The holiday season is one of the most critical periods for grocery and retail businesses. Consumer behavior shifts significantly during festive months, with an increased demand for both essential and premium products. In recent years, the rise of quick-commerce vs supermarket holiday demand data scraping has enabled companies to analyze these shifts more effectively. Platforms like Zepto, Blinkit, Instacart, Walmart, and Amazon Fresh are now competing not just on product assortment but also on speed, convenience, and data-driven insights into consumer behavior.

With the growing popularity of fast delivery services, businesses have started investing in technologies that allow them to Scrape q-commerce vs supermarket analytics. This provides detailed insights into purchase trends, peak ordering times, and regional preferences. By combining these insights with traditional supermarket data, companies can optimize inventory, improve pricing strategies, and enhance customer satisfaction.

One of the key aspects of analyzing holiday demand is the ability to Extract supermarket holiday sales data. This involves collecting historical and real-time sales data, understanding purchase patterns, and monitoring fluctuations in consumer interest. Advanced tools and web scraping technologies allow for holiday grocery demand scraping, which in turn helps retailers adjust their operations during the peak season.

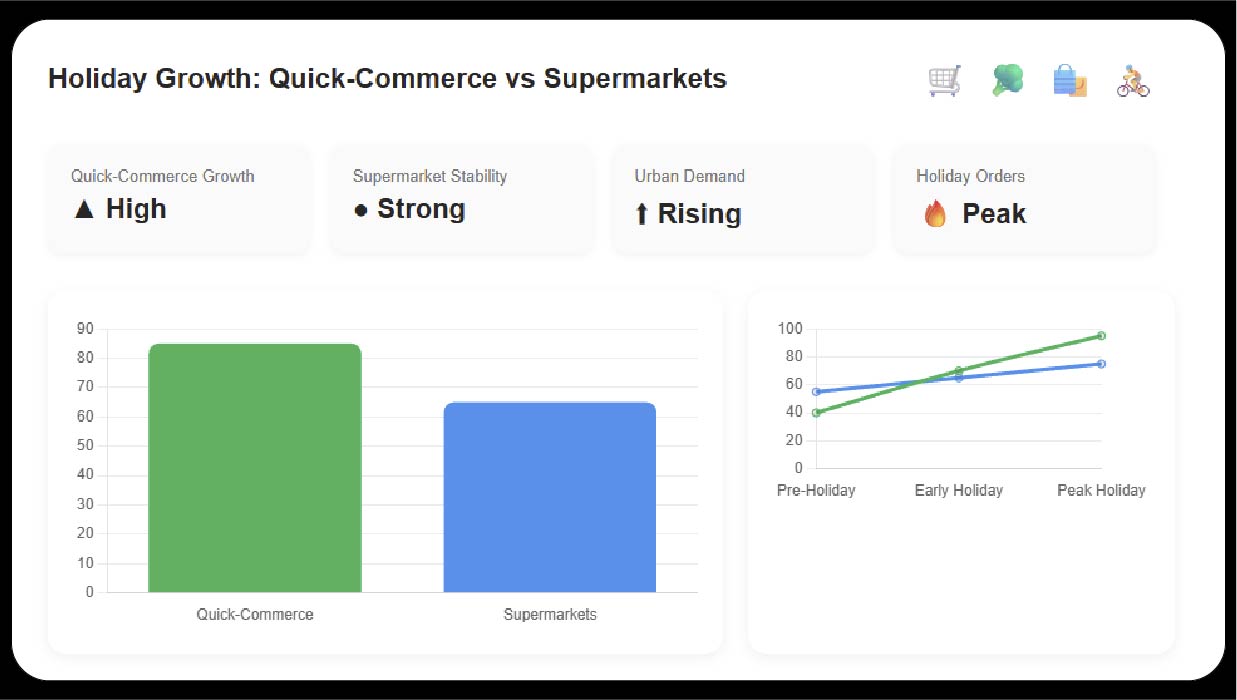

The last few years have witnessed significant growth in quick-commerce (Q-commerce) platforms like Zepto, Blinkit, and Instacart. These platforms focus on rapid delivery, often within 30–60 minutes, targeting urban consumers who prioritize convenience. On the other hand, traditional supermarkets like Walmart and Amazon Fresh continue to attract consumers seeking bulk purchases, broader product ranges, and in-store shopping experiences. By leveraging Grocery Stores location Datasets, retailers can better understand regional demand patterns and optimize delivery routes for maximum efficiency. The following table compares the average holiday order volumes for quick-commerce platforms and supermarkets across major cities in the U.S. and India:

