Starbucks continues to expand across Australia’s major metropolitan and regional areas, serving as both a lifestyle brand and a hub for urban coffee culture. With a significant focus on customer experience, beverage innovation, and digital convenience, Starbucks’ 2025 footprint across Australia reflects a carefully designed strategy that leverages real-time consumer analytics, location intelligence, and retail demand mapping.

The role of Starbucks location data scraping Australia has become increasingly vital for understanding geographical distribution, revenue density, and customer interaction zones. This data-driven approach allows stakeholders to analyze traffic, spending behavior, and store performance at a granular level.

Using tools such as Starbucks Store location data scraping for Australia, analysts can evaluate how store locations perform across diverse urban environments — from Sydney’s central business districts to Perth’s growing suburban hubs. Each Starbucks location in 2025 not only represents a retail outlet but also an ecosystem of digital ordering, local supply management, and experiential marketing.

The efficiency of Starbucks Australia store locations data extractor technology enables businesses to identify emerging hotspots and optimize their strategies for expansion, logistics, and local market engagement. These datasets form the backbone of informed business decision-making for investors, retail strategists, and coffee industry researchers.

.jpg)

In 2025, Starbucks operates across all major states of Australia, with the highest concentration of stores in New South Wales, followed by Victoria, Queensland, and Western Australia. The brand’s market positioning has evolved beyond urban cafes to include drive-thru models, university-based kiosks, and retail collaborations within shopping centers.

The Australian coffee culture, long dominated by local artisanal brands, has gradually embraced Starbucks’ unique global blend — driven by digital loyalty programs, mobile app ordering, and enhanced beverage personalization. This shift is supported by precise method to Scrape Starbucks Australia store locations data methodologies that capture coordinates, sales volume, and demographic profiles around each outlet.

The Starbucks Rewards Program in Australia has also played a pivotal role in attracting younger audiences who value convenience and sustainability. The integration of renewable energy systems, local sourcing, and cashless transactions further strengthens the brand’s relevance in 2025’s competitive food retail sector.

| State / Territory | Number of Stores | Population Served (Approx.) | Store Type Dominant | Growth Rate (2023–2025) |

|---|---|---|---|---|

| New South Wales | 88 | 7.8 million | Urban & Drive-thru | +11% |

| Victoria | 70 | 6.6 million | Mall & CBD Outlets | +9% |

| Queensland | 55 | 5.5 million | Suburban Cafes | +13% |

| Western Australia | 34 | 2.8 million | Standalone Stores | +10% |

| South Australia | 22 | 1.9 million | Mall Cafes | +7% |

| Tasmania | 8 | 541,000 | Regional Stores | +6% |

| Australian Capital Territory | 9 | 462,000 | CBD Cafes | +5% |

| Northern Territory | 5 | 247,000 | Airport Outlets | +4% |

New South Wales (NSW)

Sydney remains Starbucks’ strongest market, with over 60% of NSW outlets concentrated in the metropolitan area. High footfall zones include Circular Quay, Bondi Junction, and Parramatta, where the combination of tourism, business commuters, and local residents sustains strong daily sales volumes.

Victoria

Melbourne, known as Australia’s coffee capital, poses unique challenges. Starbucks strategically focuses on tourist-friendly areas such as Federation Square and Southbank to complement rather than compete with boutique roasters. Location insights derived from strategy to Extract Starbucks Australia store locations data 2025 show consistent sales performance linked to shopping and entertainment districts.

Queensland

Brisbane, Gold Coast, and Sunshine Coast collectively contribute to Queensland’s growing share of Starbucks’ revenue. The state benefits from warm weather and tourism-driven coffee demand, with many drive-thru models along coastal highways performing well.

Western Australia

Perth’s expanding commercial landscape provides opportunities for compact outlets within mixed-use developments. Starbucks in this region adopts sustainability-driven strategies, including solar energy and recyclable packaging initiatives, aligning with the city’s green objectives.

