The global real estate landscape has become more data-driven than ever before. Investors, property developers, buyers, and policymakers no longer rely solely on traditional property market indicators. Instead, they increasingly turn to real-time data intelligence that captures everything from property listings and price fluctuations to zoning laws and regulatory updates. Smart real estate scraping solutions have emerged as a powerful method to gather, organize, and analyze vast volumes of structured and unstructured data from online platforms. Data scraping is not just about collecting listings in high-demand markets such as the USA, UAE, Germany, Australia, and the UK. It's about unlocking market behavior, real estate market trends analysis, studying developer patterns, and even aggregating regulatory data such as RERA (Real Estate Regulatory Authority) updates to ensure compliance and transparency. When combined with real estate datasets and API integration, this approach empowers real estate professionals with seamless access to accurate, real-time insights.

This blog explores how smart real estate scraping is revolutionizing property data collection and use in these five dynamic regions.

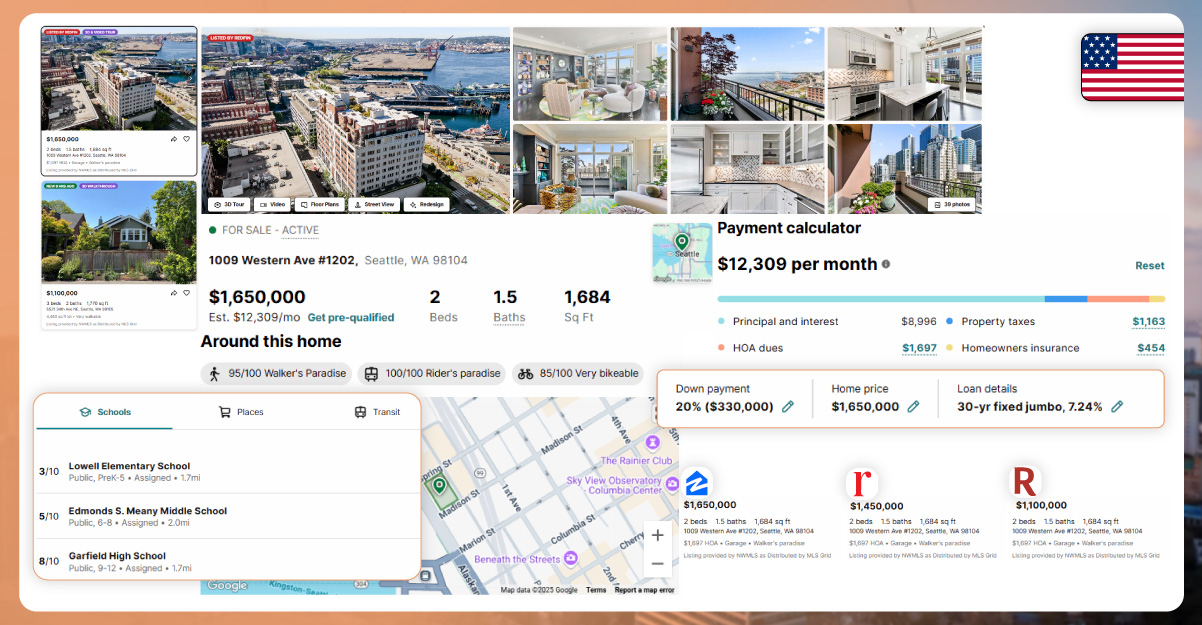

The United States represents one of the world's most transparent and digitized real estate markets. Online platforms like Zillow, Redfin, Realtor.com, and MLS databases host millions of property records. Multi-platform listing extraction through innovative scraping tools can collect key listing information—such as square footage, ZIP code trends, property age, school district ratings, pricing history, and agent data—giving investors and agencies a 360-degree view of any neighborhood.

Real-time property listing updates across metro areas like New York, Los Angeles, Austin, or Miami allow real estate analysts to monitor fluctuations in rental yields, demand spikes, foreclosures, and new construction permits.

Moreover, access to municipal and regulatory datasets helps uncover land-use restrictions, zoning codes, and local policy changes. In commercial real estate property price trend analysis that includes tenant occupancy rates, commercial lease durations, and industrial park expansions provides data-driven foresight for strategic planning.

