The global plant-based food market has grown exponentially over the past decade, driven by shifting consumer preferences toward healthier, sustainable, and ethical food choices. Scrape Plant-Based Food Market Data Globally better to understand these evolving consumer trends and market shifts. Groceries are pivotal in delivering plant-based products to end consumers, acting as the primary distribution channel for this burgeoning segment.

Understanding the plant-based food market on a global scale requires comprehensive data collection and analysis to identify trends, consumer behaviors, competitive landscapes, and emerging opportunities. Leveraging Plant-Based Food Industry Data Scraping Services enables stakeholders to gather critical insights from diverse data sources efficiently. Scraping plant-based food market data globally allows stakeholders—grocery retailers, manufacturers, distributors, and analysts—to access real-time, granular information that fuels strategic decision-making.

By leveraging large datasets sourced from multiple online grocery platforms, e-commerce sites, and retail chains, businesses can map product availability, pricing trends, consumer ratings, and market penetration across regions. Employing Web Scraping Plant-Based Food Trends Worldwide has become crucial for tracking the dynamic changes in this competitive space. This report delves into the global plant-based food market by examining aggregated data scraped from top grocery platforms worldwide. It highlights key market dynamics and presents a data-driven analysis to provide actionable insights for stakeholders in this evolving sector.

Global Market Size and Growth

In 2023, the global plant-based food market was valued at approximately USD 30 billion and is projected to exceed USD 75 billion by 2030, expanding at a CAGR of 12–15%. This remarkable surge reflects increased consumer demand for sustainable and healthy food alternatives. The grocery sector dominates this industry, accounting for nearly 65% of total sales revenue, underscoring its critical role in product distribution. Businesses aiming to Extract Plant-Based Food Trends Worldwide rely on comprehensive datasets from retail and online grocery platforms. Through Plant-Based Market Intelligence, stakeholders gain actionable insights into product performance, regional demand, and pricing dynamics. Many retailers and suppliers now Track Global Growth in Plant-Based Foods to stay competitive with Scrapers for real-time analytics and decision-making.

| Region | Market Size (2023, USD Billion) | Expected CAGR (2023–2030) | Market Share (%) |

|---|---|---|---|

| North America | 12.5 | 11.8% | 41.6 |

| Europe | 9.0 | 13.5% | 30.0 |

| Asia-Pacific | 5.5 | 17.2% | 18.3 |

| Latin America | 2.0 | 14.1% | 6.7 |

| Middle East & Africa | 1.0 | 12.0% | 3.4 |

Table 1: Global Plant-Based Food Market Size and Growth Projections by Region

North America and Europe dominate the current market, fueled by high consumer awareness, established retail networks, and extensive product availability. The Asia-Pacific region, however, is rapidly emerging due to rising health consciousness, urbanization, and growing vegan and flexitarian populations.

The scraped datasets from major grocery e-commerce platforms—including Walmart, Tesco, Carrefour, Amazon Fresh, and others—offer a comprehensive view of global plant-based product availability. These platforms highlight a wide variety of categories, including plant-based meat substitutes, dairy-free alternatives, healthy snacks, frozen plant-based meals, and beverages. Scrape Plant-Based Food Market Data Globally to gain valuable insights into how plant-based products are positioned and priced across regions. Using Web Scraping Grocery App Data, it becomes possible to assess stock frequency, customer ratings, and promotional patterns. Furthermore, Web Scraping Quick Commerce Data provides real-time visibility into consumer demand through platforms offering instant delivery, allowing grocery businesses to respond swiftly to plant-based consumption trends worldwide.

| Product Category | % of Total Plant-Based Products Listed | Average Price Range (USD) | Average Consumer Rating (out of 5) |

|---|---|---|---|

| Plant-Based Meat | 35% | 5 - 12 | 4.3 |

| Dairy Alternatives | 30% | 2 - 6 | 4.5 |

| Plant-Based Snacks | 15% | 1 - 8 | 4.2 |

| Frozen Meals | 12% | 3 - 10 | 4.1 |

| Beverages (Juices, etc.) | 8% | 1.5 - 7 | 4.4 |

Table 2: Plant-Based Food Product Category Distribution and Pricing (Global Average)

