How Can Scraped Financial Data for Stock Price Movements Improve Your Investment Decisions?

Introduction

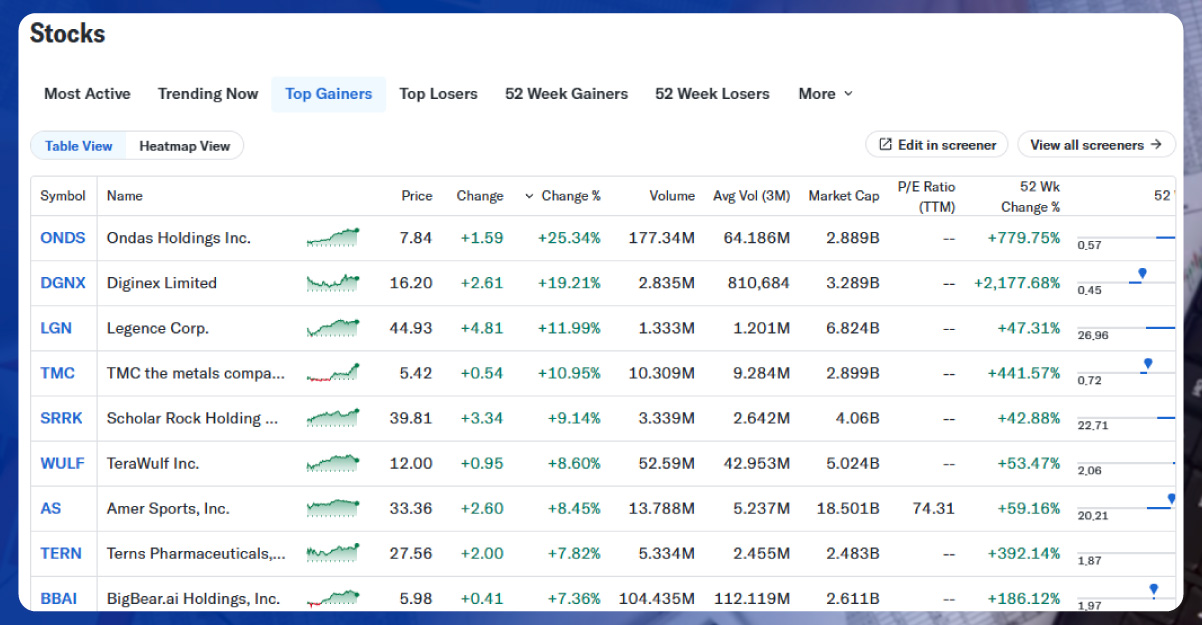

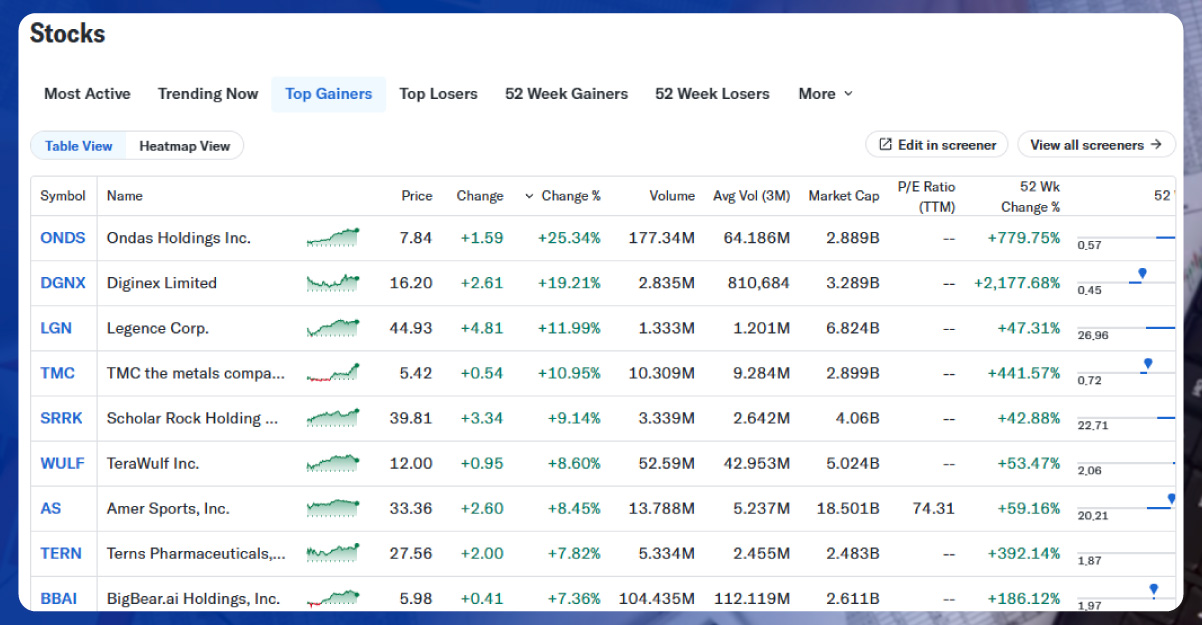

In today’s fast-paced financial markets, timely and accurate information is the cornerstone of successful investing. Traders, analysts, and AI-driven platforms increasingly rely on scraped financial data for Stock Price Movements to gain a competitive edge. By leveraging advanced data scraping techniques, businesses can access a wealth of structured and unstructured data, transforming it into actionable insights that inform trading strategies and investment decisions.

Financial data scraping involves extracting data from multiple online sources, including stock exchanges, financial news websites, company filings, and social media platforms. For investors seeking predictive insights, tools that Scrape stock price prediction data are invaluable. They help capture market sentiment, historical price trends, and company performance metrics in near real-time, enabling more informed decisions.

How Scraped Data Drives Stock Price Prediction?

The financial market is influenced by a combination of quantitative and qualitative factors. Scraping relevant data ensures that traders and AI models have access to comprehensive datasets. For instance, AI stock prediction data scraping tools can collect and process information from stock exchanges, trading platforms, and economic reports, feeding predictive algorithms that forecast future price movements.

- Historical Price Data: Historical stock prices form the foundation of predictive models. By aggregating past trading data, analysts can identify patterns such as seasonal trends, volatility spikes, and correlations between stocks. This process helps predict potential future price directions.

