What Strategies Work Best to Scrape Travel Insurance Pricing Data in UAE and UK Efficiently?

Introduction

In the evolving landscape of travel and tourism, pricing strategies play a pivotal role in

shaping consumer decisions. Travelers are increasingly price-sensitive, seeking affordable

travel insurance plans while exploring options across multiple providers. To stay competitive,

insurers, aggregators, and travel platforms need accurate, real-time data on premiums, coverage,

and competitor offerings. Scrape Travel Insurance Pricing Data in UAE and UK to gain actionable

insights, allowing businesses to monitor the market efficiently and optimize their offerings.

The UAE and UK travel insurance markets are highly dynamic, influenced by seasonal demand,

regulatory changes, and evolving traveler preferences. Using advanced web scraping techniques,

companies can Extract Travel insurance price data in UAE UK Market and obtain structured

datasets that help identify trends, benchmark pricing, and evaluate product competitiveness.

Understanding Travel Insurance Data Scraping

Travel insurance data scraping involves extracting comprehensive information from

insurance providers’ websites, online aggregators, and comparison platforms. This includes

details such as policy premiums, coverage limits, add-on benefits, age-based pricing, and policy

durations. Unlike manual data collection, automated scraping provides Travel Insurance Price

Monitoring via Web Scraping, delivering real-time insights without human error and reducing

operational overhead.

This process is particularly valuable in markets like the UAE and UK, where multiple

insurance companies compete and frequent promotional offers influence customer decisions. Live

data enables insurers and travel agencies to respond quickly to market fluctuations, design

competitive packages, and improve customer engagement.

Stay ahead in travel markets – leverage our advanced travel data

scraping services for real-time insights today

Key Benefits of Travel Insurance Pricing Data Scraping

Implementing travel insurance data scraping brings several strategic advantages:

- Competitive Benchmarking – Businesses can compare their pricing and

coverage against competitors, identifying gaps and opportunities for improvement.

- Real-Time Market Intelligence – Automated scraping ensures that

decision-makers have the latest data on policy updates, premiums, and promotions.

- Enhanced Product Offerings – Insights from scraped data allow insurers to

refine policy features, bundle add-ons, and introduce targeted offers.

- Operational Efficiency – Manual price monitoring across multiple providers

is labor-intensive and prone to errors. Automated scraping streamlines this process.

- Data-Driven Marketing – Marketers can leverage detailed pricing insights to

craft competitive campaigns, attract price-sensitive travelers, and improve conversion

rates.

By focusing on Scraping UAE and UK Travel Insurance Data, businesses can develop

a

proactive pricing strategy that aligns with market trends and traveler expectations.