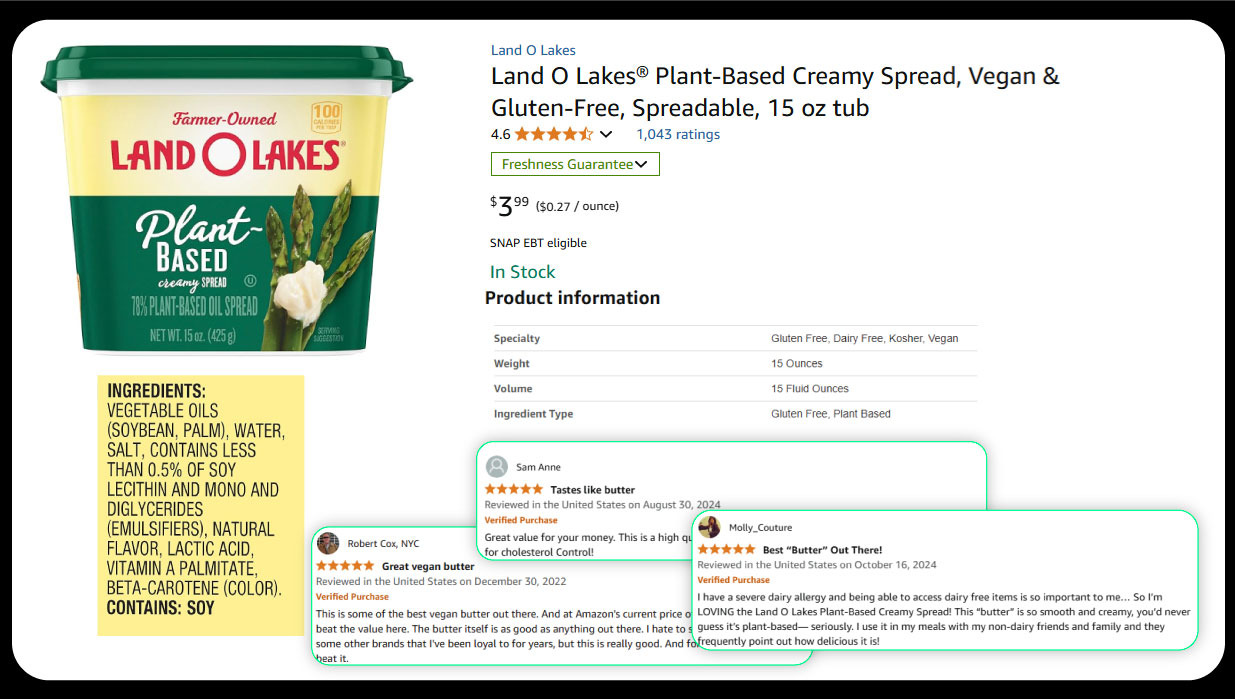

The dominance of plant-based meat and dairy alternatives aligns with consumer demand for protein substitutes and milk replacements. Pricing varies by region and brand, with premium products typically commanding higher prices and superior ratings.

