The fast-food industry in the United States is entering a transformative phase as leading QSR brands innovate rapidly to meet evolving customer expectations and digital adoption trends. Major players including McDonald’s, Burger King, Wendy’s, Taco Bell, and Subway are redefining business strategies through pricing intelligence, delivery optimization, and data-driven menu development. The USA fast food market outlook 2026 highlights that the sector is projected to expand significantly due to rising demand for convenience, healthier meal customization options, and frictionless ordering experiences. To gain a competitive advantage and prepare for future market shifts, brands are now focusing on data-based operational and pricing strategies. Advanced analytical tools enable businesses to Scrape USA fast food trends data 2026, unlocking real-time visibility into how consumers engage with restaurant menus and pricing across digital platforms. With the growth of third-party delivery platforms, AI-powered menu systems, and automated market intelligence, top chains rely heavily on QSR market data extraction to analyze product performance and anticipate consumer movement.

Digital ordering and delivery have evolved into the backbone of QSR revenue models. Mobile apps, self-service kiosks, AI-driven personalized recommendations, and loyalty-based digital ecosystems are reshaping the customer experience. In 2026 and beyond, the competitive environment will hinge largely on how brands apply data intelligence to optimize operations and differentiate menu offerings. Predictive modeling is becoming essential for supply chain and pricing strategies, powered by sophisticated USA cuisine demand forecasting 2026 methods that help businesses predict regional cuisine preferences, seasonal spikes, and demographic consumption patterns.

Consumer demand is shifting toward value-driven offers, convenience-focused services, and custom-build menu items tailored to dietary choices. The need to continuously innovate requires granular performance visibility, enabling brands to launch new products backed by real-world demand metrics. Tools that Extract Subway menu trends data 2026 empower companies to evaluate demand for customization-based sandwiches and health-conscious meals. Similarly, monitoring competitor pricing strategies can be achieved through Burger King pricing trends data Extractor, allowing analysts to compare key pricing variations and promotional impact across U.S. regions.

For chains focused on flavor innovation and specialty cuisine offerings, deep insight into product category performance is critical. Tools assisting Taco Bell cuisine insights data Collection enable targeted product decisions based on consumer taste profiles and ingredient trends, supporting sustainable menu innovation.