- Earnings Reports and Financial Statements: Companies release quarterly and annual reports containing critical information on revenue, profit margins, and cash flow. Scraping these documents allows traders to gauge a company's financial health and anticipate stock reactions to earnings surprises.

- Market Sentiment Analysis: Social media posts, blogs, forums, and financial news articles often contain signals about market sentiment. Through process to Extract quantitative trading data methods, sentiment scores can be assigned, providing a predictive edge for traders.

- Economic Indicators and Macro Data: Broader economic data such as interest rates, unemployment rates, and GDP growth significantly impact stock prices. Real-time scraping of these indicators can feed into models that adjust investment strategies according to economic shifts.

- Event-Driven Data: Corporate events like mergers, acquisitions, or product launches often drive stock volatility. Web scraping for finance app Data ensures that traders are informed instantly, allowing them to act on market-moving news before competitors.

Key Sources of Scraped Financial Data

- Stock Exchanges and Trading Platforms: These are primary sources for accurate historical and live market data. Using automation, stock news data scraping can provide minute-by-minute updates on trades, volumes, and market trends.

- Financial News Websites: Platforms like Reuters, CNBC, and Bloomberg provide both macro and microeconomic news that affect stock movements. Scraping these sites ensures timely insights for traders and AI models.

- Social Media and Forums: Platforms such as Twitter, Reddit (e.g., r/wallstreetbets), and StockTwits host conversations that can influence market sentiment. Sentiment analysis applied to scraped data offers predictive signals.

