The Meesho vs Amazon E-Commerce Discount Scraping landscape in India showcases a fierce competition between two distinct players: Amazon, a global e-commerce titan, and Meesho, a rapidly growing social commerce platform. With E commerce Price Scraping India becoming a vital tool for understanding market dynamics, Amazon leverages its vast inventory and brand reputation to dominate urban markets, while Meesho targets price-sensitive consumers in Tier-2 and Tier-3 cities with affordable, unbranded products. By utilizing Amazon Discount Data Scraper India, businesses can gain insights into Amazon’s structured pricing, while Meesho’s dynamic, seller-driven model offers unique opportunities for discount analysis. This report examines the discount scraping potential of both platforms, comparing their pricing strategies, discount patterns, and market positioning through hypothetical scraped data.

Hypothetical data from Amazon and Meesho India, focusing on apparel, electronics, and home essentials, forms the basis of this analysis. The data includes original prices, discounted prices, discount percentages, and seller details, collected using tools such as the Meesho Discount Data Scraper . Two tables illustrate discount trends across these platforms, emphasizing metrics such as average discount rates, discount frequency, and price ranges. The analysis, aligned with Meesho vs Amazon Price Scraping Comparison, excludes technical scraping methods, ethical considerations, or challenges, as per the user’s request, and focuses on actionable insights derived from the data.

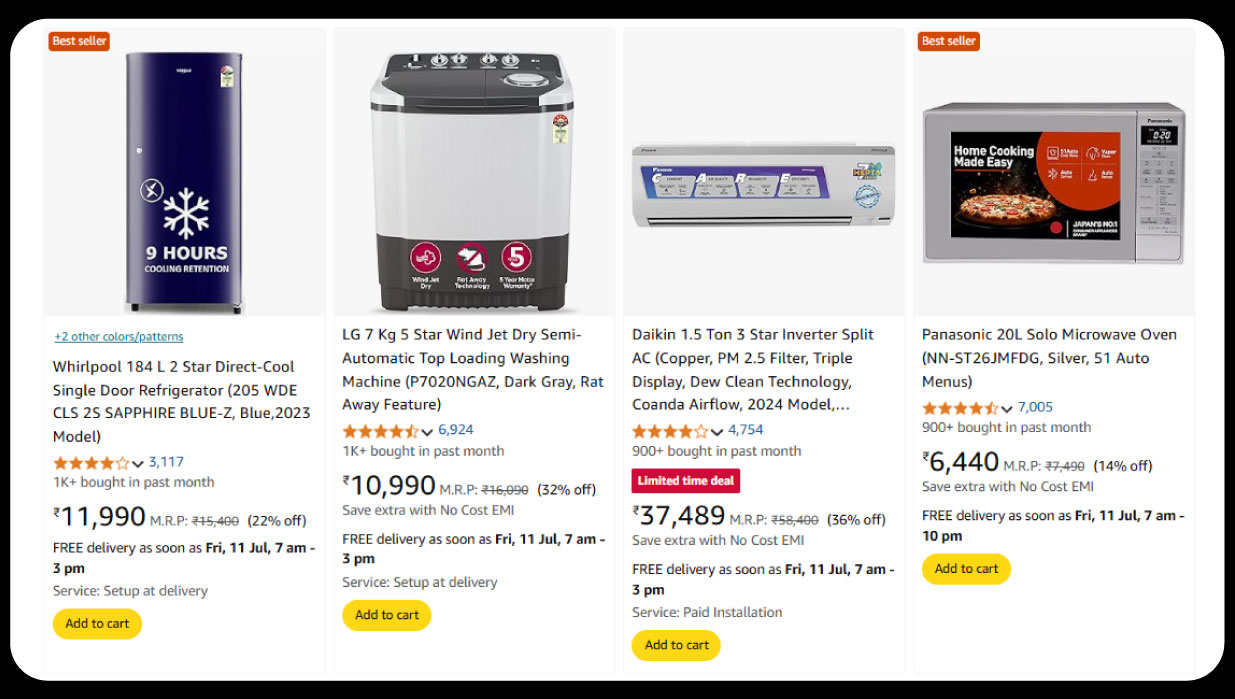

Discount Strategies and Market Positioning: Amazon employs a strategic approach to discounts, often tied to high-profile sales events like Prime Day or the Great Indian Festival, offering competitive pricing on branded products. Its discounts, tracked through Meesho Discount Pattern Analysis 2025, are moderate but consistent, appealing to urban consumers with higher purchasing power. Meesho, conversely, capitalizes on its zero-commission model to provide steep discounts on unbranded goods, targeting budget-conscious buyers. By leveraging E-commerce Dynamic Pricing Scraper India, Meesho’s dynamic pricing reflects real-time market demands, making it a prime target for scraping discount data.