Starbucks’ 2025 strategy divides stores into three operational types:

According to Scraping Starbucks Locations Data in Australia 2025, urban stores account for 52% of total operations, suburban and semi-urban make up 38%, and hybrid kiosks cover 10%. This mix optimizes accessibility and aligns with shifting consumer preferences toward mobility and speed.

Data analytics also reveal that suburban locations have experienced a 17% higher growth in loyalty transactions compared to city centers. This indicates Starbucks’ success in localizing its global identity to suit community-driven environments.

| Metric Type | Urban Stores | Suburban Stores | Hybrid Kiosks |

|---|---|---|---|

| Average Daily Transactions | 1,120 | 920 | 740 |

| Average Ticket Size (AUD) | 9.4 | 8.7 | 7.8 |

| Loyalty Program Users (%) | 64% | 68% | 59% |

| Digital Orders Share (%) | 55% | 61% | 47% |

| Sustainable Packaging Use (%) | 80% | 74% | 70% |

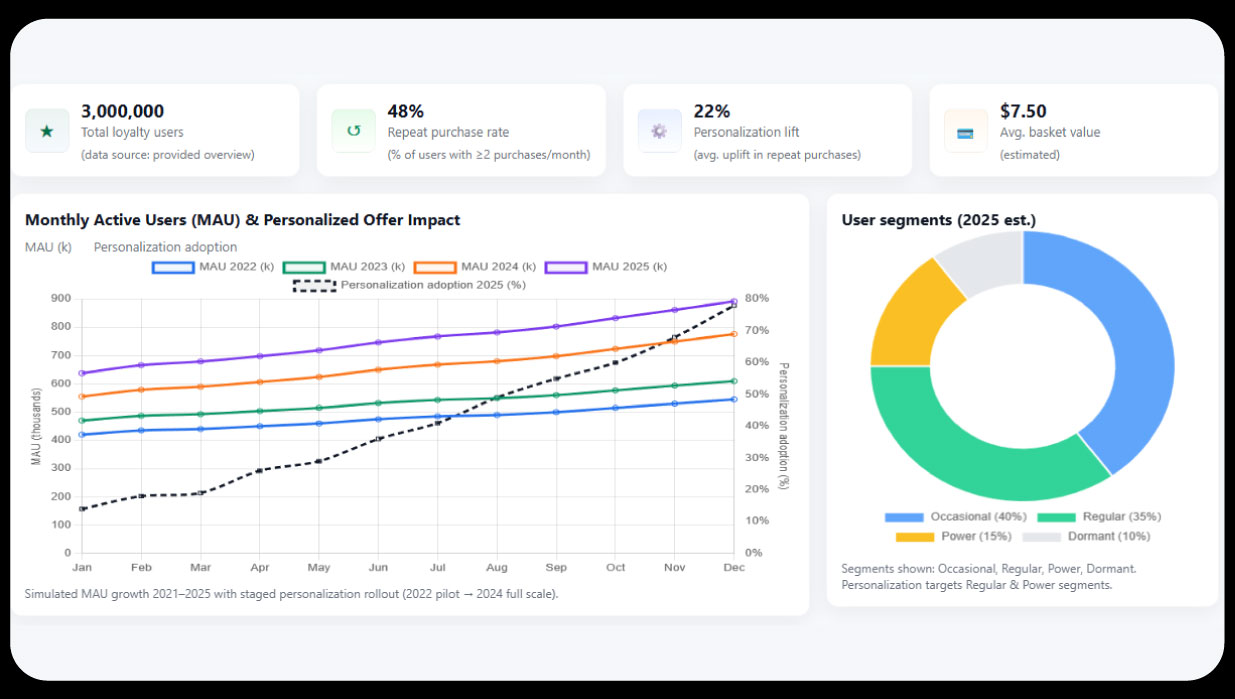

The Australian coffee consumer has evolved significantly, prioritizing ethical sourcing, digital convenience, and taste consistency. Starbucks leverages behavioral datasets to refine menu offerings, dynamic pricing, and promotions. Using Web Scraping Starbucks Australia Store Location Data 2025, analysts have been able to segment consumers into four core categories:

These profiles are critical in deciding where to launch new outlets or pilot innovative beverage lines. For instance, health-conscious suburbs in Melbourne’s north have seen a 20% increase in oat milk beverage sales.