- Corporate Filings and Regulatory Reports: Securities and Exchange Commission (SEC) filings, press releases, and annual reports contain crucial company-specific information. Financial ML datasets derived from these filings feed machine learning models for predictive analysis.

- Alternative Data Sources: Data on consumer behavior, foot traffic, satellite imagery of store parking lots, or online reviews can offer non-traditional insights into a company’s performance. Real-time stock data extraction from these sources provides a multi-dimensional perspective.

Unlock the power of real-time financial insights—start leveraging our expert data scraping services today!

Applications of Scraped Financial Data in Predictive Models

Machine Learning in Stock Prediction

Machine learning algorithms thrive on large, diverse datasets. Earnings call transcript scraping enables models to analyze executives’ tone and language, which can indicate future performance. When combined with historical stock prices, social sentiment, and macroeconomic indicators, predictive models can achieve higher accuracy in forecasting stock price movements.

Algorithmic Trading

Algorithmic trading relies on real-time data to execute trades at optimal prices. Finance and Stock Market Data Scraping ensures that algorithms receive updated market conditions without delay. This allows high-frequency trading strategies to respond to minute market changes, improving returns and reducing risk.

Risk Management

Predictive insights derived from scraped data also help manage investment risk. By identifying potential price drops or market corrections ahead of time, investors can hedge positions, allocate capital efficiently, and reduce exposure to volatile assets.

Portfolio Optimization

Investors can use scraped data to construct diversified portfolios that balance risk and return. For instance, combining market sentiment, historical price trends, and earnings forecasts enables more sophisticated portfolio rebalancing strategies.

Enhancing Financial Research

Academic researchers and financial analysts rely on large datasets to test hypotheses about market behavior. Scraping ensures they have access to the most current and comprehensive data, enabling more robust research outcomes.

Challenges and Best Practices in Financial Data Scraping

While the benefits are substantial, financial data scraping comes with challenges:

- Data Accuracy and Reliability: Scraped data must be verified against primary sources to ensure accuracy. Erroneous data can lead to flawed predictions.

- Real-Time Processing: Markets move rapidly, and delayed data can result in missed opportunities. Efficient real-time scraping pipelines are essential.

- Legal and Ethical Considerations: Financial data scraping must comply with terms of service, copyright laws, and data privacy regulations. Using authorized APIs or licensed datasets is recommended.

- Data Cleaning and Structuring: Raw scraped data often requires preprocessing to remove duplicates, correct errors, and structure it for analysis.

- Scalability: Financial markets generate massive amounts of data daily. Scalable scraping systems are crucial for handling this volume efficiently.

How iWeb Data Scraping Can Help You?

- Comprehensive Market Coverage: We provide end-to-end solutions to Scrape stock price prediction data from multiple exchanges, financial websites, and news platforms.

- AI-Ready Datasets: Our service delivers clean, structured datasets that integrate seamlessly with AI stock prediction data scraping tools for predictive modeling.

- Real-Time Insights: Using our tools, clients gain instant access to market-moving information through real-time stock data extraction, enabling faster decision-making.

- Alternative Data Integration: From social media sentiment to earnings call transcript scraping, we help incorporate alternative data for enhanced predictive accuracy.

- Regulatory Compliance: All our Finance and Stock Market Data Scraping services adhere to legal and ethical standards, ensuring secure and authorized data collection.

Conclusion

In an era where milliseconds can determine profit and loss, leveraging method to Extract AI Data is no longer optional—it is essential. Whether for AI-powered prediction models, algorithmic trading, or financial research, data scraping provides the backbone of informed decision-making in stock markets.

By partnering with specialized data scraping services, investors can Scrape Bloomberg Finance Data efficiently and reliably. These capabilities enable businesses to stay ahead of market trends, reduce risk, and enhance trading performance.

Investing in robust financial data solutions today to Scrape Bitcoin ATM Locations Data paves the way for smarter, faster, and more profitable decisions tomorrow.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.