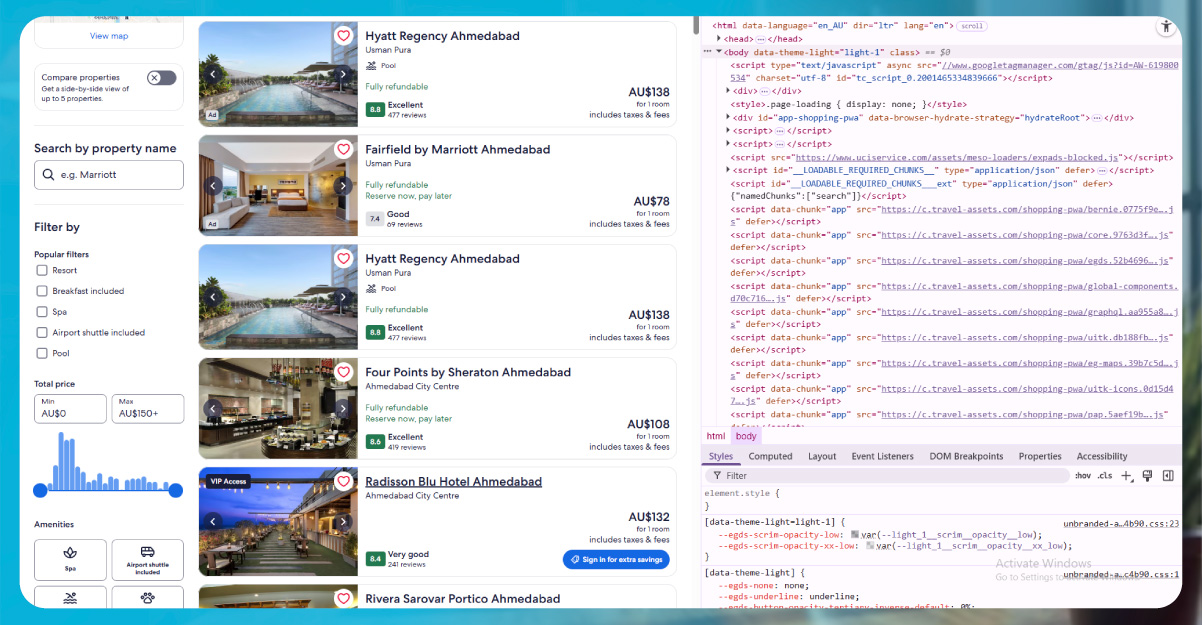

How Travel Insurance Data Scraping Works?

The process of scraping travel insurance data generally involves the following

steps:

- Identifying Target Platforms – Insurance company websites, travel

portals,

and aggregators are selected as data sources.

- Web Crawling – Automated crawlers navigate through relevant pages to

collect premium rates, policy features, coverage details, and discounts.

- Data Extraction – Using tools like XPath, CSS selectors, or APIs,

essential

data is parsed and structured into organized datasets.

- Data Cleaning and Standardization – Raw data may include

inconsistencies or

incomplete entries; these are cleaned and normalized for accuracy.

- Data Storage and Integration – Extracted data is stored in databases,

enabling analysis, reporting, and integration with business intelligence tools.

- Continuous Monitoring – Automated scripts run at scheduled intervals,

ensuring that real-time changes in pricing or policy details are captured efficiently.

Through the methods to Extract Travel Insurance Rates from UAE and UK, companies

gain access to accurate, up-to-date information that can inform strategic decision-making

across

departments, from product management to marketing.

