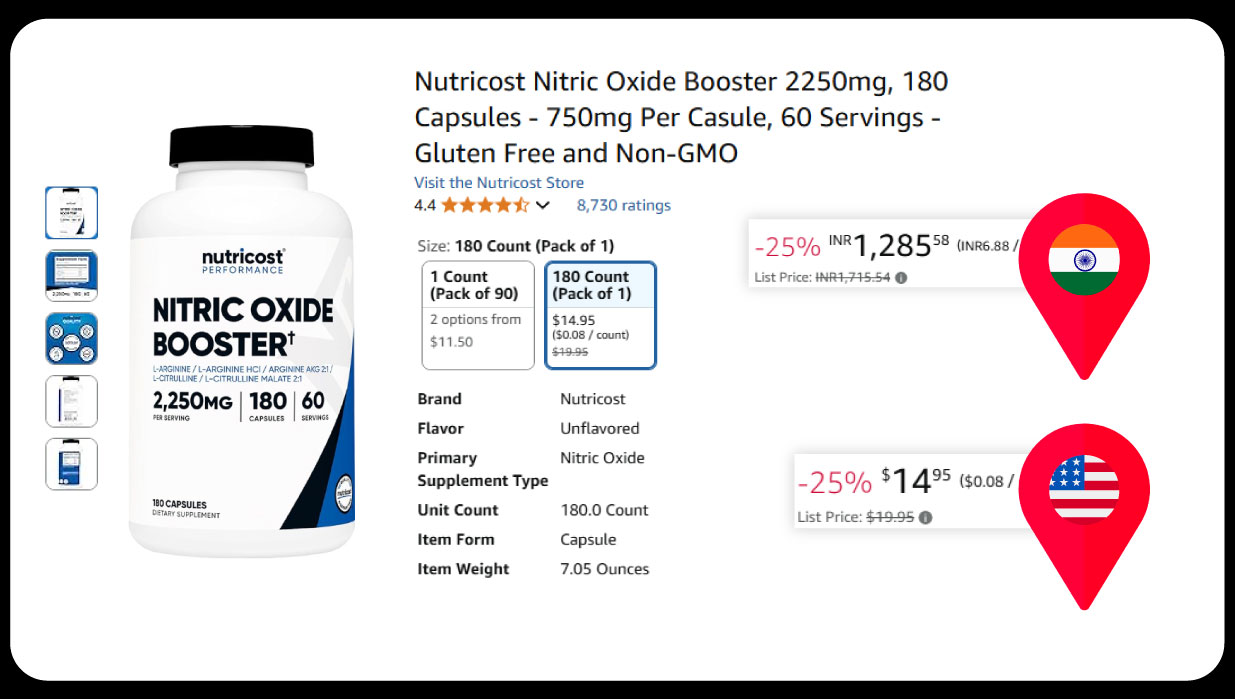

The global pharmaceutical landscape continues to be shaped by innovation, demand, and cost disparities. A significant area of interest is the India vs USA Pharma Product Price Comparison, where the price of essential medications often differs significantly between the two nations. Such disparities have wide-reaching implications for healthcare access, insurance models, government regulation, and public policy.

As governments, companies, and researchers strive to ensure affordability and transparency, Drug Price Monitoring has become increasingly essential. India's generics-driven market contrasts sharply with the innovation-led model in the United States, where branded drugs dominate. To uncover pricing gaps, we leverage Medicine Price Intelligence through web-based data collection and analytics.

