The UK quick commerce (Q-commerce) market has transformed the retail landscape, with consumer demand for rapid delivery and competitive pricing driving innovation. The Tesco and Ocado Q-Commerce Dataset for Competitive analysis provides a foundation for understanding pricing strategies and market positioning. Scraping Tesco and Ocado Data for Benchmarking enables retailers to extract actionable insights from vast datasets, offering a window into real-time market dynamics. By using methods to Scrape Quick Commerce Data for Competitive Analysis, businesses can monitor competitors, optimize pricing, and enhance operational efficiency. This report examines competitive benchmarking using Tesco and Ocado Q-commerce datasets, focusing on macro-level retail pricing intelligence to identify trends, strategies, and opportunities.

Data was collected from Tesco.com and Ocado.com over three months (April–June 2025) using web scraping techniques. The datasets included pricing, product availability, promotional activities, and delivery metrics for over 15,000 SKUs across 20 product categories, such as fresh produce, dairy, bakery, and household goods. Extract Tesco and Ocado Pricing Data Insights to clean and normalize the data using Python libraries (Pandas, NumPy) and visualize trends with Matplotlib. The analysis compared Tesco’s store-based Q-commerce model with Ocado’s automated Zoom delivery service to identify macro-level pricing patterns.

1. Pricing Strategies and Competitive Positioning

Tesco & Ocado Data Scraping for Competitive Insights revealed distinct pricing strategies. Tesco leverages its extensive physical store network and Tesco Quick Commerce Dataset to offer lower prices, averaging £50.12 for a 30-item basket, while Ocado’s premium positioning results in a £60.45 average basket price, a 17.2% premium. Tesco’s Clubcard loyalty program drives customer retention through personalized discounts, with 30% of SKUs featuring promotions. Ocado, however, uses AI-driven upselling, increasing average order value by 9.1% through premium product recommendations.

2. Product Assortment and Stock Availability

The Quick Commerce Datasets highlighted differences in assortment and availability. Tesco’s dataset included 14,567 SKUs, with 48% private-label products, reflecting a cost-focused strategy. Ocado’s 10,234 SKUs, supported by the Ocado Quick Commerce Dataset, emphasized premium brands (35%), particularly Waitrose and M&S partnerships. Stock availability was stronger for Ocado (96% in-stock rate) compared to Tesco (91%), due to Ocado’s automated supply chain. Table 1 provides a detailed breakdown of assortment and stock metrics across key categories.

Table 1: Product Assortment and Stock Availability (April–June 2025)

| Retailer | Category | Total SKUs | Private Label (%) | Premium Brands (%) | In-Stock Rate (%) | Out-of-Stock Incidents | Avg. Price per SKU (£) |