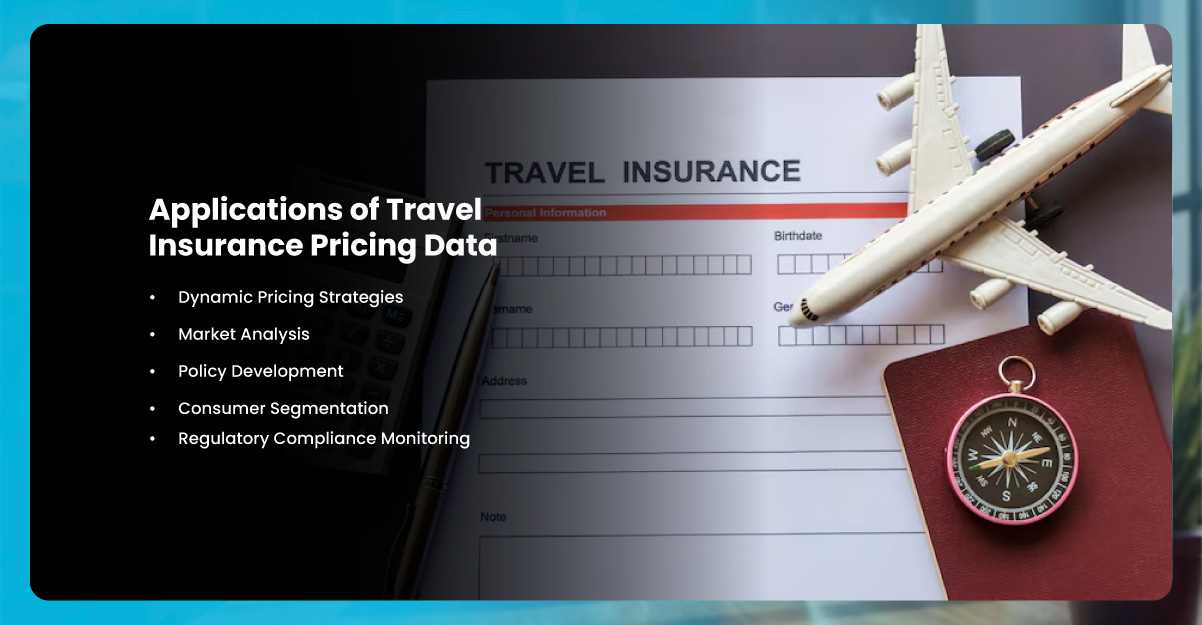

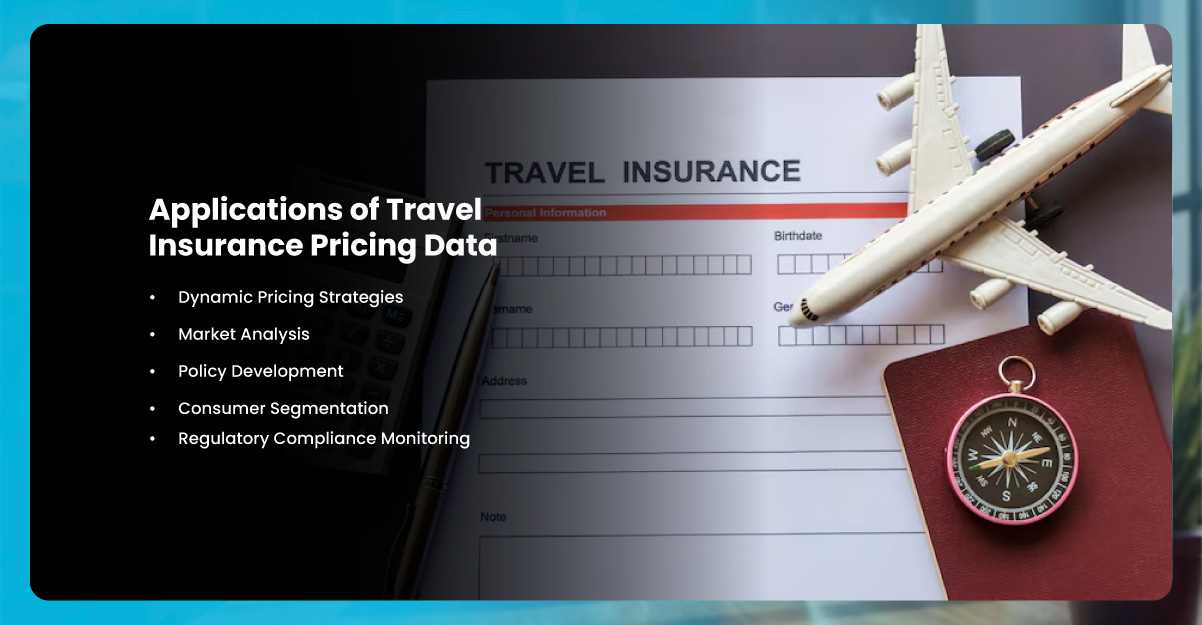

Applications of Travel Insurance Pricing Data

Applications include:

- Dynamic Pricing Strategies – Insurers can adjust premiums based on

competitor rates, market demand, and seasonal variations.

- Market Analysis – Aggregators and travel platforms can use the data to

create comparison tools, highlighting the most cost-effective options for travelers.

- Policy Development – Detailed insights into competitor offerings help

insurers design policies that are both attractive and profitable.

- Consumer Segmentation – Understanding pricing patterns allows companies

to

tailor offers for specific traveler segments, such as families, solo travelers, or

business

tourists.

- Regulatory Compliance Monitoring – Scraping data ensures that companies

stay informed about any mandatory coverage changes or updates required in UAE and UK

markets.

Tools and Techniques for Travel Insurance Data Scraping

Several technologies and methodologies support effective travel insurance data

scraping:

- Python Libraries – BeautifulSoup, Scrapy, and Selenium allow the

creation

of custom scraping scripts to collect policy and pricing data efficiently.

- APIs – Some insurance platforms provide APIs for accessing structured

data,

which reduces scraping complexity and ensures compliance.

- Headless Browsers – Puppeteer and Playwright can navigate dynamic

websites

with JavaScript-heavy content, capturing the required information.

- Cloud-Based Scraping Services – These services enable scalable and

automated scraping across multiple websites, ensuring uninterrupted data collection.

- Data Validation Tools – Tools that detect duplicates, missing values,

or

expired policies help maintain dataset accuracy.

Using Real-Time travel insurance data scraping, insurers and travel agencies can

continuously track competitors’ pricing, ensuring their offerings remain competitive and

aligned

with market expectations.

