding how one category’s discount affects others, retailers can structure balanced promotions that sustain profitability across product lines.

Machine learning algorithms enhance elasticity predictions by incorporating historical price movement, review sentiment, and external factors like holiday timing or competitor activity. Elasticity forecasting models trained on E-Commerce Product Datasets can predict price sensitivity weeks before peak sales periods.

Retailers using predictive elasticity models can simulate “what-if” pricing scenarios—evaluating how different discount levels will affect total sales and margin. This empowers pricing teams to design promotional calendars supported by data rather than guesswork.

Automated pricing engines rely heavily on real-time scraping inputs to adjust price points dynamically. By applying rule-based triggers and predictive coefficients, systems can implement responsive pricing at the SKU level.

These models draw from Web Scraping Price Elasticity Data for Seasonal Categories, feeding continuous updates into dashboards that track competitor moves and market sentiment. This automation allows retailers to synchronize online and offline pricing while maintaining margin control.

While elasticity scraping yields valuable insights, it must operate within ethical and regulatory frameworks. Scraping tools should comply with site policies, respect robots.txt directives, and anonymize request headers to ensure responsible data collection.

Data privacy and intellectual property must also be protected. Ethical scraping reinforces credibility while supporting sustainable access to valuable retail datasets.

The strategic application of elasticity data transforms how retailers approach Halloween planning. Using Price Elasticity Data Extraction for Candy, Décor, and Costumes, brands can:

Integrating elasticity data into unified decision systems helps enterprises anticipate consumer behavior, align marketing spend, and improve fulfillment precision.

Historical data serves as the foundation for elasticity modeling. Scrape Historical Pricing Data for Holiday Products to establish long-term benchmarks that reveal evolving consumer sensitivities.

For example, from 2022 to 2024, costume elasticity increased by 12%, driven by higher competition and rising online comparisons. Candy elasticity, however, declined slightly as brand loyalty strengthened. These benchmarks guide long-term pricing strategies and inventory investments.

Advancements in AI-driven web scraping will enable real-time elasticity dashboards integrated directly into retail decision engines. Future systems will automatically detect shifts in elasticity coefficients, allowing dynamic adjustments to discount structures.

Elasticity analytics will also merge with sentiment analysis, image recognition, and supply chain data, giving brands a multidimensional understanding of pricing responsiveness across global markets.

Seasonal retail success depends on data accuracy and timely insights. The ability to measure and act upon price sensitivity across costumes, décor, candy, and party supplies defines competitive leadership. Through Ecommerce Product Ratings and Review Dataset, retailers can decode how price shifts influence demand and profitability.

By deploying systems for Price Monitoring, analysts capture real-time variations that shape marketing and inventory strategies. Simultaneously, Halloween Product Price Elasticity Data Scraping delivers the actionable intelligence needed to tailor promotions and maximize sales returns.

Incorporating these elasticity datasets enhances qualitative insights on product performance, while integrated Pricing & Promotions Services support smarter discount management. It further refines strategic execution, helping brands adapt swiftly to market dynamics.

Ultimately, category-wise elasticity analysis transforms Halloween from a seasonal rush into a data-driven opportunity for sustained retail intelligence.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.