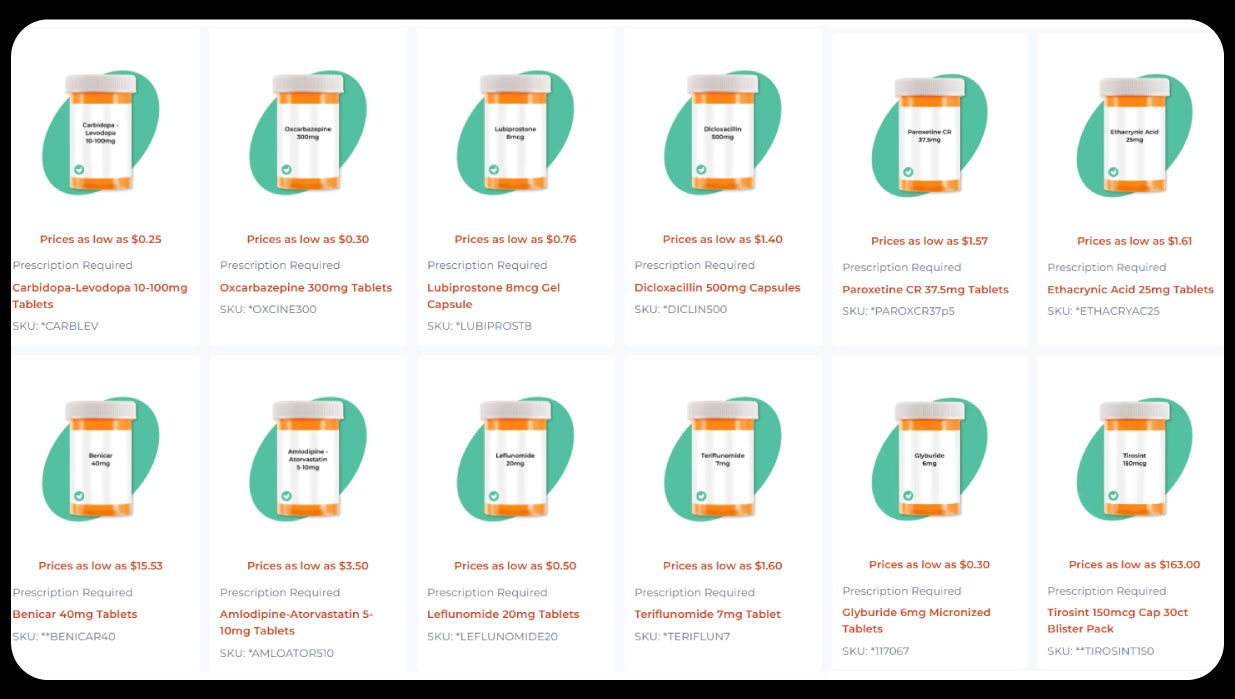

Using Real-time Drug Pricing Scrape methodologies, this report analyzes pharmaceutical pricing patterns across a curated set of commonly prescribed drugs in both countries. These insights are drawn from digital pharmacies, public databases, and pricing repositories.

India operates on a cost-plus pricing model regulated by the National Pharmaceutical Pricing Authority (NPPA), which ensures affordability and transparency. A majority of drugs sold are generics, and domestic production keeps costs low.

In contrast, the U.S. follows a market-driven approach. Pharmaceutical companies in the United States have significant pricing freedom, especially for patented and specialty medications. The result is substantial cost differences even for identical active pharmaceutical ingredients (APIs).

Table 1: Common Drug Prices in India vs the United States (in INR Equivalent)

| Drug Name | Form | India Price (INR) | USA Price (INR Equivalent) | Price Difference |

|---|---|---|---|---|

| Atorvastatin 10mg | 30 Tablets | ₹120 | ₹2,400 | 20x |

| Metformin 500mg | 60 Tablets | ₹80 | ₹1,800 | 22.5x |

| Omeprazole 20mg | 30 Capsules | ₹60 | ₹1,200 | 20x |

| Amlodipine 5mg | 30 Tablets | ₹45 | ₹1,500 | 33x |

| Salbutamol Inhaler | 200 Doses | ₹100 | ₹2,000 | 20x |

| Losartan 50mg | 30 Tablets | ₹90 | ₹1,300 | 14.4x |

| Insulin Glargine | 1 Pen (3ml) | ₹300 | ₹7,500 | 25x |

The comparison reveals stark contrasts rooted in regulatory frameworks, production ecosystems, and commercial practices. Medicine Price Comparison data suggests that India’s pharma ecosystem is focused on low-cost generics with high volume, while the U.S. emphasizes innovation, exclusivity, and patent protections.

