The global Halloween retail landscape has evolved into a data-rich environment where granular insights determine market advantage. From costume collections to candy assortments and themed décor, every product SKU reflects consumer intent and competitive positioning. Modern analytics teams and e-commerce strategists rely on SKU-Level Halloween Product Data Scraping Across Global Marketplaces to decode real-time demand, pricing volatility, and inventory trends across Amazon, Walmart, Tesco, and other global platforms.

To meet this growing analytical demand, advanced data extraction frameworks are being developed to Scrape Halloween Product Data from Global Marketplaces — capturing SKU-wise listings, prices, reviews, ratings, and availability. This allows retailers, suppliers, and analysts to compare regional variations, identify high-margin products, and adapt to seasonal buying patterns efficiently.

Modern data pipelines that Scrape SKU-Level Halloween Product Data from Global Marketplaces offer both breadth and precision — integrating data from multiple marketplaces into structured datasets for cross-border analysis. The result is a comprehensive intelligence network that supports pricing strategies, inventory optimization, and product development decisions throughout the Halloween season.

Halloween is one of the largest global retail events, generating billions in seasonal sales. From early September to late October, demand surges across costumes, lighting accessories, candies, masks, and themed decorations. In this competitive window, SKUs — or Stock Keeping Units — serve as the fundamental data point for distinguishing variations in product size, color, type, or package quantity.

By capturing SKU-level datasets across global marketplaces, businesses gain visibility into product duplication, pricing differentiation, promotional timing, and availability patterns. This level of granularity enables more effective forecasting models, supply chain agility, and competitive benchmarking.

For example, two pumpkin lights with similar designs might vary by SKU due to wattage or packaging differences. Scraping both entries ensures accurate understanding of retailer-level differentiation. Such precise extraction underpins smarter assortment planning and discount forecasting.