Starbucks Australia’s 2025 data infrastructure integrates sales dashboards, traffic heatmaps, and predictive models. The role of Starbucks store location data scraping extends beyond mapping—it enables live tracking of inventory cycles, customer dwell times, and promotional conversion rates.

Predictive analytics models use weather, event, and economic data to forecast demand fluctuations. This precision-driven method helps the brand optimize its daily supply chain and reduce waste, supporting its commitment to sustainability.

Starbucks’ cloud-based data architecture now synchronizes with regional data servers, ensuring each store’s operational efficiency aligns with its geographic demand metrics.

The year 2025 introduces several notable trends:

These innovations emphasize how Starbucks uses geospatial and customer analytics to evolve with market needs.

Challenges:

Opportunities:

Such insights, backed by advanced data extraction, offer Starbucks the flexibility to adapt its pricing, product placement, and marketing.

Every new outlet is now chosen based on predictive models that combine demographic data, commute times, and competitor mapping. Heatmaps generated through Starbucks Australia store locations data extractor applications assist in projecting profitability before establishing new stores.

The integration of AI and machine learning into the site-selection process ensures that Starbucks maximizes footfall potential and aligns with evolving urban infrastructure. By 2025, 90% of site planning decisions are influenced by such predictive insights.

Starbucks Australia uses digital dashboards to monitor staffing efficiency, scheduling, and productivity metrics. Employee engagement data shows that stores with higher staff retention record a 12% increase in customer satisfaction scores.

Advanced workforce analytics also support equitable distribution of workloads and flexible shift patterns. The brand’s focus on “employee-first analytics” reflects its strategy of aligning operational excellence with customer delight.

The integration of sustainability tracking in Starbucks’ Australian operations enables real-time monitoring of packaging materials, supplier carbon footprints, and waste management.

Data gathered through Scrape Starbucks Australia store locations data also supports Starbucks’ sustainability reporting, showing that 85% of its Australian outlets have adopted renewable energy systems. These insights contribute directly to brand transparency and consumer trust.

Additionally, local sourcing of dairy and baked goods supports regional suppliers while reducing logistics costs.

In 2025, Starbucks’ customer engagement strategy in Australia relies on personalization algorithms driven by big data. Loyalty data from over 3 million users is analyzed to tailor offers, enhancing repeat purchase rates.

AI-based recommendation systems determine product pairings, cross-selling opportunities, and seasonal favorites. Such precision-driven engagement not only boosts sales but also strengthens emotional connections between customers and the Starbucks brand.

Looking ahead, Starbucks aims to cross 300 outlets in Australia by 2027. Emerging suburbs in Western Sydney, Greater Brisbane, and Perth’s outer regions are expected to host the next wave of openings.

Digital integration will remain central, with potential implementation of AI-assisted ordering, drone-based delivery trials, and sustainability-based loyalty credits.

The next evolution of Starbucks in Australia will depend heavily on continuous data capture and refined analytics—transforming static store data into actionable business intelligence.

By 2025, Starbucks’ data ecosystem across Australia has become one of the most refined models in retail analytics. The integration of geographic, demographic, and behavioral datasets provides unparalleled insights into consumer needs and market dynamics.

The precision of Food Delivery Data Extraction Services supports allied industries that study beverage trends, price dynamics, and customer experience benchmarks across Australia.

Furthermore, curated Food Delivery App Menu Datasets empower businesses to benchmark product offerings, understand consumer preferences, and forecast emerging flavor trends in Australia’s competitive café scene.

Finally, as the country’s urban and suburban landscapes evolve, Fast food Stores location data scraping will continue to be essential for brands seeking a data-led advantage in retail expansion, pricing optimization, and consumer engagement.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.