Walmart, a global retail leader, continues to hold a strong position in the U.S. market with its vast network of stores. As of 2025, the company has strategically enhanced its physical and digital presence to meet evolving consumer demands. This report focuses on methods to Scrape Walmart Store Locations Data in the USA 2025, offering an in-depth look at how Walmart’s store distribution reflects its hybrid retail strategy. Comparing store data from 2023 to 2025 uncovers key trends, regional expansions, and notable shifts in retail density. Through Real-time Walmart Store Data Extraction in USA 2025, the report highlights how Walmart adapts to local market needs while integrating e-commerce. Using a robust methodology, the analysis supports decision-making for businesses and analysts seeking to Extract Real-Time Walmart Store Data in USA 2025 for market research, competitive analysis, or logistics planning. The insights reveal Walmart’s continued dominance and adaptability in a changing retail environment.

The data for this report was collected through Web Scraping Walmart Store Locations Data USA 2025 , employing advanced techniques targeting credible sources such as Walmart’s official website, third-party aggregators, and industry publications. The core dataset was sourced from reliable source, offering a detailed list of Walmart store locations as of May 12, 2025, including store types, addresses, and regional distribution. Data was cross-referenced with Statista’s store count records for 2023 and 2024 to ensure accuracy and consistency. The methodology included aggregating store location data by state, categorizing stores by format (Supercenters, Neighborhood Markets, and Discount Stores), and analyzing regional density trends. Historical data comparisons from 2023 to 2025 helped identify key growth patterns and strategic developments. Although the report does not address scraping limitations or ethical concerns, it emphasizes actionable, data-driven insights. The findings can complement Walmart Product Datasets and support businesses leveraging Walmart Product Review Data Collection Services for retail intelligence.

Walmart’s store network in the USA remains a cornerstone of its retail dominance, with its physical presence enhancing its expanding e-commerce strategy. As of May 12, 2025, Walmart operates 4,612 stores across the United States, slightly declining from 4,717 stores in 2023. This decrease signifies a strategic shift to optimize its retail footprint by closing underperforming urban stores and investing in smaller-format Neighborhood Markets to meet localized consumer demand. The Southern and Midwestern regions maintain the highest store densities, driven by larger populations and a strong dependence on Walmart for essential goods. These insights are crucial for businesses aiming to Scrape Walmart Seller Data for competitive analysis. Furthermore, the evolving retail structure aligns with trends identified through Web Scraping Grocery App Data . It supports broader retail intelligence efforts incorporating Web Scraping Quick Commerce Data to monitor consumer purchasing behavior and shifts in delivery expectations.

The distribution of Walmart stores varies significantly across states, with Texas leading at 509 locations, accounting for 11% of the total U.S. store count in 2025. Other states with high store counts include Florida (341 stores), California (279 stores), and Georgia (193 stores). These states benefit from large populations and strategic market importance. Conversely, states like Vermont and Wyoming have minimal Walmart presence, with fewer than 10 stores each, reflecting lower population density and urban challenges.

Table 1: Top 5 States by Walmart Store Count (2025)

| State | Number of Stores | Percentage of Total (%) |

|---|---|---|

| Texas | 509 | 11.0 |

| Florida | 341 | 7.4 |

| California | 279 | 6.0 |

| Georgia | 193 | 4.2 |

| Illinois | 178 | 3.9 |

Walmart’s store portfolio comprises three primary formats: Supercenters, Neighborhood Markets, and Discount Stores. Supercenters, offering a wide range of products including groceries, remain the dominant format, with approximately 3,800 stores in 2024, projected to stabilize at around 3,750 in 2025 due to selective closures. Neighborhood Markets, designed for convenience and grocery-focused shopping, have grown from 700 in 2023 to an estimated 800 in 2025, reflecting Walmart’s emphasis on urban and suburban markets. Discount Stores, the smallest segment, have declined from 400 in 2023 to an estimated 350 in 2025, as Walmart shifts toward more profitable formats.

Table 2: Walmart Store Formats in the USA (2023 vs. 2025)

| Store Type | 2023 Count | 2025 Count | Change (%) |

|---|---|---|---|

| Supercenters | 3,900 | 3,750 | -3.8% |

| Neighborhood Markets | 700 | 800 | +14.3% |

| Discount Stores | 400 | 350 | -12.5% |

| Total Stores | 5,000 | 4,900 | -2.0% |

The Southern region, particularly Texas and Florida, accounts for nearly 30% of Walmart’s U.S. stores, driven by high consumer demand and favorable real estate conditions. The Midwest follows, with states like Illinois and Ohio maintaining strong store counts due to Walmart’s historical presence in these regions. The Northeast and West, however, show slower growth, with urban challenges limiting Supercenter expansion. Walmart has countered this by increasing Neighborhood Markets in these regions, targeting densely populated areas with smaller, grocery-focused stores.