Challenges in Travel Insurance Data Scraping

Despite its advantages, scraping travel insurance data comes with challenges:

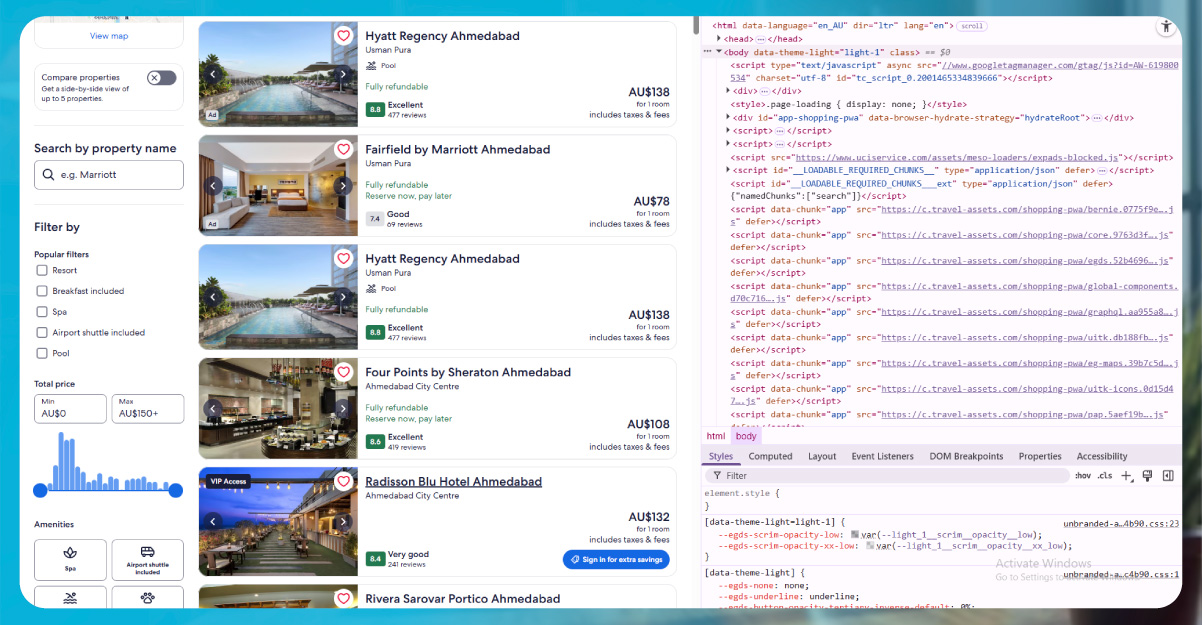

- Dynamic Websites – Many insurance websites update their layouts

frequently,

which may break scraping scripts. Regular maintenance is necessary.

- Anti-Scraping Measures – Websites may use CAPTCHAs, IP restrictions, or

rate limits to prevent automated access. Techniques like rotating proxies or session

management are often required.

- Data Accuracy – Policies may have region-specific conditions,

exclusions,

or discounts. Ensuring precise and actionable data requires robust validation

mechanisms.