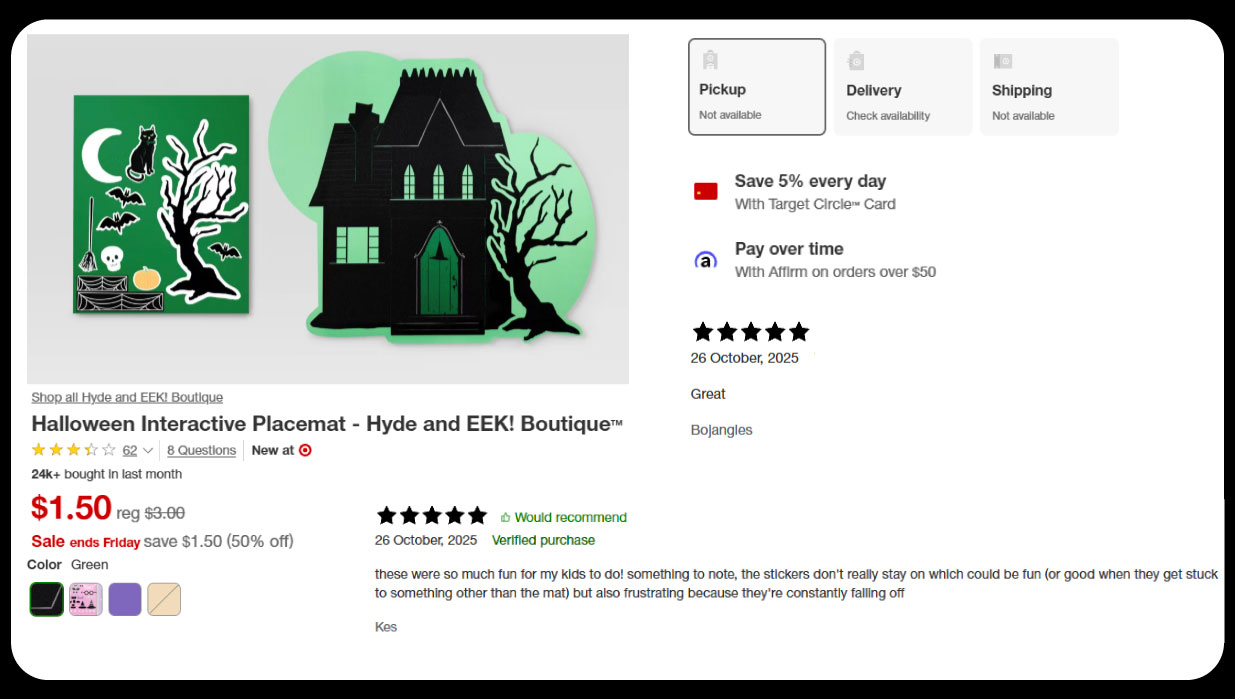

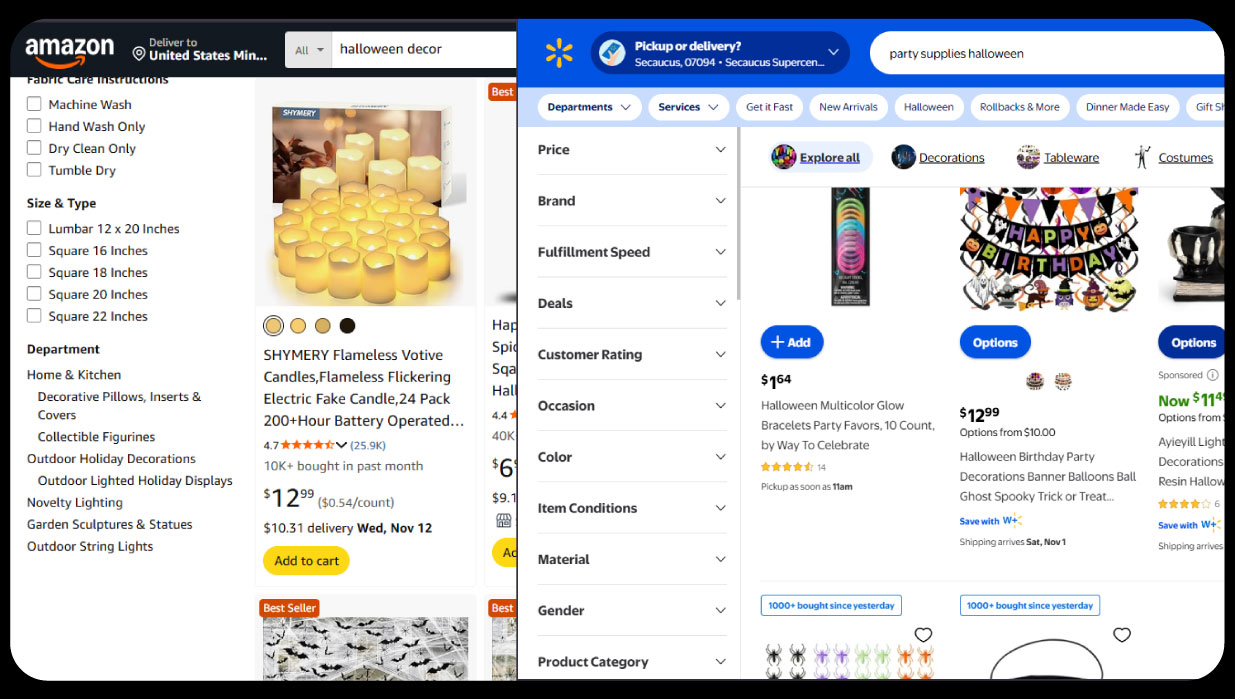

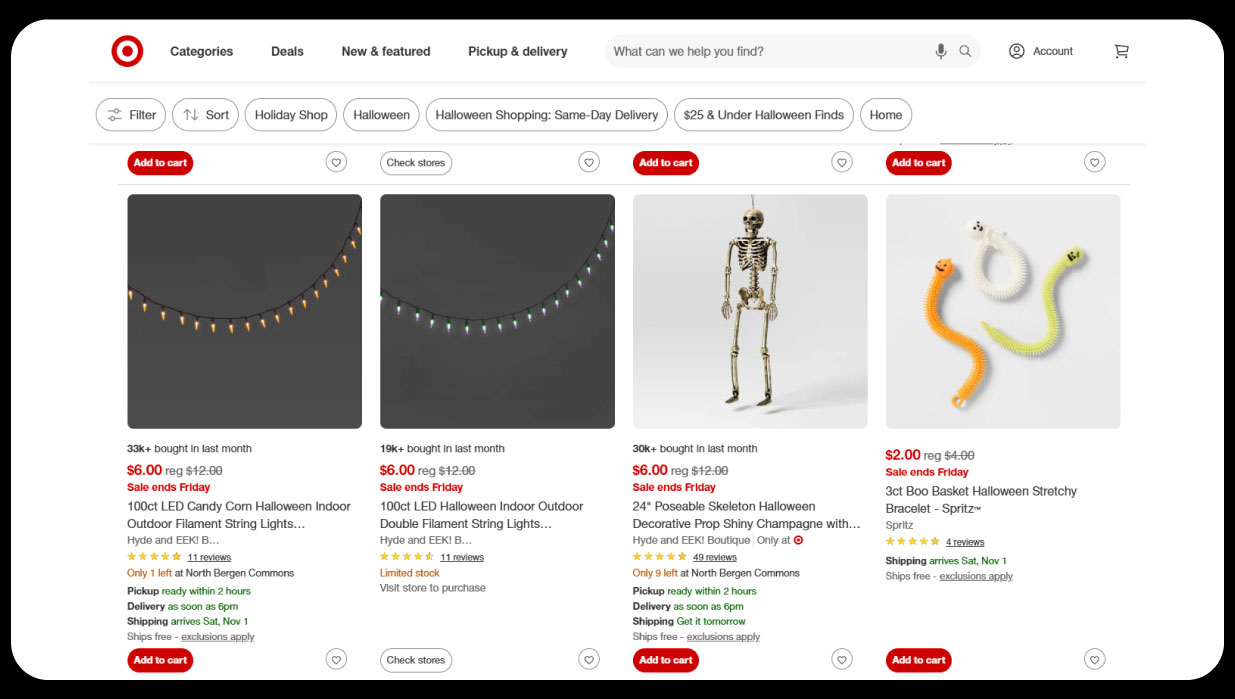

Marketplaces like Amazon, Walmart, eBay, Tesco, Target, and Alibaba play pivotal roles in the global Halloween product ecosystem. They act as central data reservoirs for thousands of third-party sellers and brands. SKU-level insights from these platforms help reveal how pricing and promotional tactics differ regionally.

In 2024, Amazon listed over 850,000 Halloween-related SKUs globally, while Walmart maintained roughly 150,000 Halloween SKUs across the U.S. and Canada. Tesco in the U.K. displayed over 8,500 product SKUs, mostly in candy and costume categories. Scraping data from such diverse sources allows analysts to track pricing elasticity and promotional response across regions.

The combination of Global Halloween Product Price and SKU Data Extraction enables comprehensive visibility into category-level competition. These insights are vital for consumer brands aiming to understand the effectiveness of their campaigns across multiple online retail ecosystems.

Accurate data extraction depends on well-structured scraping methodologies that balance automation, compliance, and analytical accuracy. Below are key methodological stages used in global Halloween product data scraping:

This systematic extraction allows enterprises to Extract Halloween Product Listings and Prices by SKU, forming a unified dataset ready for visualization and analytical modeling.

| Marketplace | Product Name | SKU ID | Category | Price (USD) | Stock | Rating | Discount (%) |

|---|---|---|---|---|---|---|---|

| Amazon | “Spooky Pumpkin LED Lights” | HALW-AMZ-125 | Décor | 14.99 | In Stock | 4.6 | 10 |

| Walmart | “Kids Ghost Costume Set” | HALW-WM-093 | Costume | 24.99 | Limited | 4.3 | 15 |

| Tesco | “Assorted Halloween Candy Pack 1kg” | HALW-TES-011 | Confectionery | 8.50 | In Stock | 4.7 | 5 |

| eBay | “Skeleton Wall Stickers” | HALW-EBY-074 | Décor | 6.99 | In Stock | 4.2 | 8 |

| Target | “Witch Hat LED Accessory” | HALW-TGT-044 | Accessories | 12.00 | Low Stock | 4.8 | 12 |

