In 2026, understanding real estate market dynamics has become crucial for investors, homeowners, and renters alike. The Redfin & Apartment Housing Price Analysis 2026 offers comprehensive insights into price fluctuations, market demands, and emerging trends across the U.S. housing sector. By leveraging structured datasets and historical records, analysts can better predict whether a market favors buyers or sellers. Simultaneously, businesses and individuals can benefit from the ability to Scrape apartment.com price trends USA, gathering real-time data for informed decision-making. Comparing data from multiple platforms ensures a holistic view, and the Redfin vs Apartment home price comparison dataset helps stakeholders benchmark market valuations efficiently.

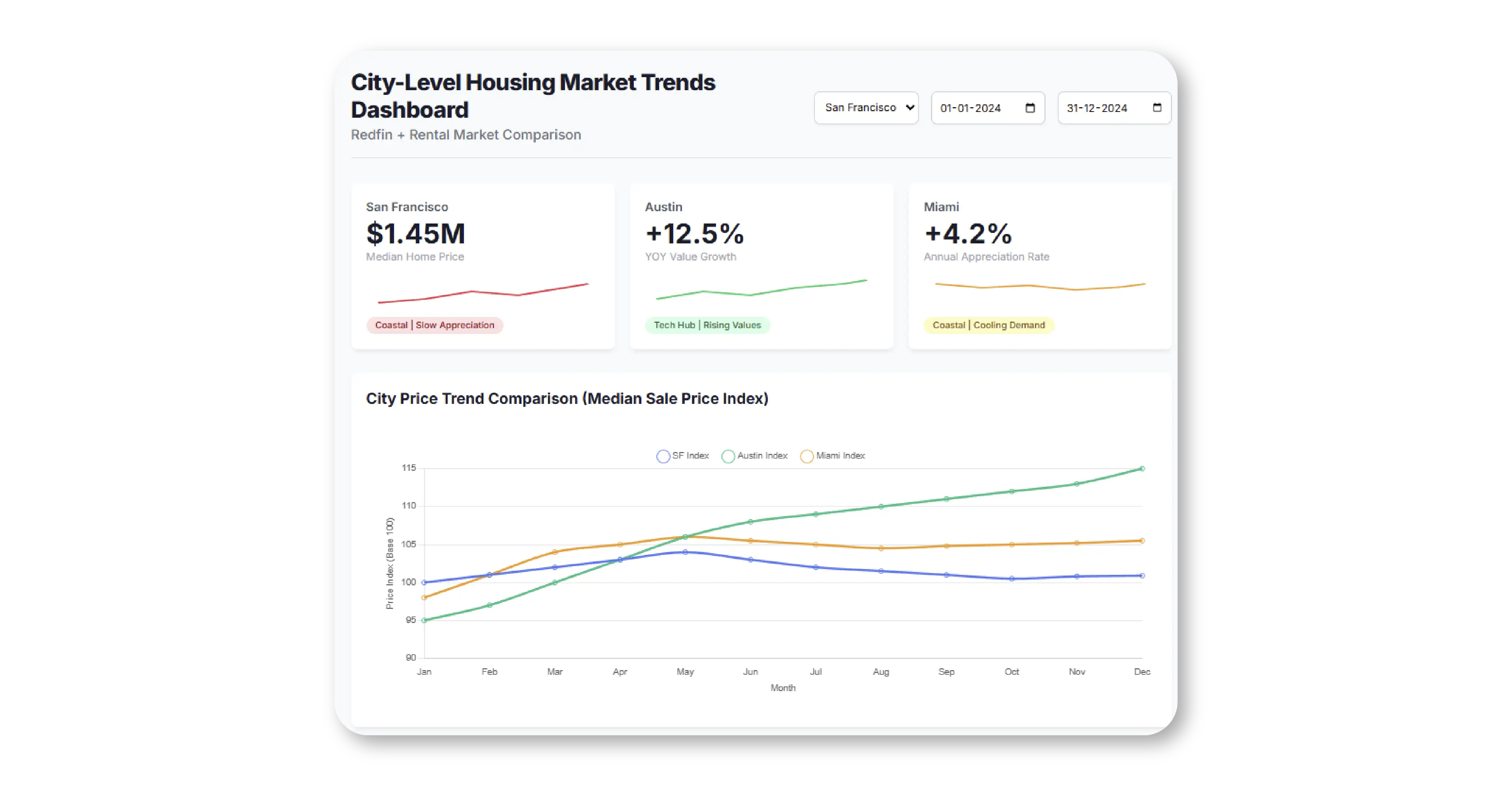

A critical step in understanding housing trends is analyzing city-level housing market trends data collection from Redfin. Cities like San Francisco, Austin, and Miami exhibit unique pricing patterns influenced by local supply, demand, and migration trends. For instance, coastal cities are witnessing a slowdown in appreciation rates, while inland tech hubs continue to experience rising property values. By aggregating city-level insights, investors can pinpoint opportunities for high returns or identify undervalued neighborhoods for future investment.