North America

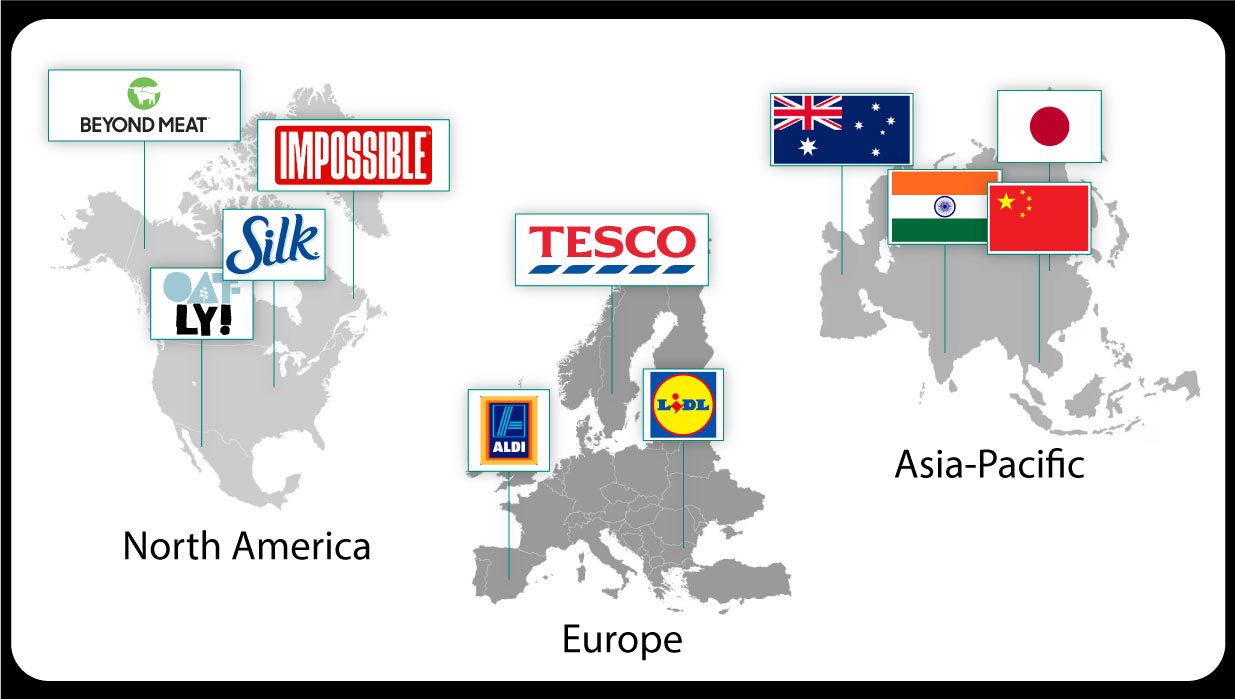

The U.S. and Canada showcase robust plant-based food markets concentrated in metropolitan areas with dense grocery retail networks. Scraped data indicates that popular grocery chains stock a wide variety of products from well-known brands such as Beyond Meat, Impossible Foods, Oatly, and Silk.

Data highlights:

Europe

Europe's market is characterized by a strong presence of plant-based dairy alternatives, especially oat milk and cheese substitutes. The UK's Tesco and Germany’s Aldi and Lidl provide extensive product lines.

Data highlights:

Asia-Pacific

Emerging markets like China, India, Japan, and Australia are experiencing surges in plant-based food availability, driven by health awareness and environmental concerns.

Data highlights:

Market Penetration and Product Innovation

Scraped data reveals increasing product diversity within plant-based categories, signifying innovation efforts by manufacturers to capture market share. The trend toward hybrid products—mixing plant-based and traditional ingredients—is notable in categories like sausages and cheese.

Pricing Dynamics

Analysis of scraped price data across regions shows significant variation influenced by local supply chains, brand positioning, and consumer purchasing power. Price elasticity appears higher in developing markets, suggesting growth opportunities through affordable product development.

Consumer Ratings and Reviews

Aggregated consumer ratings from multiple platforms suggest generally favorable perceptions of plant-based foods, with average scores between 4.1 and 4.5 out of 5. Text mining of reviews highlights taste, nutritional content, and sustainability as frequent purchase drivers.

Seasonal and Regional Variations

Data indicates seasonal fluctuations in plant-based food demand, with spikes observed around January (New Year’s resolutions) and during key regional festivals promoting vegetarian diets (e.g., Lent in Europe). Additionally, urban centers show higher product variety and consumer engagement than rural areas.

Competitive Landscape

Scraping data from grocery sites and brand portals exposes the competitive landscape with several major players dominating shelf space and online visibility. Beyond Meat and Impossible Foods lead the plant-based meat segment, while Oatly and Alpro excel in dairy alternatives. Regional brands and private labels are increasingly prominent, especially in Europe and Asia-Pacific.

Opportunities for Grocery Retailers

Data-driven insights from the scraped market data help grocery retailers optimize inventory, tailor promotions, and expand plant-based assortments based on consumer preferences and emerging trends. By analyzing Grocery and Supermarket Store Datasets, businesses can identify high-performing products and detect regional variations in demand. Additionally, leveraging Grocery Pricing Data Intelligence allows for dynamic pricing strategies, ensuring competitive positioning while maximizing profitability in the growing plant-based food segment. For example:

The global plant-based food market within the grocery sector continues to expand rapidly, fueled by consumer interest in health, sustainability, and ethical consumption. Grocery Data Scraping Services enable stakeholders to capture a comprehensive view of product availability, pricing, consumer sentiment, and regional dynamics. Scraping plant-based food market data globally empowers data-driven strategies that support growth initiatives, competitive positioning, and innovation planning.

Through ongoing collection and analysis of diverse grocery datasets worldwide, businesses can stay ahead of market shifts, optimize product portfolios, and better serve a growing consumer base committed to plant-based lifestyles. By leveraging Quick Commerce Data Intelligence , retailers and suppliers gain faster visibility into trending products, stock levels, and local demand patterns across ultra-fast delivery platforms.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.