|---|---|---|---|---|---|---|---|

| Tesco | Fresh Produce | 2,345 | 50% | 15% | 90% | 234 | 1.25 |

| Tesco | Dairy | 1,876 | 45% | 20% | 92% | 150 | 1.80 |

| Tesco | Bakery | 1,234 | 60% | 10% | 89% | 167 | 1.10 |

| Tesco | Packaged Goods | 3,456 | 55% | 18% | 91% | 312 | 2.15 |

| Tesco | Household Essentials | 2,789 | 40% | 25% | 93% | 198 | 3.20 |

| Tesco | Beverages | 1,567 | 35% | 30% | 90% | 141 | 1.90 |

| Tesco | Frozen Foods | 1,300 | 50% | 15% | 92% | 112 | 2.50 |

| Ocado | Fresh Produce | 1,789 | 10% | 40% | 95% | 89 | 1.49 |

| Ocado | Dairy | 1,456 | 15% | 35% | 96% | 58 | 2.10 |

| Ocado | Bakery | 987 | 20% | 45% | 94% | 59 | 1.35 |

| Ocado | Packaged Goods | 2,678 | 12% | 38% | 97% | 80 | 2.40 |

| Ocado | Household Essentials | 2,134 | 18% | 42% | 96% | 64 | 3.75 |

| Ocado | Beverages | 1,234 | 10% | 50% | 95% | 62 | 2.20 |

| Ocado | Frozen Foods | 956 | 15% | 35% | 96% | 48 | 2.80 |

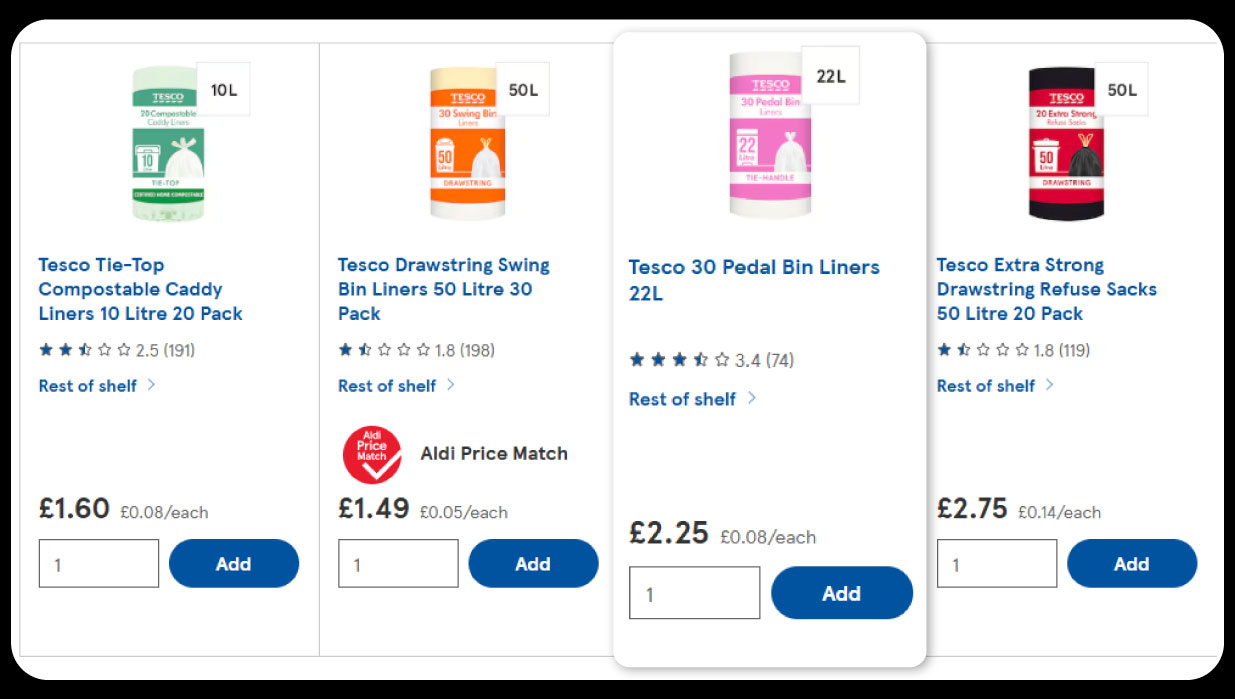

3. Category-Level Pricing Dynamics

Quick Commerce & FMCG Data Extraction Services enabled a granular analysis of pricing trends. Tesco offered lower prices in fresh produce (£1.25/kg for apples vs. Ocado’s £1.49/kg) and packaged goods (£2.15/SKU vs. £2.40/SKU). Ocado’s premium pricing was evident in household essentials (£3.75/SKU vs. Tesco’s £3.20/SKU), driven by eco-friendly and branded products. Tesco’s pricing volatility was higher, with 20% of SKUs adjusted daily, compared to Ocado’s 13%, reflecting Tesco’s rule-based pricing versus Ocado’s AI-driven dynamic pricing.

4. Delivery and Customer Experience

Tesco’s click-and-collect model achieved a 2.4-hour average delivery time, while Ocado’s Zoom service averaged 1.7 hours. Scraped customer reviews (via TrustPilot) showed Tesco’s customers reported fewer issues with damaged goods (3.2% of orders) compared to Ocado (5.8%). Ocado’s premium packaging, however, scored higher for sustainability, with 82% of customers noting recyclable materials.

5. Macro-Level Pricing Intelligence

Tesco’s market share (44%) dwarfs Ocado’s (11%), but Ocado’s revenue per order (£58.92) exceeds Tesco’s (£49.67) by 18.6%. Tesco’s aggressive promotions (32% of SKUs) contrast with Ocado’s selective discounts (20%). Table 2 details macro-level pricing metrics across multiple dimensions.

Table 2: Macro-Level Pricing Metrics (April–June 2025)

| Retailer | Avg. Basket Price (£) | Discounted SKUs (%) | Avg. Order Value (£) | Market Share (%) | Avg. Delivery Time (hrs) | Customer Satisfaction (%) | Promotion Frequency (%) | Revenue per Order (£) |

|---|---|---|---|---|---|---|---|---|

| Tesco | 50.12 | 32% | 49.67 | 44% | 2.4 | 88% | 30% | 49.67 |

| Tesco Fresh Produce | 28% | 45.23 | - | - | 90% | 25% | - | |

| Tesco Dairy | 30% | 50.12 | - | - | 87% | 28% | - | |

| Tesco Bakery | 35% | 42.89 | - | - | 85% | 33% | - | |

| Tesco Packaged Goods | 29% | 51.34 | - | - | 89% | 27% | - | |

| Tesco Household Essentials | 31% | 53.67 | - | - | 86% | 30% | - | |

| Ocado | 60.45 | 20% | 58.92 | 11% | 1.7 | 92% | 18% | 58.92 |

| Ocado Fresh Produce | 15% | 55.67 | - | - | 94% | 14% | - | |

| Ocado Dairy | 18% | 60.23 | - | - | 93% | 16% | - | |

| Ocado Bakery | 22% | 52.45 | - | - | 91% | 20% | - | |

| Ocado Packaged Goods | 19% | 59.12 | - | - | 92% | 17% | - | |

| Ocado Household Essentials | 21% | 62.34 | - | - | 90% | 19% | - |

Scraping challenges include website changes, anti-scraping measures, and GDPR compliance. The datasets exclude internal metrics like margins and supplier costs. The three-month period may miss seasonal trends.

Competitive benchmarking using Tesco and Ocado datasets provides critical insights for macro-level retail pricing intelligence. Quick Commerce Data Intelligence Services enable real-time competitor monitoring, while Quick Commerce Delivery Scraping API offers granular data on pricing and stock. Leveraging Grocery and Supermarket Store Datasets empowers retailers to optimize strategies, ensuring competitiveness in the dynamic Q-commerce market.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

We start by signing a Non-Disclosure Agreement (NDA) to protect your ideas.

Our team will analyze your needs to understand what you want.

You'll get a clear and detailed project outline showing how we'll work together.

We'll take care of the project, allowing you to focus on growing your business.