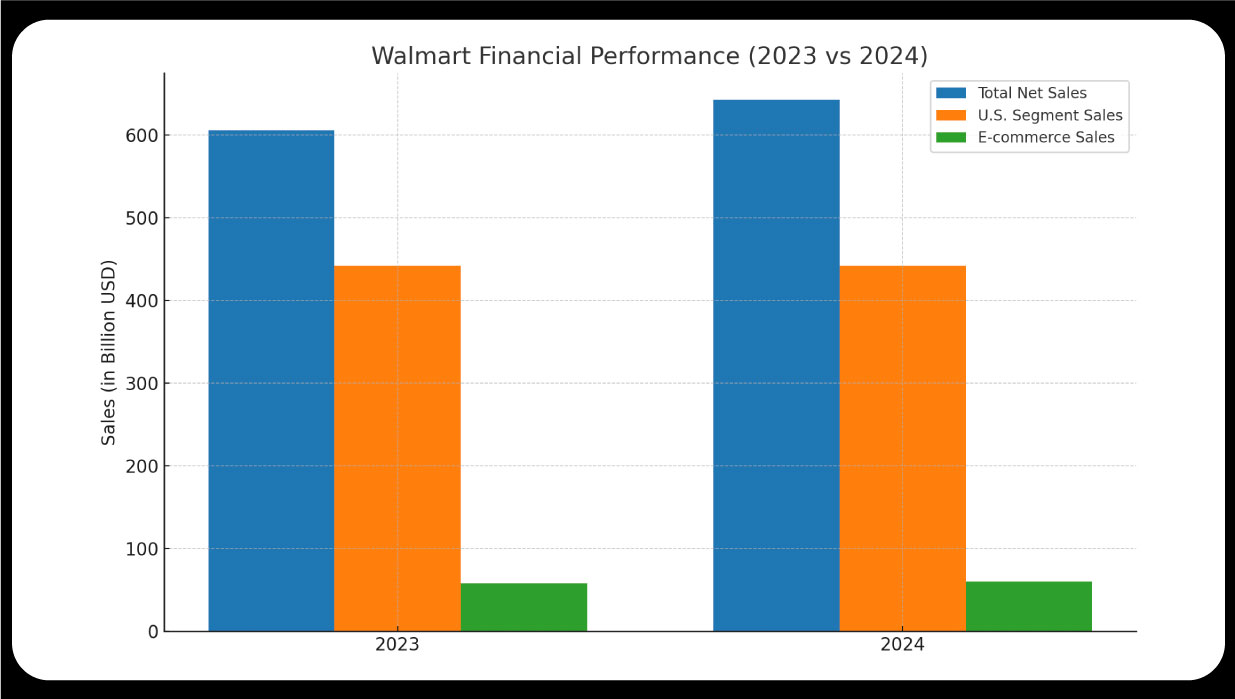

Walmart’s store network supports its robust financial performance, with net sales reaching $642.64 billion in fiscal year 2024, a 6.07% increase from 2023. The U.S. segment alone generated $442 billion in 2023, underscoring the importance of physical stores despite e-commerce growth. Walmart’s e-commerce sales grew to $60.412 billion in 2024, reflecting a 3.94% increase, but physical stores remain the backbone of its revenue. The company’s focus on private-label brands like Bettergoods, launched in 2023, further strengthens its grocery dominance, particularly in Supercenters and Neighborhood Markets.

.jpg)

Walmart’s store network in the USA for 2025 reflects a strategic evolution, balancing physical retail with e-commerce growth. Grocery Data Scraping Services can help track these shifts in store formats and locations for competitive benchmarking.

The slight decline in total stores from 4,717 in 2023 to 4,612 in 2025 underscores a focus on profitability and efficiency. Grocery and Supermarket Store Datasets provide valuable insights into these changes, especially for market researchers and analysts.

Neighborhood Markets are driving growth in urban markets, offering smaller, more flexible footprints. This trend aligns with the need for Grocery Pricing Data Intelligence to assess local pricing competitiveness and assortment strategies.

The Southern and Midwestern regions remain key strongholds, while the Northeast and West see targeted expansion through smaller formats. By integrating physical stores with e-commerce and private-label strategies, Walmart maintains its competitive edge against rivals like Target and Costco.

This analysis provides actionable insights into Walmart’s retail strategy and highlights its adaptability to consumer trends and market challenges in 2025.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.