In 2020, the retail sector witnessed significant closures, particularly in the apparel and accessory segment. Throughout August 2020, 361 apparel and accessory stores across the United States ceased operations, signaling a challenging period for the industry. Notably, California experienced a substantial portion of these closures, with 40 stores shutting down, accounting for 12.4% of the nationwide closures.

Monitoring the pulse of retail through meticulous retail data scraping, iWeb Data Scraping Data Store diligently tracks and analyzes retail data, including the location data of 55 prominent apparel brands operating in the US market. Their findings reveal that 19 of these apparel and accessory brands included shutter stores in August 2020 amid the closures. This data underscores the dynamic nature of the retail landscape and the challenges businesses face within the apparel and accessories sector.

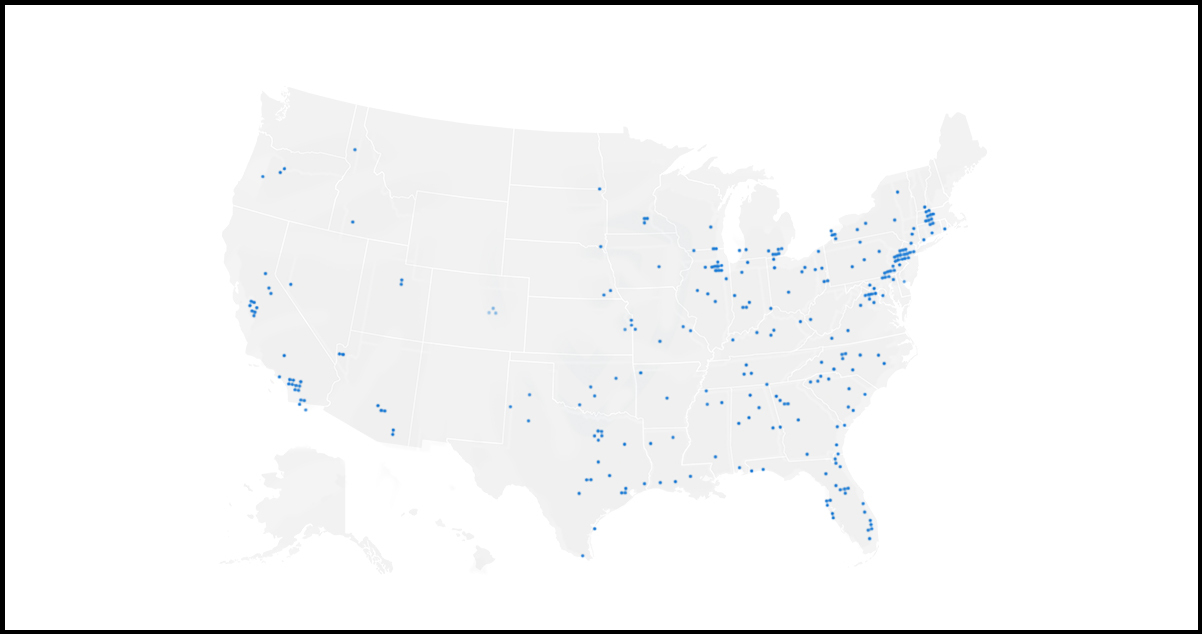