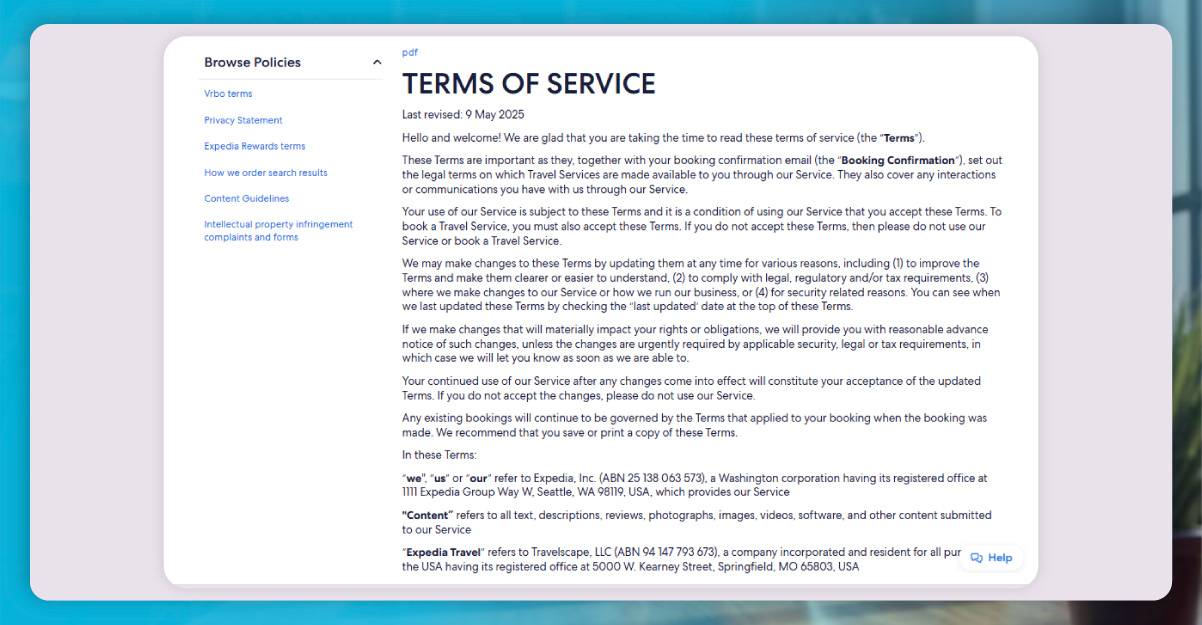

- Legal and Ethical Compliance – Scraping must respect website terms of

service and data privacy regulations, such as GDPR in the UK and applicable laws in the

UAE.

Best Practices for Effective Travel Insurance Data Scraping

To maximize efficiency and minimize risk, consider the following best practices:

- Respect Legal Guidelines – Always review terms of service and comply

with

regional regulations.

- Incremental Scraping – Track changes instead of scraping entire

websites

repeatedly to reduce server load and improve efficiency.

- Data Quality Monitoring – Regularly check for inconsistencies, missing

entries, or expired policies.

- Automation and Scheduling – Utilize automated scripts to collect data

during off-peak hours, thereby minimizing the risk of IP blocking.

- Secure Data Handling – Protect sensitive data from unauthorized access

and

ensure proper storage.

Implementing these practices ensures that Travel insurance price tracking in UAE

&

UK remains accurate, reliable, and actionable.

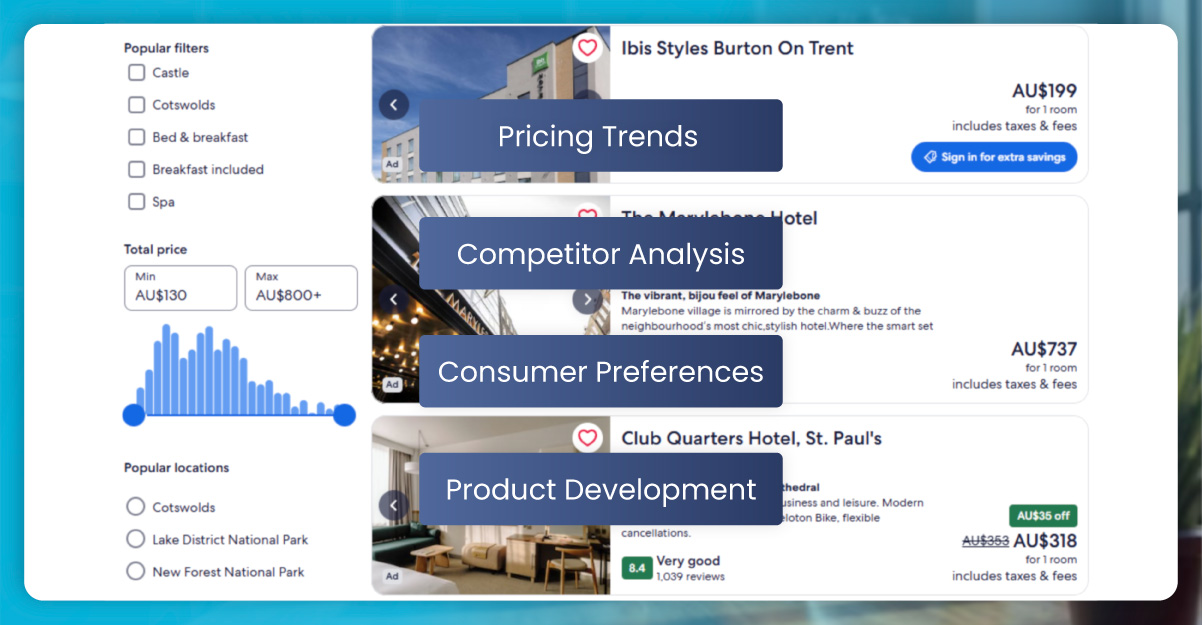

Insights Derived from Travel Insurance Pricing Data

When data is collected and analyzed effectively, it can provide actionable

insights

such as:

- Pricing Trends – Understand how premiums fluctuate during peak travel

seasons or in response to market events.