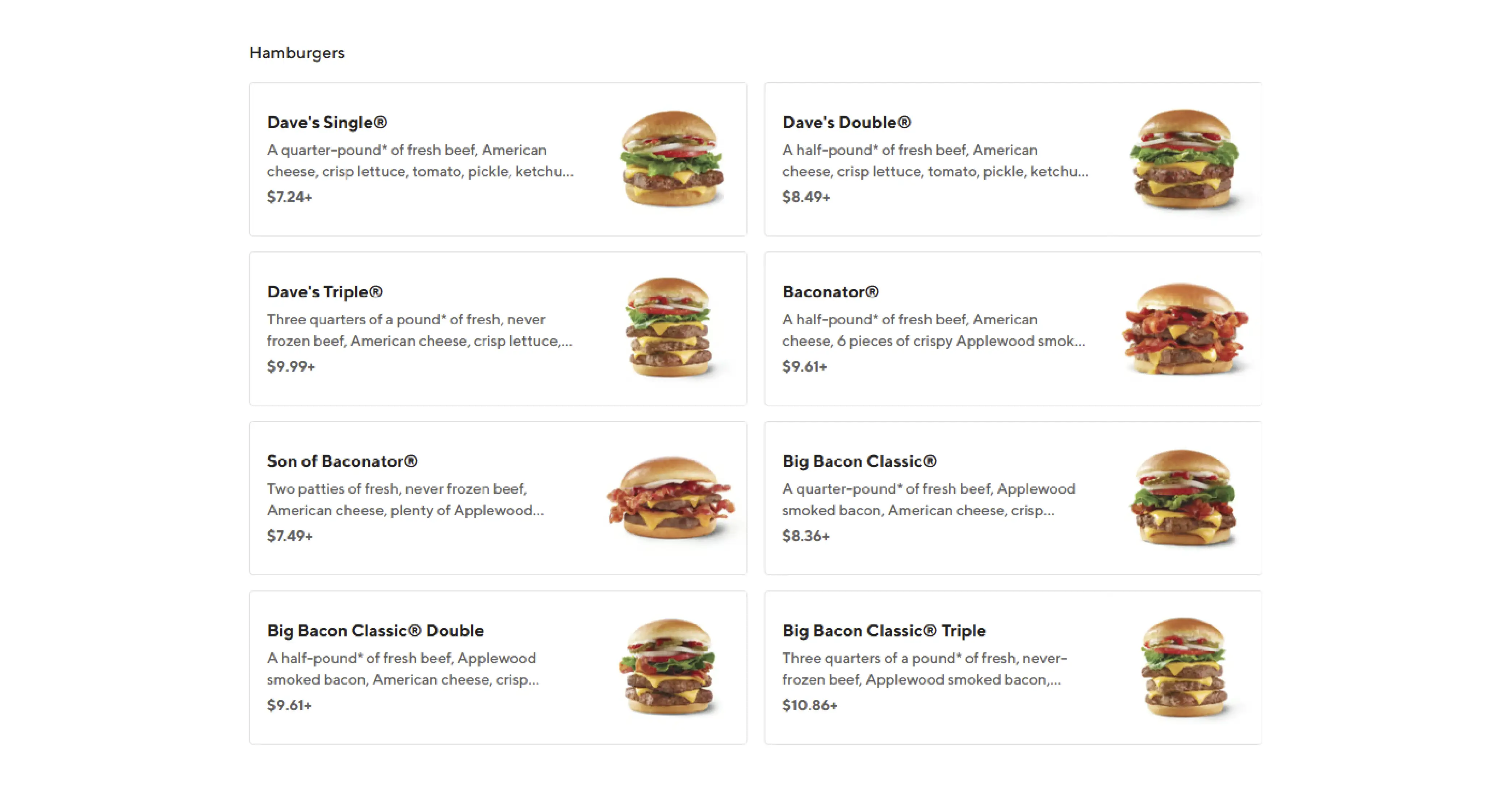

The performance and profitability of menu items vary widely across regional markets. Leading brands are increasingly turning to analytics platforms such as Wendy’s menu performance Data Mining to evaluate item popularity, contribution margins, and substitution behavior. These insights help determine bundle offers, promotional discounts, and category restructuring opportunities.

Competitive pricing has become a key battleground for major QSR operators, particularly within value and combo-meal segments. Real-time tracking tools enable brands to analyze competitor prices across delivery and dine-in channels. Datasets such as QSR competitor monitoring dataset support dynamic price adjustments and strategic discount management.

Delivery channel dominance continues to expand, driving additional reliance on analytics tools. Companies extract real-time demand intelligence from delivery applications through Food delivery app data extraction, enabling deeper understanding of order volume, delivery charge sensitivity, and product-level conversion behavior. These insights heavily influence promotional rollouts, packaging innovation, and multi-store inventory planning.

Equally vital is the analysis of geographic positioning and expansion territories. Brands rely on insight-driven mapping and demographic-level consumption intelligence to Scrape Fast food Stores Location Data USA, helping determine profitable store placement, regional menu adaptation, and logistics optimization for delivery networks.

Ready to transform your fast-food business with data-driven insights? Contact us now for customized QSR data scraping solutions.

The next two years will bring strong opportunities and challenges in digital transformation, customer loyalty, operational automation, and sustainability. All major fast-food chains are actively investing in robotics-assisted cooking, AI-supported inventory systems, smart drive-thru lanes, and sustainable packaging. Brands are rapidly embracing data-centralized operations to increase efficiency, reduce waste, and enhance real-time decision-making based on performance metrics.

Menu adaptation strategies are shifting toward healthier alternatives, premium ingredient offerings, and limited-time promotional rotations. Consumer demand for freshness, transparency, and personalization continues to grow. Chains gain significant competitive advantages by utilizing Wendy’s menu data extraction to understand product acceptance cycles and adjust menu structures accordingly. Meanwhile, insight tools such as Burger King pricing data Scraping allow comparison and adjustment of price points in response to competitor movements and economic volatility.

The year 2026 is expected to bring intensified competition in brand differentiation, loyalty programs, and digital ecosystem development. As consumers continue shifting ordering behavior between dine-in, drive-thru, and app-based delivery channels, real-time analytics influence everything from promotional planning to regional expansion.

The future of the U.S. fast-food market will be shaped by pricing intelligence, product performance analytics, digital-first operations, and real-time competitive monitoring. Data is becoming the foundation of decision-making across QSR strategies, from menu engineering to dynamic pricing, multi-channel ordering, and customer engagement personalization. The use of machine learning and automated scraping tools to extract insights from millions of customer interactions will define industry leaders in 2026.

Brands seeking growth must embrace advanced real-time data extraction and forecasting methodologies that drive faster, smarter operational decisions. Tools such as MCDonald's Data Scraping Service enable fast-food brands to gather cross-channel menu and pricing data for competitive benchmarking. Industry-specific solutions including Taco Bell Food Data Extraction Services support cuisine performance evaluation, while Subway menu data Scraping enables deeper analysis of product customization trends and demand segmentation. As digital intelligence becomes essential to success, the brands that excel in transforming data into actionable strategy will lead the next generation of fast-food innovation.

Experience top-notch web scraping service and mobile app scraping solutions with iWeb Data Scraping. Our skilled team excels in extracting various data sets, including retail store locations and beyond. Connect with us today to learn how our customized services can address your unique project needs, delivering the highest efficiency and dependability for all your data requirements.

The USA fast food industry is projected to experience strong expansion by 2026 due to rising demand for convenience foods, digital ordering, personalized menus, and competitive pricing strategies from major QSR brands.

Brands can use real-time analytics, menu performance tracking, delivery channel insights, and pricing movement data to improve product positioning, enhance customer experience, and drive higher profitability.

Understanding shifting dietary patterns, regional cuisine demand variations, and value-based pricing preferences enables brands to tailor menus to emerging customer needs and sustain long-term loyalty.

AI-powered forecasting, automated food delivery networks, digital loyalty platforms, and data-driven decision-making play a crucial role in optimizing supply chains, improving operational efficiency, and strengthening competitive strategies.

Key data includes menu pricing trends, delivery platform performance, customer ratings and reviews, SKU-level sales analytics, and regional demand segmentation—helping brands refine offerings and boost revenue.