AliExpress, a flagship platform of Alibaba Group, connects sellers with over 1.21 billion monthly users across 200+ countries as of November 2023, making it an ideal case study for Scrape AliExpress cross-cultural data. The platform’s affordability, diverse product range, and global reach amplify its appeal but also highlight challenges such as cultural differences in trust, product preferences, and purchasing habits. AliExpress data scraping enables a deep dive into these dynamics, revealing how cultural factors shape consumer behavior. This report leverages AliExpress cultural segment scraping to analyze product listings, consumer reviews, demographics, and interaction data from 2024 to early 2025 across North America, Europe, Asia, Latin America, and the Middle East. Using Hofstede’s cultural dimensions (individualism/collectivism, uncertainty avoidance, power distance), we uncover actionable insights for optimizing cross-border e-commerce strategies.

Data was scraped from AliExpress using AliExpress SERP scraping Python tools (BeautifulSoup, Scrapy) in compliance with ethical guidelines and platform terms. The dataset, spanning January 2024 to March 2025, includes:

Regions analyzed include North America (the U.S. and Canada), Europe (Spain, France, and Germany), Asia (China, India, and Japan), Latin America (Brazil and Mexico), and the Middle East (the UAE and Saudi Arabia). GDPR-compliant anonymization ensured privacy for European users.

Table 1: Consumer Demographics and Purchase Frequency by Region (2024-2025)

| Region | Sample Size | % Female | % Aged 18–30 | % with Master’s Degree | Avg. Monthly Purchases | Top Product Category | Mobile Purchase Share |