- Competitor Analysis – Identify which providers offer the most

competitive

pricing or innovative coverage options.

- Consumer Preferences – Assess which policy features or add-ons are most

appealing to travelers.

- Product Development – Use insights to design new policies or bundles

that

align with traveler needs.

In addition, scraping allows businesses to correlate pricing with other travel

data

such as flight, hotel, and rental information, creating a holistic understanding of traveler

behavior and expenditure.

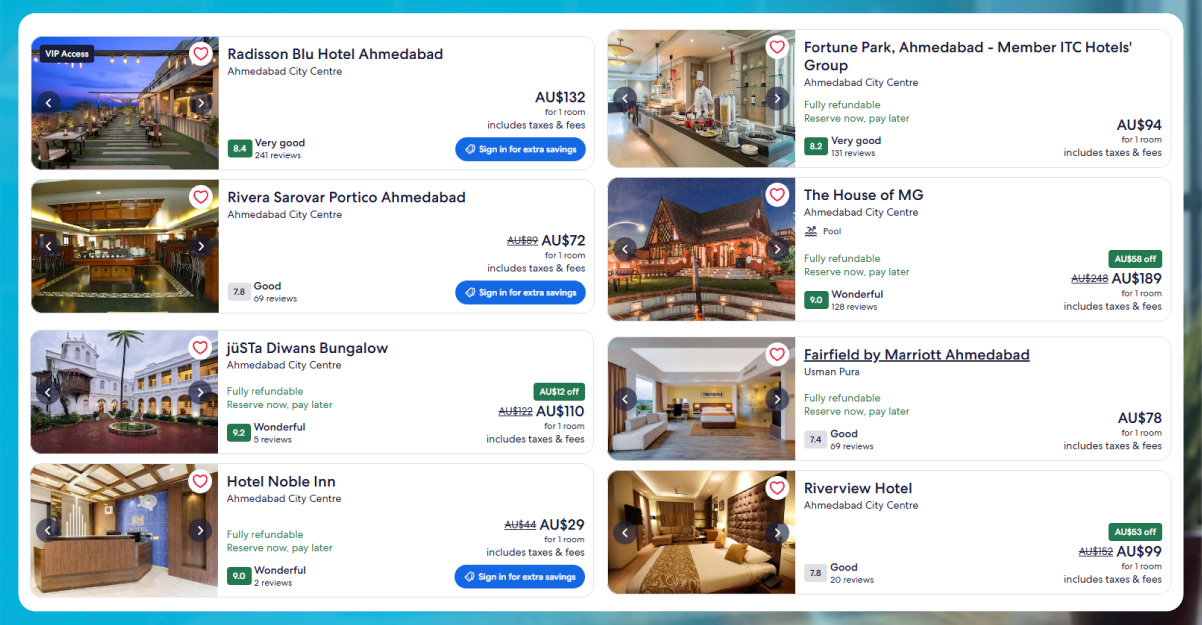

Expanding Travel Data Intelligence

Beyond insurance, comprehensive scraping can extend to broader travel datasets:

- Airline Pricing and Availability – Track ticket rates, promotions, and

seat

availability.