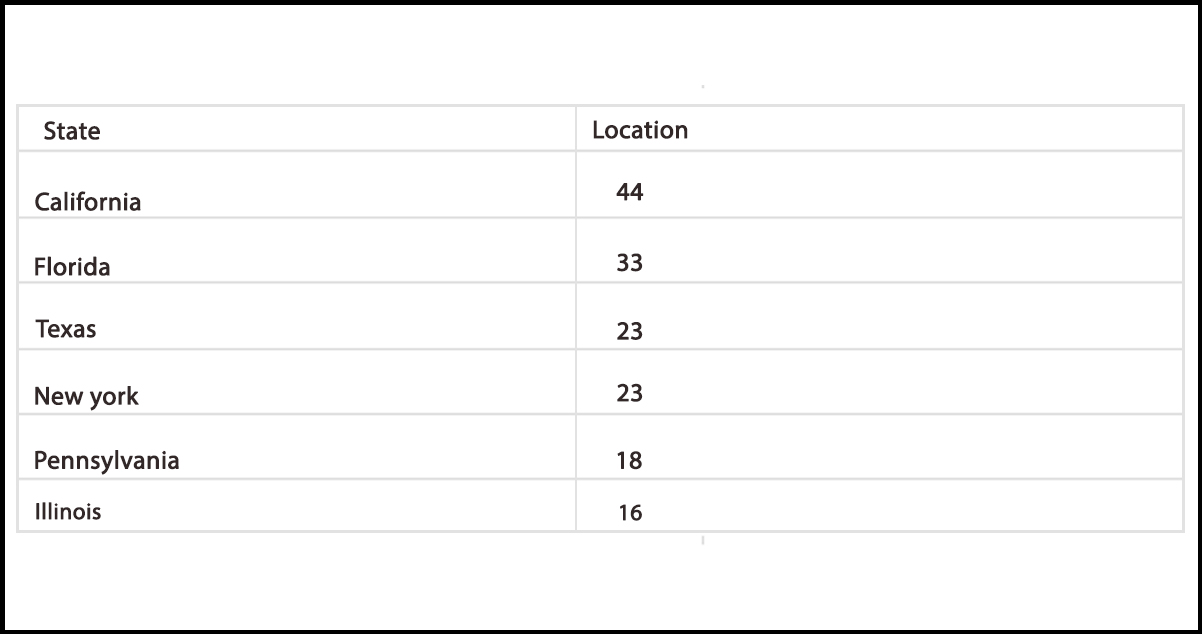

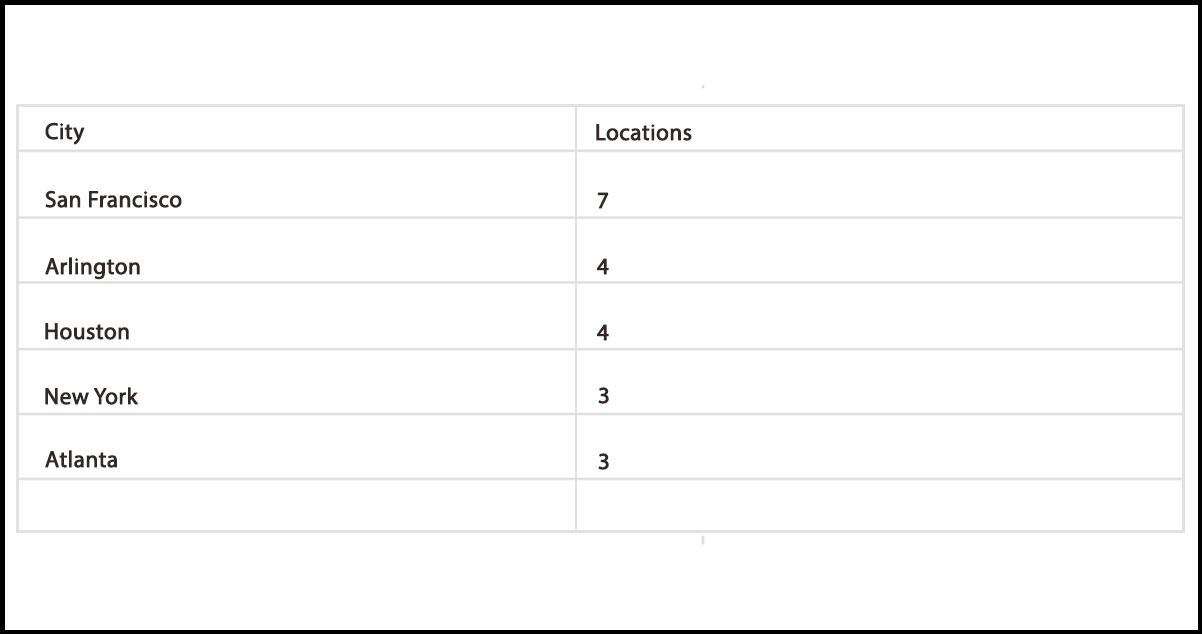

In apparel and accessory retail, California emerges as the state bearing the brunt of closures, with a notable count of 44 store closures. Trailing behind, Florida witnesses 33 closures, accounting for 7.8% of the total closures, closely followed by Texas and New York, each tallying 23 closures, making up 5.5% of closures individually. These statistics shed light on the varying degrees of impact across different regions within the United States. From the bustling streets of California to the vibrant landscapes of Florida, the retail sector faces diverse challenges in the wake of closures. Understanding these trends using retail data scraping services is crucial for stakeholders in navigating the shifting dynamics of the apparel and accessory market, enabling them to devise informed strategies to adapt to evolving consumer demands and market conditions.