Extract Pharma Pricing Data from pharmacies like NetMeds, Apollo Pharmacy, Walgreens, and CVS has helped in mapping identical medications in both markets. The result clearly shows that consumers in the United States bear much higher out-of-pocket costs, especially for chronic treatments.

When filtered across regions and therapeutic categories, India consistently maintains lower price points even for branded generics. The existence of DPCO (Drug Price Control Order) ceilings in India acts as a safeguard, unlike the U.S., where manufacturers can increase prices year-over-year.

Table 2: Cost of 5-Year Treatment of Chronic Diseases in India vs the U.S. (Selected Medications)

| Disease Category | Medication | 5-Year Cost in India (INR) | 5-Year Cost in U.S. (INR Equivalent) | Multiplier |

|---|---|---|---|---|

| Hypertension | Amlodipine | ₹2,700 | ₹90,000 | 33x |

| Type 2 Diabetes | Metformin + Insulin | ₹9,000 | ₹225,000 | 25x |

| Cardiovascular | Atorvastatin | ₹7,200 | ₹180,000 | 25x |

| Acid Reflux | Omeprazole | ₹3,600 | ₹72,000 | 20x |

| Respiratory (Asthma) | Salbutamol Inhaler | ₹6,000 | ₹120,000 | 20x |

The data underlines that the affordability gap widens over time, with long-term treatments draining U.S. household savings significantly more than those in India.

Price Intelligence API for Pharmacy Products allows real-time tracking of pricing anomalies, helping public health organizations and consumer rights bodies. India's centralized approach to pricing and compulsory licensing has kept medical inflation low.

The U.S., lacking a unified pricing body, experiences highly fragmented pricing depending on the pharmacy chain, insurance model, or even ZIP code. Such fragmentation, combined with administrative and middlemen costs, inflates retail prices.

Regional Drug Price Intelligence Scraping has also shown that U.S. drug prices may vary as much as 300% between states or insurance providers, unlike India, where standardization is much higher.

India’s pharmaceutical industry, being one of the largest exporters of generic medicines, thrives on volume and accessibility. Competitive bidding and bioequivalent generic approvals ensure a strong supply-demand balance, keeping prices low.

In the U.S., patent-holding companies often deploy litigation to delay generic entry, reducing price competition. Even when generics enter, market exclusivity and brand loyalty often mean prices remain high.

Thus, Compare US India Pharmacy Prices is not merely an economic analysis—it’s a window into systemic contrasts in public health policy and pharma capitalism.

Affordable medications in India improve access and adherence, especially among low-income populations. In contrast, rising medication costs in the U.S. lead to non-adherence, rationing of doses, and in extreme cases, skipping life-saving drugs altogether.

Access to Extract Data from Pharmacy Sites is essential for developing public dashboards, policy simulations, and cross-market forecasts. It helps patients make informed decisions, and regulators identify abusive pricing practices.

The data clearly outlines a dramatic disparity in pharmaceutical pricing between India and the United States. While India ensures affordability through regulation and generic competition, the U.S. pharmaceutical sector is challenged by free-market dynamics and monopolistic pricing practices.

Leveraging Medical and Pharmacy Data Scraping Services , we can continuously monitor global pharma trends, detect abnormal pricing behaviors, and enable smarter healthcare policy. For stakeholders, Price Monitoring Services offer strategic advantages in procurement, insurance design, and market forecasting.

To ensure patient-centric care and sustainable access, it is crucial to Extract Data from Pharmacy Sites and translate it into actionable insights for both countries and beyond.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.