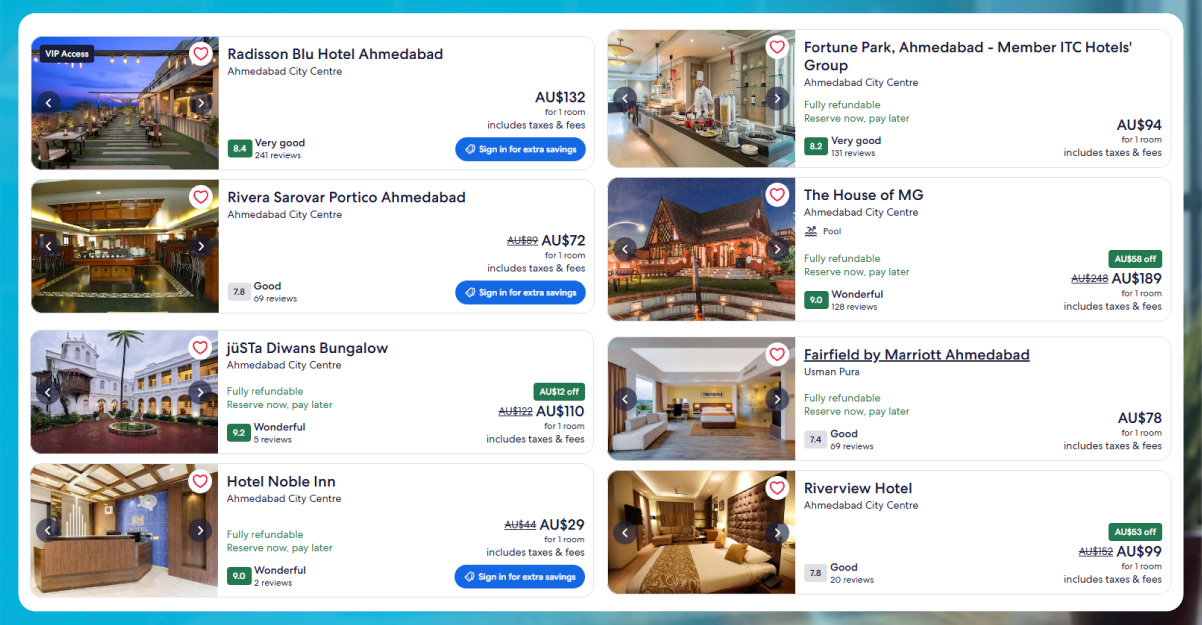

- Hotel Room Rates and Deals – Monitor competitive pricing across

accommodations.

- Car Rentals and Packages – Analyze pricing trends and availability for

rental services.

- Tour Packages – Compare bundled travel experiences for better market

insights.

Travel &

Tourism App Datasets provide businesses with opportunities to combine

insurance pricing with other travel-related data, enabling personalized offers and improved

user

experiences.

The Future of Travel Insurance Data Scraping

As travel markets in the UAE and UK become more competitive, real-time data

intelligence will be critical. Advances in AI and machine learning are likely to enhance the

accuracy of data scraping, detect anomalies, and predict pricing trends. Integrating these

insights with recommendation engines, dynamic pricing tools, and automated marketing

campaigns

will empower insurers and travel platforms to make more informed, timely, and profitable

decisions.

How iWeb Data Scraping Can Help You?

- Deep-Dive Analysis – We go beyond surface-level pricing to capture

detailed

policy terms, coverage nuances, and hidden fees.

- Cross-Platform Coverage – Our services pull data from multiple sources,

including insurers, aggregators, and travel apps for a complete market picture.

- Adaptive Scraping Technology – Our tools automatically adjust to

website

changes, ensuring uninterrupted data collection.

- Actionable Insights – We transform raw data into meaningful reports,

dashboards, and analytics ready for strategic decision-making.

- Compliance-First Approach – We prioritize legal and ethical data

collection, adhering to regulations in both the UAE and UK markets.

Conclusion

In conclusion, leveraging Travel

Intelligence Services for Travel Strategies allows

insurers, travel agencies, and aggregators to gain a comprehensive view of the competitive

landscape. By implementing automated scraping techniques to Extract

Airline, Hotel, & Rental

Data alongside travel insurance information, businesses can create richer, more

actionable

datasets. Using Web Scraping Travel

data API , companies can continuously monitor rates,

trends,

and promotions across the UAE and UK, driving smarter pricing decisions, better customer

engagement, and long-term market success.

Scraping Travel Insurance Pricing Data is not just about collecting numbers—it’s

about transforming raw data into a strategic asset that informs competitive strategies,

enhances

customer experiences, and maximizes revenue potential in the fast-paced travel industry.

Experience top-notch web scraping

service

and mobile app scraping solutions with iWeb

Data

Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us

today to learn how our customized services can address your unique project needs, delivering

the

highest efficiency and dependability for all your data requirements.