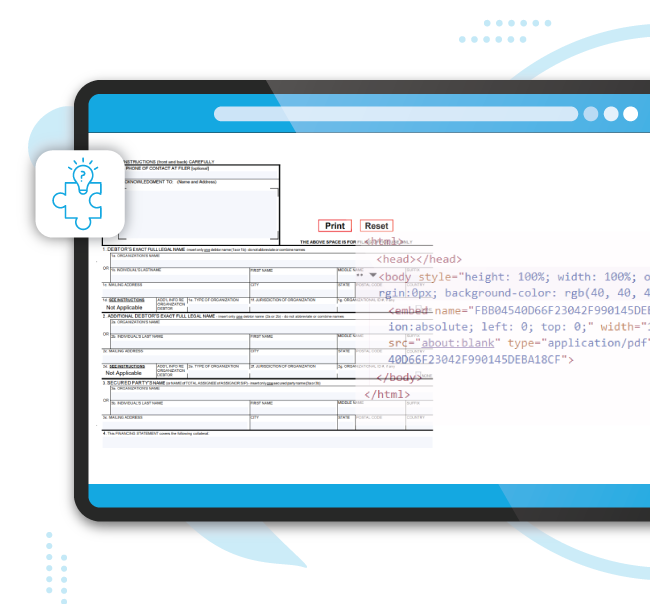

A financial services client approached iWeb Data Scraping to aggregate Uniform Commercial Code (UCC) filings from all 50 US states and territories. While UCC data is public, each state maintains its own online system—with different search interfaces, formats, and update frequencies. The client aimed to collect structured data from every state’s UCC search portal, standardize it into a unified CSV format, and ensure the resulting dataset was complete, deduplicated, and ready for analysis.By building a state-by-state scraping framework, handling diverse formats, and respecting each portal’s access rules, we delivered a nationwide, consolidated UCC dataset that accelerated the client’s research and compliance operations.

Primary Objectives

Step 1: State-by-State Inventory

Step 2: Source-Specific Scraping

Step 3: Data Normalization

Step 4: Deduplication

Step 5: QA and Verification

UCC Filings CSV

| Filing Number | State | Filing Date | Filing Type | Debtor Name | Secured Party Name | Collateral Description |

|---|---|---|---|---|---|---|

| 2025-IL-0001 | IL | 2025-08-05 | Original | John Smith Construction LLC | First Midwest Bank | All inventory, equipment, A/R |

| 2025-CA-0098 | CA | 2025-08-03 | Continuation | Green Energy Solutions Inc. | Bank of America | Solar panels, installation tools |

| 2025-TX-0452 | TX | 2025-08-01 | Termination | Blue Sky Farms LLC | AgriBank, FCB | Livestock, feed, and tractors |

Key Benefits

By building a robust, state-by-state scraping framework and standardizing highly fragmented UCC filing data, iWeb Data Scraping — a leading web scraping service provider USA — transformed a complex, manual process into a scalable, automated solution. The consolidated nationwide dataset not only delivered accuracy and completeness across 50 states and territories but also enabled the client to run faster compliance checks, streamline research, and gain actionable insights into lending and collateral trends. This project demonstrates how thoughtful data engineering and compliance-conscious scraping can unlock the full potential of public records for financial services and beyond.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.