Such structured data provides a baseline for trend discovery, allowing analysts to compare stock fluctuations, price changes, and promotional intensity by platform.

Price volatility is one of the most dynamic metrics in seasonal commerce. During Halloween, sellers adjust prices frequently based on competition, stock levels, and promotional timing. Advanced crawlers perform Web Scraping Halloween SKUs and Price Movements Globally, monitoring these fluctuations hourly or daily.

In 2024, Amazon’s costume prices showed an average 13% reduction during the final week before Halloween. Walmart, in contrast, used a more gradual discounting approach, averaging 8% markdowns over three weeks. Tesco’s candy category showed shorter discount windows but higher depth, with some SKUs discounted up to 25%.

This continuous monitoring allows analysts to develop predictive pricing algorithms that anticipate peak sales periods and optimize promotional timing for future seasons.

| SKU ID | Marketplace | Base Price | Lowest Price | Discount Pattern | Duration (Days) |

|---|---|---|---|---|---|

| HALW-AMZ-125 | Amazon | 14.99 | 12.99 | Sharp drop | 5 |

| HALW-WM-093 | Walmart | 24.99 | 21.49 | Gradual decline | 10 |

| HALW-TES-011 | Tesco | 8.50 | 6.75 | Sudden weekend discount | 3 |

| HALW-TGT-044 | Target | 12.00 | 10.80 | Small periodic reductions | 7 |

This data-driven patterning helps retailers evaluate market responsiveness and optimize future discount structures.

Different geographies show unique Halloween purchasing behavior. North American markets lead in costume variety and home décor categories, while European platforms emphasize confectionery and eco-friendly packaging. In Asian e-commerce, growth is driven by themed accessories and lighting.

By leveraging SKU-Level Halloween Product Dataset for Competitive Analysis, brands can identify these regional distinctions to localize offerings. For instance:

Scraping regional SKU-level datasets thus informs both cultural targeting and logistical decisions for inventory allocation.