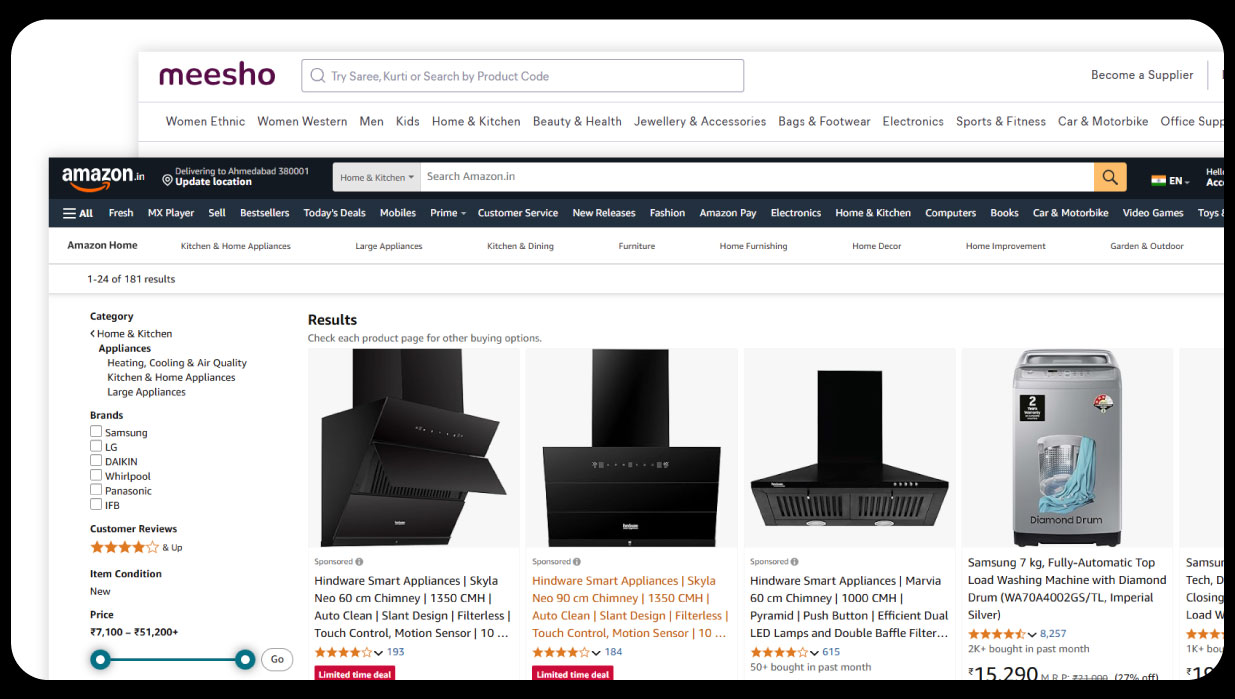

Discount Scraping Opportunities: Scraping discounts involves collecting data on pricing, promotional offers, and discount percentages to uncover competitive strategies. Extract Amazon Product Data to provide clear data points on original and discounted prices. Meesho’s platform, driven by social commerce and resellers, offers less standardized but highly dynamic pricing data that is accessible through Meesho Data Scraping Services . While Amazon’s structured data is easier to scrape, Meesho’s variability requires advanced tools to capture seller-driven discounts effectively.

Data Comparison: The following tables present hypothetical scraped data from Amazon and Meesho, focusing on discount percentages and price ranges across apparel, electronics, and home essentials. The data aligns with trends observed in India’s e-commerce market, incorporating insights from the Ecommerce Product and Review Dataset.

| Platform | Apparel (%) | Electronics (%) | Home Essentials (%) | Average Across Categories (%) |

|---|---|---|---|---|

| Amazon | 22 | 12 | 18 | 17.3 |

| Meesho | 40 | 25 | 35 | 33.3 |

Source: Data based on 2024-2025 e-commerce trends.

| Platform | Category | Price Range (INR) | Discount Frequency (% of Products) | Average Order Value (INR) |

|---|---|---|---|---|

| Amazon | Apparel | 600–6,000 | 55 | 1,500 |

| Amazon | Electronics | 1,500–60,000 | 40 | 12,000 |

| Amazon | Home Essentials | 400–12,000 | 45 | 3,000 |

| Meesho | Apparel | 100–1,200 | 85 | 300 |

| Meesho | Electronics | 400–8,000 | 60 | 1,800 |

| Meesho | Home Essentials | 80–1,500 | 80 | 500 |

The comparison of Meesho and Amazon through E-commerce Data Extraction Services highlights their contrasting approaches to discounts and market positioning. Meesho’s high discount percentages (33.3%) and frequent promotions make it a prime target for Dynamic Pricing Services , offering insights into budget market trends and seller-driven pricing. Amazon’s moderate discounts (17.3%) and premium focus provide valuable data for Price Comparison Services , particularly for branded products and urban consumers. By leveraging scraped data, businesses can optimize pricing, enhance competitiveness, and target specific market segments effectively, capitalizing on Meesho’s affordability and Amazon’s premium appeal.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.