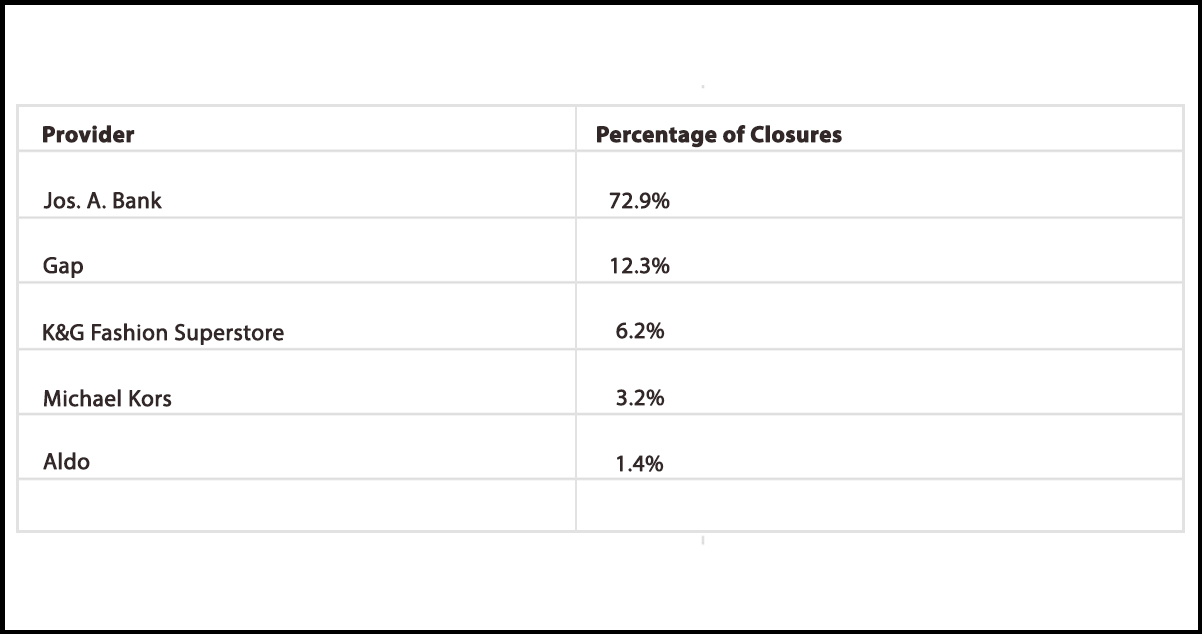

Amid the tumultuous landscape of the retail industry in 2020, apparel and accessory chains faced significant challenges, with closures impacting a notable percentage of their total stores. Jos. A. Bank emerged as the most brutal hit, closing 72.9% of its stores in August. Following closely behind, Gap and K&G Fashion Superstore experienced closure rates of 12.3% and 6.2%, respectively.

Tailored Brands, the parent company of Jos. A. Bank and K&G Fashion Superstore, initiated extensive restructuring measures, including the closure of hundreds of stores and substantial reductions in corporate staff, in response to the ongoing impact of the COVID-19 pandemic on the retail sector. Meanwhile, Gap Inc. embarked on a strategic shift, closing stores under its Gap and Banana Republic brands while expanding its footprint with Old Navy and Athleta.

The significance of these closures using retail data scraper is underscored by the table below, showcasing retail brands with closure rates exceeding one percent of their total store count. This data reflects the profound challenges apparel and accessory retailers face amidst the evolving retail landscape.

iWeb Data Scraping offers comprehensive location data for hundreds of brands spanning various industries, including Automotive, Healthcare, and Fast Food. Subscribing to their store data plans provides access to datasets featuring key data points such as store openings, closures, parking availability, in-store pickup options, services offered, subsidiaries, nearest competitor store information, and more.

The complete analysis dataset is easily downloadable for those seeking detailed insights from our data store. It offers a selection of records, offering a glimpse into the breadth and depth of data provided, empowering businesses with actionable intelligence to drive informed decision-making and strategic planning.

The retail sector has faced unprecedented challenges amidst the coronavirus pandemic, marked by bankruptcies and accelerated store closures. As retailers cautiously reopen, they must reassess their sales floor strategies. Embracing alternative methods such as curbside pickup, locker pickup, or repurposing stores into distribution or internet sales fulfillment centers becomes imperative for survival.

However, amidst the turmoil, budget retailers and variety stores like Dollar General, Dollar Tree, and Five Below stand out as exceptions, experiencing rapid expansion. These chains cater to budget-focused customers, bolstering their resilience amid economic uncertainties.

For retail brands that demonstrated robust performance before the crisis and maintain a strong consumer position, there's potential to thrive in the months and years ahead. Adaptation, innovation, and strategic positioning are pivotal in navigating the evolving retail landscape amidst the challenges posed by the pandemic.

Contact iWeb Data Scraping for comprehensive data services, including mobile app scraping and web data scraping. Our team offers expert guidance and tailored solutions for scraping retail store location data. Reach out now to discuss your specific needs and discover how we can bring efficiency and reliability to your project.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.