The rise of digital commerce has made online marketplaces critical battlegrounds for global FMCG brands. For Nestlé, platforms like Amazon serve as dynamic ecosystems where pricing, consumer sentiment, and competitive positioning constantly evolve.

Businesses increasingly Scrape Nestlé Products on Amazon to build structured datasets for real-time decision-making.

Through Amazon Nestlé price tracking scraping, analysts monitor SKU-level price shifts, promotional cycles, and seller behavior.

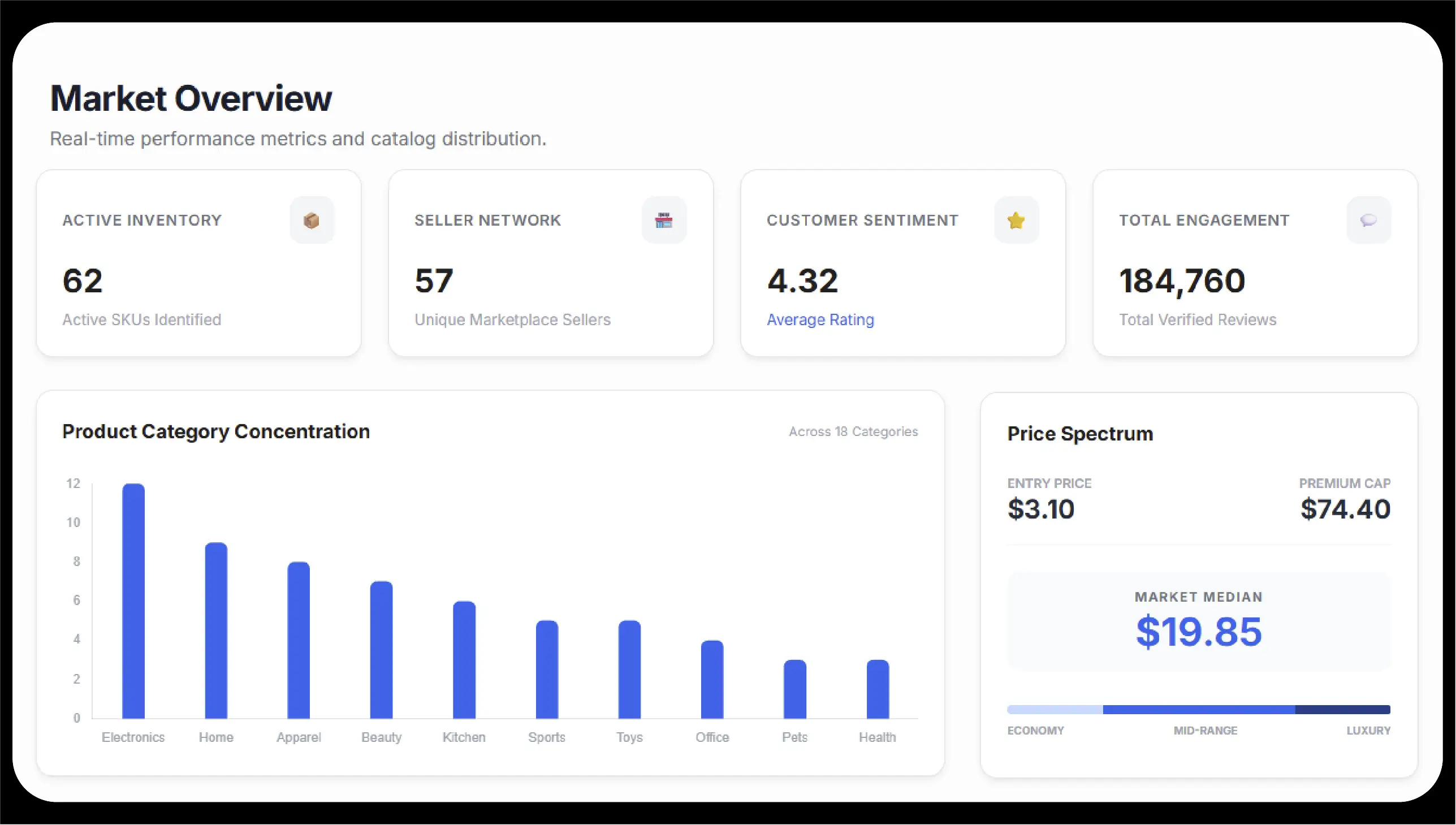

Comprehensive dashboards powered by Nestlé Amazon market share analysis help quantify digital shelf share, engagement density, and category dominance.

This research report analyzes 62 active Nestlé SKUs observed over a 7-day monitoring window.

