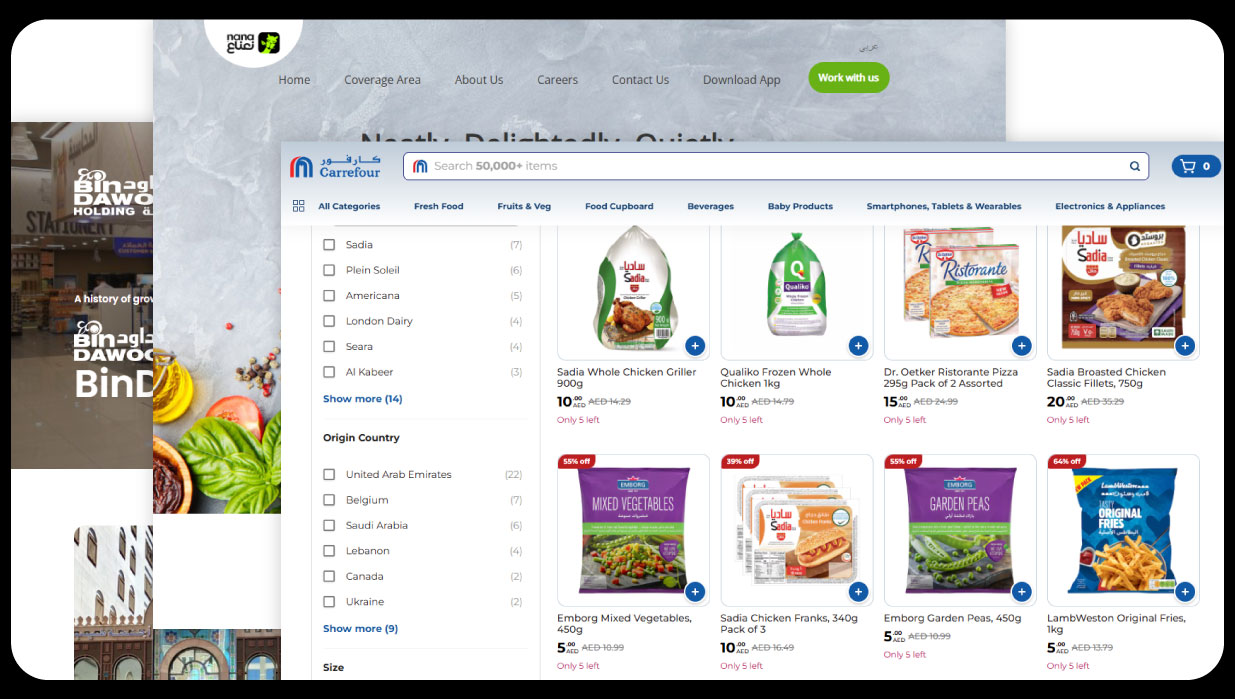

The rapid evolution of e-commerce has significantly shifted consumer behavior in the grocery sector, giving rise to the quick commerce data analysis 2025 landscape. Quick commerce (Q-commerce) focuses on delivering products within a short window, often under one hour, making speed and efficiency critical. In Saudi Arabia, the adoption of Q-commerce has grown exponentially, driven by urbanization, smartphone penetration, and changing lifestyle preferences. This report presents a comprehensive overview of Scraped data for q-commerce market report 2025, focusing on three major players in the Saudi Arabian market: Nana Direct, Carrefour, and BinDawood. Additionally, it explores the role of real-time retail data scraping in understanding operational trends and customer behavior.

The Q-commerce market in Saudi Arabia has been witnessing robust growth, with consumers increasingly favoring rapid grocery deliveries. Platforms such as Nana Direct, Carrefour, and BinDawood have leveraged digital solutions, app-based ordering, and strategic partnerships to enhance their reach. Insights from Saudi Arabia grocery delivery trends data extractor indicate that urban areas such as Riyadh and Jeddah contribute the majority of orders, reflecting high consumer demand for convenience-oriented services.

Key Metrics by Platform

| Platform | Monthly Active Users (MAU) | Avg. Delivery Time | Popular Categories | Order Volume (Monthly) |

|---|---|---|---|---|

| Nana Direct | 1,200,000 | 35 mins | Fresh Produce, Beverages | 850,000 |

| Carrefour SA | 2,500,000 | 45 mins | Packaged Food, Household | 1,400,000 |

| BinDawood | 1,800,000 | 40 mins | Dairy, Snacks | 1,050,000 |

The table above showcases the operational performance metrics of these platforms. Nana Direct’s shorter delivery times and high order fulfillment rates position it as a leading Q-commerce operator. Carrefour SA, with the largest user base, demonstrates strong brand recognition and reach. BinDawood, meanwhile, maintains consistent service quality, particularly in dairy and packaged snack categories.

Nana Direct has emerged as a dominant player in the Saudi Q-commerce landscape due to its technologically driven approach. With a focus on rapid inventory turnover, seamless app experience, and efficient last-mile logistics, the company has gained significant traction among urban consumers. Extract Carrefour Saudi data analytics to reveal trends in pricing, stock availability, and delivery efficiency, providing strategic insights for competitors and investors.

