Nasdaq is a famous global marketplace known for buying and selling securities. Known for its technology-focused companies, it is the largest stock exchange in the world. The data-driven website helps perform sentiment analysis using news, blogs, and social media status, predicting stock market price, and performing financial analysis of any company. If you want to scrape Nasdaq data, iWeb Data Scraping is your perfect solution. Our advanced Nasdaq data scraper can extract data, including share volume, market cap, current yield, open process, open date, close price, earnings per share, dividend payment date, etc. Leverage the benefits of our cutting-edge Nasdaq scraping services across the USA, UK, Dubai, Canada, India, Australia, France, Germany, UAE, Spain, Philippines, and Mexico.

Nasdaq Data Scraper

Use IWeb Data Scraping Scraping real time Data Collector,

- Collect stock market data to analyze trends

- Find new investment opportunities

- Collect stock exchange data in real-time

- Scrape Nasdaq for stock price predictions

Nasdaq scraper Overview

- The Nasdaq scraping tool can send HTTP requests to the website and extract the desired data, including stock symbols, dates, stock prices, company names, market indices, financial metrics, etc.

- The scraper can handle rate limits by incorporating a delay mechanism to ensure compliance and avoid disruptions.

- It can easily store data in the desired format, including CSV, JSON, or Excel files.

- It can quickly parse HTML content to collect the relevant information using CSS selectors and XPath techniques.

- It can easily clean and standardize the data by eliminating unnecessary characters, handling missing values, and applying additional data manipulation operations.

- It can use pagination techniques to navigate through pages and collect all the necessary information.

How To Use Data Collected with the Nasdaq Data Extractor?

- Analyze the collected data to gain insights into market trends, stock performance, and overall market sentiment. This data is helpful to perform statistical analysis and identify patterns to make informed investment decisions and strategies.

- Perform in-depth financial research on specific companies using the collected data. It will help analyze historical stock prices, market capitalization, trading volumes, etc., to evaluate the performance of companies.

- Web scraping for financial and stock market data can help manage investment portfolios. It is helpful to monitor the stock's performance and make informed decisions on asset allocation, portfolio diversification, etc.

- The collected data helps assess the risk associated with investments, calculate the risk metrics, including volatility and VaR, understand the market, and manage risk exposure effectively.

- Use the collected data to generate dashboards and charts to provide a clear overview of market data and trends.

- Easily make informed investment decisions using the extracted data. It helps identify trends, evaluate investment opportunities, and determine potential risks associated with specific stocks.

How it works

-

STEP 1

Choose the website you would like to scrape public data from, in real-time.

-

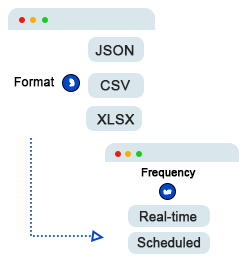

STEP 2

Select the frequency: real-time or scheduled, and delivery format: JSON, CSV, HTML, or Microsoft Excel.

-

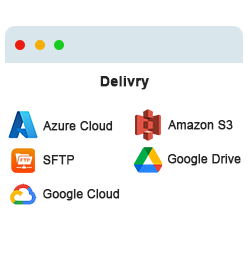

STEP 3

Decide where to send the data: webhook, email, Amazon S3, Google Cloud, Microsoft Azure, SFTP, or API.

Want to learn more?

Talk to an expert to discuss your data collection needs and see our platform in action.

Let’s Talk About Product

What's Next?

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.