During the observation period:

Nestlé’s digital footprint is concentrated in dairy, powdered beverages, confectionery bundles, and nutritional drinks.

| Category | SKU Count | Min Price ($) | Max Price ($) | Avg Price ($) | Total Reviews | Avg Rating | Seller Count | % of Total SKUs |

|---|---|---|---|---|---|---|---|---|

| Condensed & Evaporated Milk | 9 | 3.10 | 18.40 | 9.85 | 48,320 | 4.46 | 21 | 14.5% |

| Powdered Beverage Mixes | 11 | 8.20 | 39.90 | 22.75 | 36,480 | 4.38 | 18 | 17.7% |

| Chocolate Bars | 8 | 6.50 | 29.80 | 17.60 | 21,940 | 4.29 | 14 | 12.9% |

| Assorted Bundles | 7 | 19.90 | 74.40 | 41.30 | 14,220 | 4.34 | 11 | 11.3% |

| Nutrition & Protein Drinks | 6 | 24.50 | 68.90 | 52.40 | 16,870 | 4.21 | 7 | 9.7% |

| Breakfast Cereals | 5 | 7.60 | 21.30 | 14.95 | 12,430 | 4.35 | 9 | 8.1% |

| Baking Ingredients | 6 | 4.20 | 16.75 | 10.10 | 18,960 | 4.44 | 17 | 9.7% |

| Ready-to-Drink Beverages | 4 | 14.50 | 33.20 | 23.10 | 8,540 | 4.18 | 6 | 6.5% |

| Specialty Imported Variants | 6 | 21.80 | 59.90 | 38.75 | 7,000 | 4.27 | 5 | 9.7% |

Key Insight:

Dairy and powdered beverage mixes account for 32% of total SKUs and 46% of total reviews, reinforcing staple-driven demand dominance.

Price discipline is one of Nestlé’s strongest marketplace advantages.

Using Nestlé price history tracking API, we monitored daily average pricing over a 7-day window.

| Day | Avg Price ($) | Highest SKU ($) | Lowest SKU ($) | Daily Price Change % | Active Promotions | Buy Box Ownership % |

|---|---|---|---|---|---|---|

| Day 1 | 20.14 | 74.40 | 3.10 | — | 6 | 91% |

| Day 2 | 20.28 | 74.40 | 3.10 | +0.69% | 7 | 92% |

| Day 3 | 20.05 | 73.90 | 3.10 | -1.13% | 6 | 90% |

| Day 4 | 20.32 | 74.40 | 3.20 | +1.34% | 8 | 93% |

| Day 5 | 20.41 | 74.40 | 3.20 | +0.44% | 9 | 94% |

| Day 6 | 20.27 | 73.50 | 3.10 | -0.69% | 7 | 92% |

| Day 7 | 20.46 | 74.40 | 3.10 | +0.94% | 10 | 95% |

Observations:

This indicates strong centralized pricing control.

Through Nestlé Amazon review data extraction, we tracked review growth during the same 7-day period.

| Day | Total Reviews | Daily Review Growth | % Growth | SKUs Out of Stock | Avg Rating | New Sellers Added |

|---|---|---|---|---|---|---|

| Day 1 | 182,940 | — | — | 3 | 4.32 | 0 |

| Day 2 | 183,120 | 180 | 0.09% | 4 | 4.32 | 1 |

| Day 3 | 183,450 | 330 | 0.18% | 3 | 4.31 | 0 |

| Day 4 | 183,880 | 430 | 0.23% | 2 | 4.33 | 1 |

| Day 5 | 184,060 | 180 | 0.09% | 4 | 4.32 | 0 |

| Day 6 | 184,420 | 360 | 0.20% | 5 | 4.31 | 1 |

| Day 7 | 184,760 | 340 | 0.18% | 3 | 4.32 | 0 |

Observations:

Using structured competitor benchmarking:

Advanced Nestlé Amazon competitive analysis shows that price undercutting occurs most frequently in mid-tier chocolate SKUs, but rarely in dairy staples.

Through Nestlé Amazon inventory tracking scraping, we observed:

Integration with a Real-time Amazon monitoring API enables:

The structured Amazon FMCG product dataset Nestlé highlights:

Advanced Amazon digital shelf analytics Nestlé confirms keyword stability and conversion consistency in core segments.

Continuous marketplace intelligence allows brands to move from reactive pricing to predictive strategy.

Organizations leveraging professional eCommerce data scraping services gain scalable, structured access to competitive intelligence.

Customizable eCommerce datasets services enable advanced BI modeling and forecasting.

For automation at scale, an eCommerce marketplace data scraping API provides real-time integration into dashboards, pricing engines, and monitoring systems.

In the modern FMCG ecosystem, structured data isn’t optional — it’s competitive survival.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.