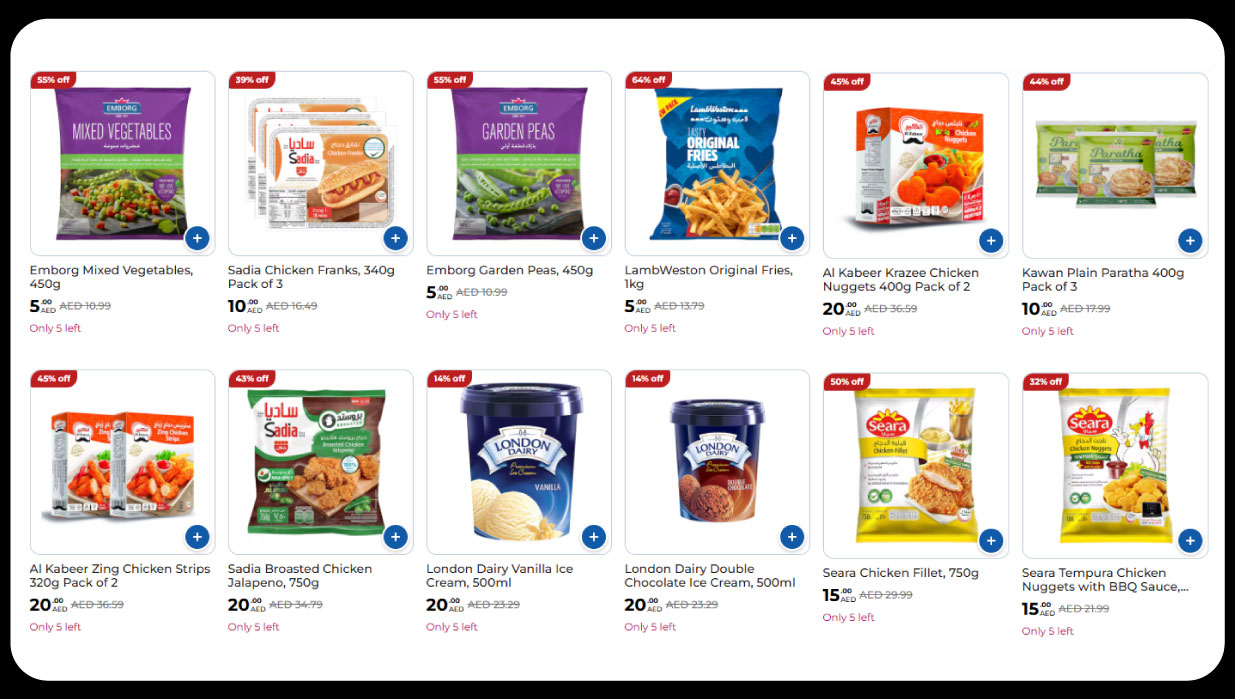

Carrefour Saudi has traditionally been recognized for its physical stores but has strengthened its online presence to compete in Q-commerce. Analysis of BinDawood online retail data insights and Carrefour’s platform performance shows that diversified product offerings and frequent promotions drive higher engagement.

| Product Category | Nana Direct (Orders/Month) | Carrefour SA (Orders/Month) | BinDawood (Orders/Month) |

|---|---|---|---|

| Fresh Produce | 300,000 | 450,000 | 280,000 |

| Packaged Foods | 200,000 | 500,000 | 300,000 |

| Beverages | 180,000 | 300,000 | 200,000 |

| Dairy & Snacks | 170,000 | 150,000 | 270,000 |

This table provides category-wise order data, highlighting consumer preferences and platform performance. The data confirms Nana Direct’s strong performance in fresh produce and beverages, Carrefour’s dominance in packaged foods, and BinDawood’s focus on dairy and snacks.

BinDawood has positioned itself as a reliable mid-sized player in the Saudi Q-commerce sector. Leveraging its established offline presence, it integrates online platforms for a hybrid retail approach. Scrape Nana Direct q-commerce data to reveal that BinDawood’s strengths lie in consistent stock availability and specialized product categories.

The data presented in this report was collected through a combination of Quick Commerce Data Scraping Services, real-time API integrations, and proprietary retail analytics tools. The methodologies included:

The Saudi Q-commerce market shows significant growth potential, with key insights including:

The 2025 Q-commerce landscape in Saudi Arabia highlights the critical role of data-driven decision-making. Leading platforms like Nana Direct, Carrefour, and BinDawood are increasingly adopting advanced analytics to streamline operations and improve customer satisfaction. Nana Direct Grocery Data Scraping enables real-time monitoring of inventory, pricing, and demand patterns, allowing the company to optimize delivery efficiency. Similarly, BinDawood Grocery Data Extraction provides insights into product performance and order trends, helping the platform refine its service offerings. The availability of Grocery Dataset from Carrefour Saudi Arabia empowers market players to analyze consumer preferences and adjust strategies accordingly. Through evolving Quick Commerce Data Scraping Services, businesses can gather actionable insights, track competitor performance, and respond promptly to emerging trends, maintaining a competitive edge in the fast-growing Saudi Q-commerce sector.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.