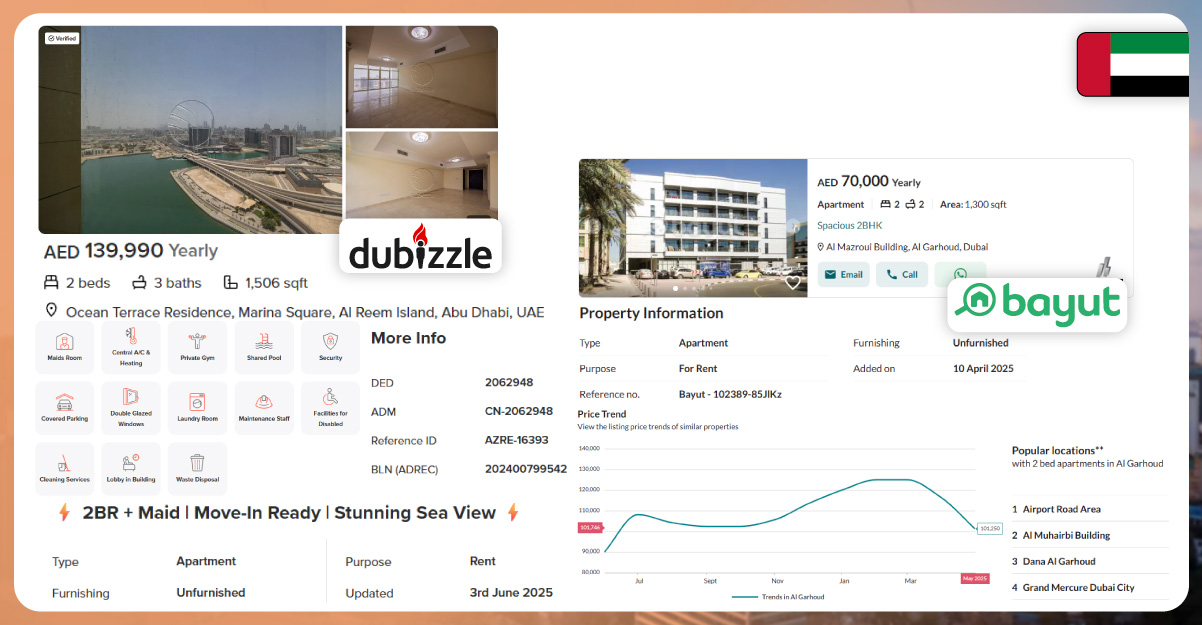

In the United Arab Emirates, especially in cities like Dubai and Abu Dhabi, real estate is tightly regulated by authorities such as the Dubai Land Department (DLD) and RERA (Real Estate Regulatory Agency). These regulatory bodies maintain databases on registered projects, developers, brokers, and contractual obligations. RERA data scraping helps gather this vital information, enabling compliance verification, monitoring of escrow accounts, and project completion timelines. Investors can compare actual delivery timelines versus promised handover dates—a common concern in fast-growing markets.

Additionally, platforms like Bayut, Property Finder, and Dubizzle contain rich data on property categories ranging from off-plan units to waterfront villas and branded residences. Scrape real estate listings data from these platforms provides insights into square-foot pricing, popular districts, payment plans, and even shifting preferences toward furnished or serviced apartments.

With Expo 2020 boosting Dubai's real estate boom and ongoing government-led foreign investment incentives, having a clear view of location-based property insights is vital. Smart scraping keeps stakeholders ahead of demand trends and competitive positioning.

Germany's real estate sector is built on stability, rental regulations, and long-term investment returns. Key cities such as Berlin, Munich, Hamburg, and Frankfurt have seen a surge in foreign interest. While the German property market does not rely as heavily on online listings as other nations, platforms like Immobilienscout24, Immowelt, and regional brokerage portals still offer high-quality structured data. A property listing data scraper can be used to gather detailed information from these platforms to understand current market dynamics better. Real estate data scraping services in Germany can uncover hidden demand zones based on property page views, time-on-market metrics, rental cap enforcement, and annual price appreciation. With increasing regulation around rental controls and energy efficiency, scraping data from municipal records can help investors identify properties that meet green building standards or might need retrofitting.

Real estate data intelligence services also help track rental licenses, tenant caps, and mortgage rules by city, ensuring that buyers, landlords, and fund managers remain compliant and competitive in one of Europe's most stable real estate environments.

Australia's real estate market is uniquely diverse, with cities like Sydney, Melbourne, Brisbane, and Perth offering different trajectories in pricing, zoning, and population growth. Proptech innovation thrives, and smart scraping is pivotal in property investment and valuation. Platforms like Domain, Realestate.com.au, and regional agency websites host property data, including auction results, open home schedules, energy ratings, floor plans, and suburb comparisons. Smart scraping across these portals helps track price growth, property flipping trends, and emerging suburbs before they become saturated.

Australian state governments provide open access to zoning regulations, land valuations, and planning applications. Scraping this public data helps identify rezoning areas, infrastructure projects, and school district boundaries that could affect long-term property value.

Additionally, scraping property development registers helps assess the activity level of key developers and volume builders, creating transparency in both residential and commercial growth sectors.

The UK's property market, especially in London, Manchester, Birmingham, and Edinburgh, is characterized by fluctuating demand cycles, regional pricing differences, and a mix of leasehold and freehold structures. Real-time data is invaluable with Brexit, inflation, and housing supply issues affecting buyer behavior.

Web scraping platforms such as Rightmove, Zoopla, OnTheMarket, and government data repositories provide investors and agencies with detailed insights into price per square foot, stamp duty changes, sold histories, and energy performance ratings (EPCs).