Amazon remains the largest digital marketplace for Halloween merchandise. Its SKU diversity and algorithmic recommendations drive significant sales during October. Retail analysts frequently Scrape Amazon Halloween product price to understand category-level elasticity and dynamic repricing strategies.

Walmart, with its hybrid online and offline presence, uses price matching and rollbacks to compete effectively. Data teams extract Walmart Halloween discount trend insights to evaluate how Walmart’s promotional timing influences market-wide price shifts. This comparison highlights how real-time scraping reveals the competitive dynamics that shape seasonal retail ecosystems.

In the U.K., Tesco combines physical retail dominance with strong online fulfillment. Seasonal SKUs are updated weekly, with stock visibility closely tied to location-based availability. Businesses that Extract Tesco Halloween product stock availability can forecast shortages and restock cycles, optimizing supply chain synchronization.

For example, candy SKUs may go out of stock regionally due to bulk online ordering, but remain available in neighboring store zones. Such localized scraping provides SKU-to-location mapping essential for regional planning.

Analytical systems rely heavily on E-Commerce Product Datasets to train predictive models that forecast Halloween product demand and price trajectories. By integrating SKU-level scraping results with historical data, data scientists can simulate market reactions, promotional peaks, and inventory shortfalls.

Predictive analytics derived from these datasets help:

Such intelligence supports not only retail planning but also supplier negotiations and marketing budget optimization.

The integration of AI-driven scraping systems enables faster, cleaner, and regulation-compliant extraction. Automated pipelines can collect thousands of SKUs daily, deduplicate entries, and update dashboards with refreshed metrics. These systems ensure accuracy through proxy rotation, CAPTCHA solving, and semantic tagging of data points.

Advancements in NLP and computer vision allow identification of product types even from image metadata, which enhances cross-category classification accuracy.

Through machine learning, these platforms adapt to frequent changes in website structure, enabling continuous monitoring of marketplace variations — a key aspect of E-Commerce Data Intelligence Services.

Beyond costumes and candies, SKU-level Halloween scraping also extends to themed electronics, tableware, and pet accessories. By comparing average pricing, stock longevity, and review volumes across these subcategories, analysts can determine which product verticals hold the greatest margin potential.

For example:

This benchmarking supports data-backed product portfolio diversification for upcoming seasons.

The future of global Halloween data intelligence lies in predictive analytics powered by real-time data streams. Emerging scraping frameworks will integrate API-based data sharing with marketplace-approved pipelines, enabling legal and secure data exchange.

Advancements will also support:

These capabilities will extend seasonal analytics into continuous retail intelligence — a necessity for brands competing globally.

Despite its analytical benefits, large-scale data scraping must balance efficiency with ethical and regulatory compliance. Retailers should ensure adherence to platform policies, GDPR regulations, and regional data collection laws. Implementing proper anonymization, request throttling, and respect for robots.txt files is essential.

Moreover, scraped data should be used strictly for market insights and not for replicating proprietary content or infringing intellectual property. Responsible practices safeguard industry trust while maintaining access to valuable market data sources.

The insights extracted from Halloween product datasets directly impact several strategic domains:

A unified scraping framework transforms fragmented retail data into a cohesive view of global marketplace dynamics, improving both responsiveness and profitability.

A U.S.-based retailer integrated SKU-level scraping from Amazon, Walmart, and Tesco to build a comparative dashboard. Data revealed that similar costumes were priced 18% higher on Amazon than Walmart during early October but reversed in the final week. Tesco, meanwhile, offered shorter-duration discounts, leading to rapid sell-outs.

The retailer used these insights to synchronize its promotional calendar, improving sell-through rate by 22%. This exemplifies how SKU-level analytics directly influence performance outcomes.

Interactive dashboards are increasingly used to represent Halloween SKU data. Visualization tools show real-time price curves, stock depletion rates, and review sentiment trends.

Key performance indicators (KPIs) monitored include:

These visual metrics convert large datasets into actionable insights for category managers and marketing teams.

Halloween commerce is an intricate mix of timing, creativity, and competitive intelligence. By deploying Ecommerce Product Ratings and Review Dataset, brands and analysts can capture real-time shifts in global consumer behavior, pricing, and stock movements.

Through frameworks that Scrape Halloween Product Data from Global Marketplaces, teams build resilient datasets reflecting authentic marketplace dynamics. Similarly, Price Monitoring allows e-commerce players to outpace competitors through better demand forecasting and price synchronization.

The convergence of SKU-level data and automation empowers businesses to not only optimize seasonal sales but also create comprehensive, long-term analytical infrastructures. Such evolution drives smarter retail operations and continuous that elevate competitive intelligence across global e-commerce ecosystems.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.