| Platform | Average Orders per Day (Holiday Season) | Average Basket Size | Delivery Time | Key Markets |

|---|---|---|---|---|

| Zepto | 25,000 | $12 | 30–45 mins | Mumbai, Delhi |

| Blinkit | 28,500 | $14 | 25–40 mins | Bangalore, Delhi |

| Instacart | 32,000 | $45 | 60–90 mins | USA Major Cities |

| Walmart | 40,000 | $60 | 90–120 mins | USA Nationwide |

| Amazon Fresh | 35,500 | $55 | 90–120 mins | USA Major Cities |

As seen, Q-commerce platforms tend to have smaller basket sizes but higher delivery frequency, while supermarkets cater to larger purchases with longer delivery times. Companies can leverage Festive Season grocery trends data Extractor tools to identify these patterns and optimize their operational strategies.

Consumer behavior during the holidays is highly dynamic. Shoppers often plan their purchases in advance, but impulse buying increases as festive days approach. By employing Web Scraping holiday shopping behavior data, retailers can track what products are trending, which regions show higher demand, and how promotions impact sales.

In particular, Q-commerce platforms excel in capturing last-minute demand spikes. For example, items like snacks, beverages, and ready-to-eat meals see an uptick in Q-commerce orders compared to supermarkets, which are more frequently chosen for bulk staples and premium products.

The next table highlights consumer preference patterns for Q-commerce versus supermarket purchases:

| Product Category | Q-Commerce Share (%) | Supermarket Share (%) | Peak Purchase Days | Notes |

|---|---|---|---|---|

| Fresh Fruits & Vegetables | 40 | 60 | Dec 20–24 | Supermarkets preferred for variety |

| Ready-to-Eat Snacks | 70 | 30 | Dec 22–25 | Quick delivery crucial |

| Beverages (Soft & Alcohol) | 55 | 45 | Dec 18–24 | Both channels popular |

| Packaged Groceries | 35 | 65 | Dec 15–23 | Bulk buying favors supermarkets |

| Dairy & Bakery Items | 60 | 40 | Dec 20–25 | Quick replenishment drives Q-commerce |

A key advantage of using digital tools in the holiday season is real-time grocery demand tracking. Retailers can monitor order volumes, inventory depletion rates, and consumer preferences as they unfold. This allows companies to prevent stockouts, dynamically adjust pricing, and plan for timely replenishments.

In addition, in-store grocery demand trends scraper technologies enable supermarkets to analyze foot traffic patterns, product scans, and sales data, providing a holistic view of demand trends. Combining online and offline Supermarkets Stores Location Datasets ensures that both Q-commerce and traditional grocery players can accurately forecast demand, ultimately reducing waste and improving profitability.

The following table showcases how demand forecasting models based on scraped data can inform stocking strategies:

| Platform Type | Forecast Accuracy (%) | Peak Hour Predictions | Stockout Reduction (%) | Revenue Impact (%) |

|---|---|---|---|---|

| Zepto | 92 | 6 PM – 9 PM | 20 | 15 |

| Blinkit | 90 | 5 PM – 8 PM | 18 | 12 |

| Instacart | 88 | 4 PM – 7 PM | 15 | 10 |

| Walmart | 85 | 3 PM – 6 PM | 12 | 8 |

| Amazon Fresh | 87 | 2 PM – 5 PM | 14 | 9 |

Quick commerce data scraping has multiple benefits for both retailers and analysts:

Technology like Grocery & Supermarket Data Extraction enable these processes, ensuring faster insights and better operational decision-making.

The comparison between Q-commerce platforms and traditional supermarkets during the holiday season highlights the complementary nature of these channels. While quick-commerce caters to immediate needs and last-minute purchases, supermarkets dominate in bulk buying and in-store experiences. Leveraging demand forecasting using scraped data, businesses can align inventory, promotions, and marketing strategies to match consumer demand.

Advanced analytics tools allow companies to access Grocery and Supermarket Store Datasets, providing a comprehensive understanding of regional demand patterns. This intelligence empowers businesses to make data-driven decisions, optimize operations, and maximize holiday season profitability.

In summary, integrating Q-Commerce Data Scraping API with traditional sales tracking mechanisms enables a more agile, informed, and consumer-centric approach to holiday retail. Retailers that adopt these practices are better positioned to meet festive demand spikes while maintaining operational efficiency.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.