The UK Land Registry offers datasets that, when scraped and organized effectively, can trace ownership patterns, price changes by postcode, and mortgage activity. Furthermore, the Build to Rent (BTR) segment has grown rapidly. Smart scraping helps developers track BTR project launches, tenancy terms, and landlord incentives.

Combining scraped data with government housing policies, planning applications, and local council records allows professionals to create powerful forecasting tools tailored for buy-to-let, holiday rentals, and mixed-use properties.

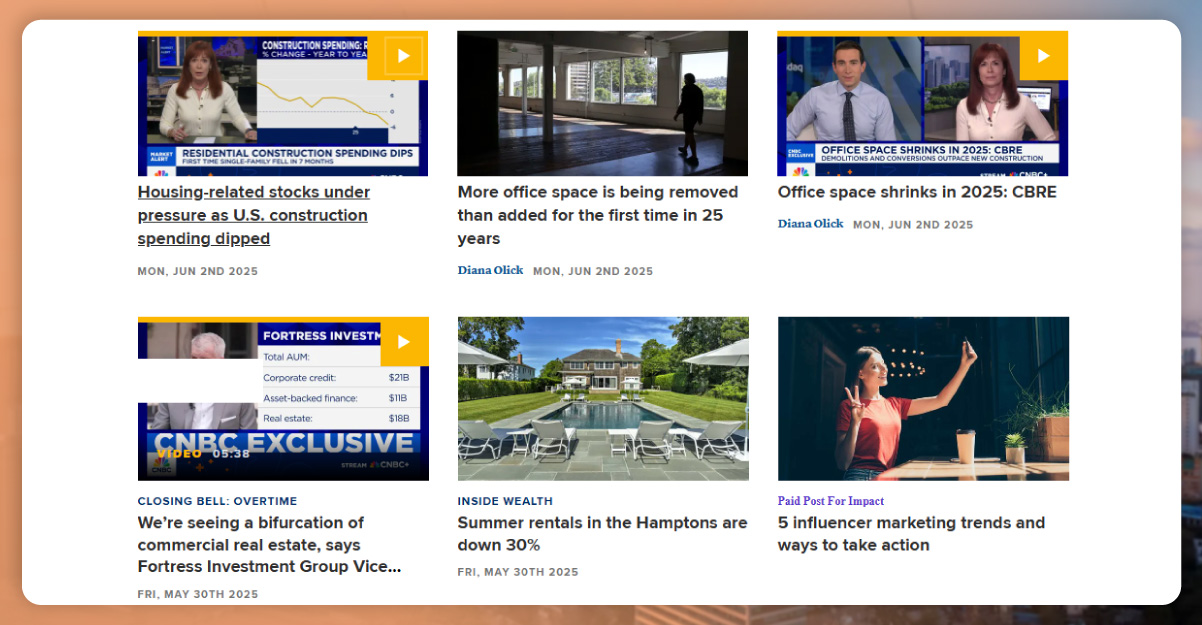

What sets smart real estate scraping apart from basic data collection is the analytical layer it enables. Companies gain a holistic view of real estate markets by merging data from multiple sources—including property listings, regulatory records, social sentiment, news announcements, and GIS information.

Smart scraping also integrates AI and ML models to forecast neighborhood development, flag high-risk investments, and detect underpriced assets. For instance, cross-referencing scraped data from RERA databases in Dubai with developer review platforms can highlight reputational risks. In the US, scraping permit data and matching it with job listings can predict future population inflow and housing demand in a particular ZIP code.

Additionally, scraped data can power dashboards for internal decision-making or client-facing tools. Brokers use it to fine-tune recommendations, developers use it to assess land value, and insurers rely on it to estimate risk premiums based on crime rate and climate data proximity. The future of real estate is not just about brick and mortar—it's about data, and those who harness it intelligently will lead the next wave of growth.

Get accurate property data—start scraping smarter today!

Each region—USA, UAE, Germany, Australia, and the UK—has unique data touchpoints, legal frameworks, consumer behavior patterns, and digital infrastructure. Smart real estate scraping recognizes this diversity and adjusts scraping logic, frequency, and targets accordingly.

This level of customization ensures relevance, regulatory compliance, local alignment, and strategic accuracy for regional and international investors alike.

Smart Real Estate Property Datasets scraping is no longer an option—it's a necessity. With the digitization of property markets, access to timely, structured, and actionable data can make or break an investment strategy. Whether evaluating new developments in Dubai, tracking suburb growth in Sydney, or analyzing rental demand in Berlin, Web Scraping Property Data delivers the granular intelligence needed for success.

As more platforms emerge and government agencies continue to open their datasets, the scope of smart scraping will only expand. Organizations that invest in scalable, intelligent Real Estate Data Scraping for Real-time Insights stand to gain not just profit but also foresight, agility, and leadership in an increasingly competitive property market.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.