For individuals weighing renting versus buying, the Redfin vs Apartment rental vs buying cost analysis provides actionable insights. This analysis examines the long-term cost benefits of owning property versus renting and considers mortgage rates, rental growth, and property appreciation. Such datasets empower homeowners and tenants to make financially prudent decisions, particularly in volatile markets.

Market sentiment often drives short-term price movements and investment decisions. Redfin vs Apartment real estate sentiment data scraping allows analysts to capture consumer opinions, agent forecasts, and buyer confidence levels. Sentiment data from online reviews, forum discussions, and social media mentions can indicate market optimism or caution. For example, rising positive sentiment about urban apartment complexes might correlate with higher listing prices, whereas negative sentiment could signal a cooling market.

Alongside sentiment, historical price patterns remain a core focus. Tracking apartment.com price trends USA enables real-time monitoring of property appreciation, rental rate changes, and neighborhood desirability. Continuous tracking ensures that stakeholders stay informed of fluctuations and market anomalies.

Leveraging Redfin API data scraping enhances the precision and scalability of market research. APIs provide structured data on listings, transactions, property features, and neighborhood statistics. This allows analysts to conduct trend analysis, price forecasting, and comparative studies without manual data collection.

The Redfin listing price dataset can reveal patterns like seasonal spikes, price drops due to oversupply, or rapid appreciation in high-demand areas. For instance, data may show that mid-sized apartments in tech-heavy cities are appreciating faster than luxury condos, providing actionable insights for investors.

Additionally, firms and researchers can Extract Redfin housing data to combine with other datasets like rental prices, occupancy rates, or mortgage interest trends. Integrating multiple data points helps generate predictive models for identifying emerging buyer or seller market conditions.

To supplement Redfin insights, apartment housing data extraction from platforms like Apartment.com provides complementary perspectives on rental trends, vacancy rates, and demographic preferences. These datasets help identify shifts in housing demand, such as increased interest in suburban apartments or smaller urban units. For buyers, renters, and developers, this data-driven approach ensures that strategic decisions are informed by market realities rather than speculation.

Analyzing housing data also helps uncover macro trends. For example, markets with increasing new construction may temporarily favor buyers, while older neighborhoods with limited inventory may tilt the advantage toward sellers. Understanding such nuances requires robust, regularly updated datasets.

Unlock real-time housing market insights—leverage our data scraping services to make smarter buying, selling, and investment decisions today!

The combined insights from Redfin and Apartment.com datasets indicate that 2026 is likely to see mixed market conditions across the U.S.:

Through Redfin vs Apartment home price comparison dataset and Redfin vs Apartment rental vs buying cost analysis, investors can identify which markets are likely to remain competitive for sellers versus those offering favorable conditions for buyers.

The value of real estate data extends beyond price predictions. Businesses can refine marketing strategies, financial institutions can optimize mortgage offerings, and policy planners can anticipate housing shortages. Collecting, analyzing, and applying city-level housing market trends data collection from Redfin ensures informed decisions that mitigate risks.

Furthermore, Redfin vs Apartment real estate sentiment data scraping combined with price datasets enables a holistic view of market dynamics. Investors and homeowners can detect patterns in demand elasticity, buyer sentiment, and property appreciation. Such data-driven intelligence is especially valuable in 2026, given the ongoing market shifts post-pandemic and the evolving mortgage rate landscape.

In summary, the integration of Redfin and Apartment.com datasets offers unparalleled insights into U.S. housing markets. By employing tools for Real Estate Property Data Extraction, businesses and individual investors can monitor trends, evaluate opportunities, and anticipate market shifts. Using a Real Estate Data Scraping API ensures real-time data availability, while access to structured Real Estate Property Datasets allows for precise comparative analysis. For anyone navigating the complex landscape of U.S. real estate in 2026, leveraging these data-driven strategies is essential for informed decision-making.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

It is a comprehensive study of property price trends, buyer vs seller market dynamics, and investment opportunities across the U.S. housing sector in 2026.

By using automated data collection tools and APIs, users can extract rental and sale prices, historical trends, and neighborhood insights for analysis.

This analysis helps compare long-term costs of renting versus buying, factoring in property appreciation, rental growth, and mortgage interest rates.

Sentiment data from reviews, social media, and forums provides early indicators of buyer confidence and market optimism, influencing short-term price trends.

These datasets compile structured property information, such as listing prices, rental rates, and property features, which analysts use to forecast trends and guide investment decisions.