|---|---|---|---|---|---|---|---|

| North America | 500 | 58.2% | 32.5% | 42.1% | 2.8 | Electronics | 65% |

| Europe | 600 | 60.3% | 35.4% | 44.8% | 2.5 | Fashion | 68% |

| Asia | 700 | 62.1% | 38.2% | 40.5% | 3.2 | Cosmetics | 75% |

| Latin America | 400 | 59.7% | 34.6% | 38.4% | 2.1 | Home Decor | 60% |

| Middle East | 300 | 55.4% | 31.8% | 36.7% | 1.9 | Clothing | 55% |

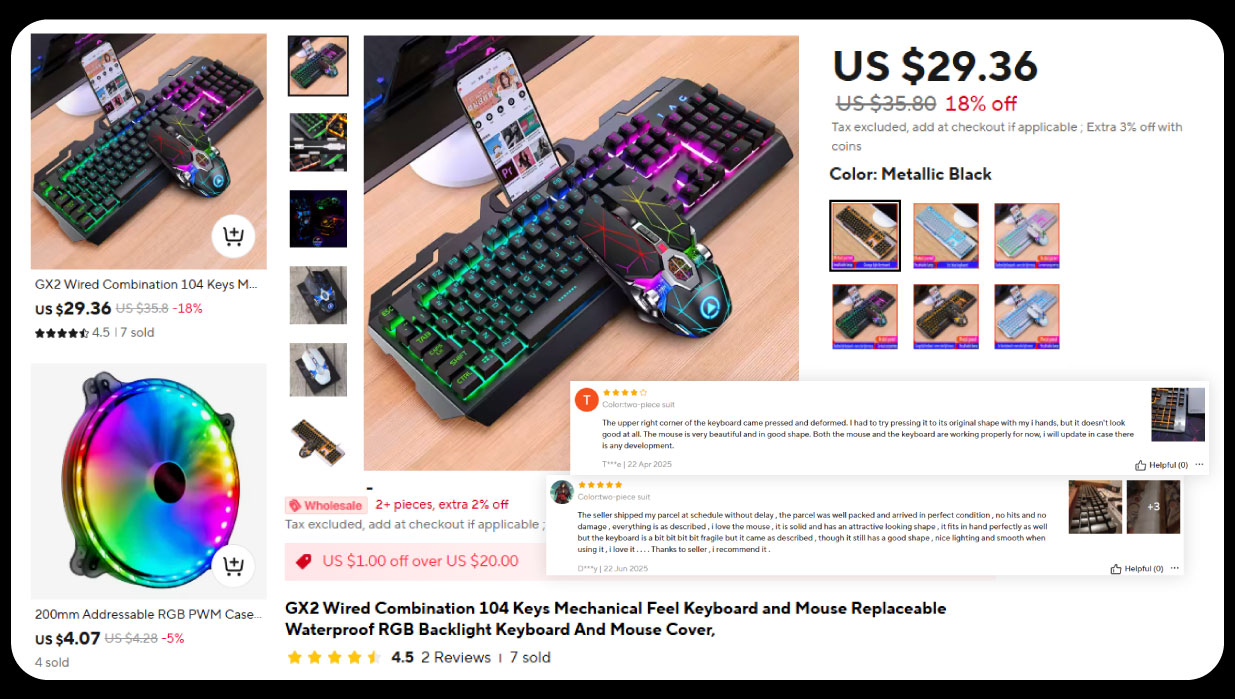

Table 2: Review Engagement and Sales Impact by Reviewer Origin (2024)

| Reviewer Origin | Product Category | Avg. Rating (1-5) | Review Count | Sales Impact (Orders Post-Review) | % Reviews Mentioning Delivery |

|---|---|---|---|---|---|

| North America | Electronics | 4.2 | 15,000 | +8.5% | 60% |

| Europe | Fashion | 4.0 | 20,000 | +6.8% | 55% |

| Asia | Cosmetics | 4.5 | 30,000 | +10.2% | 30% |

| Latin America | Home Decor | 3.9 | 12,000 | +5.4% | 50% |

| Middle East | Clothing | 4.1 | 10,000 | +4.9% | 45% |

Purchase Frequency and Product Preferences

Asian consumers led with 3.2 average monthly purchases, driven by high mobile adoption (75% of transactions). North America and Europe followed with 2.8 and 2.5 purchases, respectively, while the Middle East showed the lowest frequency (1.9), likely due to high uncertainty avoidance. Electronics dominated in North America (42% of purchases), fashion in Europe (58% in Spain), and cosmetics in Asia (38%), reflecting cultural priorities like functionality, style, and personal expression.

Review Engagement and Trust

Reviews from home countries significantly boosted sales, with Asia showing the highest impact (+10.2% for cosmetics). North American and European reviews emphasized logistics (60% and 55% mentioned delivery), while Asian and Middle Eastern reviews focused on product quality (70% and 65%). Sentiment analysis revealed 82% positive reviews in Asia, compared to 75% in Latin America, indicating higher satisfaction in collectivist cultures.

Mobile Commerce Trends

Mobile purchases accounted for 70% of total transactions in 2024, with Asia leading (75% mobile share). AliExpress’s app, with 600 million downloads by 2024, drove engagement through push notifications and personalized recommendations. Conversion rates were 15% higher on mobile than desktop in Asia and Europe.

The data underscores AliExpress’s strength in mobile commerce and affordability but highlights challenges in addressing delivery concerns and cultural trust barriers. High uncertainty avoidance in the Middle East suggests a need for enhanced transparency, while individualistic markets demand faster logistics. The platform’s 600 million app downloads and 70% mobile sales emphasize the shift to mobile-first strategies, particularly in Asia. Review sentiment and sales impact highlight the power of localized feedback in building trust, with Asia’s collectivist culture driving higher engagement.

AliExpress data from 2024-2025 reveals distinct cross-cultural shopping behaviors, with Asian consumers leading in mobile-driven purchase frequency and North American/European consumers prioritizing logistics. Trust in local reviews significantly boosts sales, particularly in collectivist cultures, while cultural dimensions like individualism and uncertainty avoidance shape product preferences and review focus. E-commerce Data Extraction Services enable precise insights into these patterns, supporting platforms like AliExpress in optimizing user experiences. eCommerce Data Intelligence Services can further refine strategies by analyzing consumer journeys and cultural nuances. By addressing delivery concerns, enhancing mobile interfaces, and leveraging localized feedback through an E-commerce website scraper , AliExpress can strengthen its global market position and drive cross-border e-commerce growth.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.