In a noteworthy development last week, the landscape of the Indian retail industry underwent a significant transformation, propelled by a monumental acquisition involving a major player in the country's e-commerce sector and the world's largest retailer. In this article, let's understand how retail data scraping sheds light on the effect of Walmart's acquisition of Flipkart.

On the notable date of May 10th, discussions across diverse sectors were dominated by what is now the most substantial e-commerce deal. Culminating after a 20-month discourse, Walmart Inc. finalized the acquisition of a formidable 74% stake in Flipkart, amounting to a staggering $14 billion. With this acquisition reaching an evaluation exceeding $22 billion, has the United States-based retail giant ever executed the largest buyout?

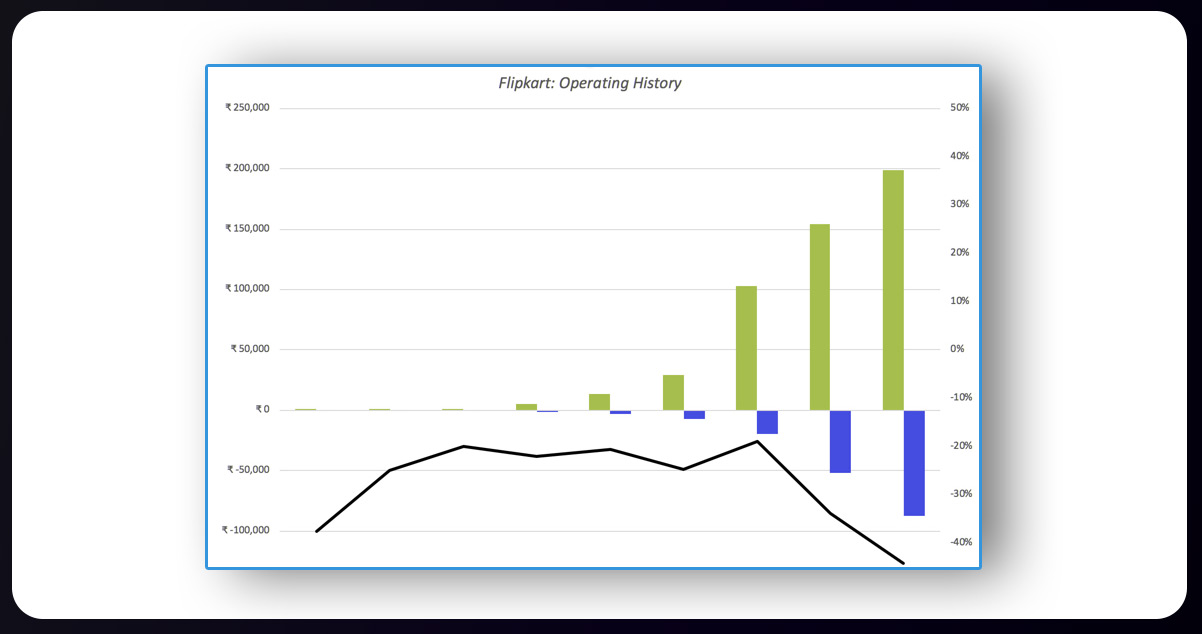

Central to the deal is an allocation of $2 billion earmarked by Walmart for fresh investments. The strategic objective behind this substantial move is to actively challenge the global expansion endeavors of their formidable rival, Amazon, thereby attributing a remarkable value of $20 billion to Flipkart. The data is available by scraping retail product data on the web. While the global discourse revolves around the intricacies of this business deal, it is imperative to delve into its multifaceted implications for the companies involved, the broader retail industry, and, most notably, the consumers.

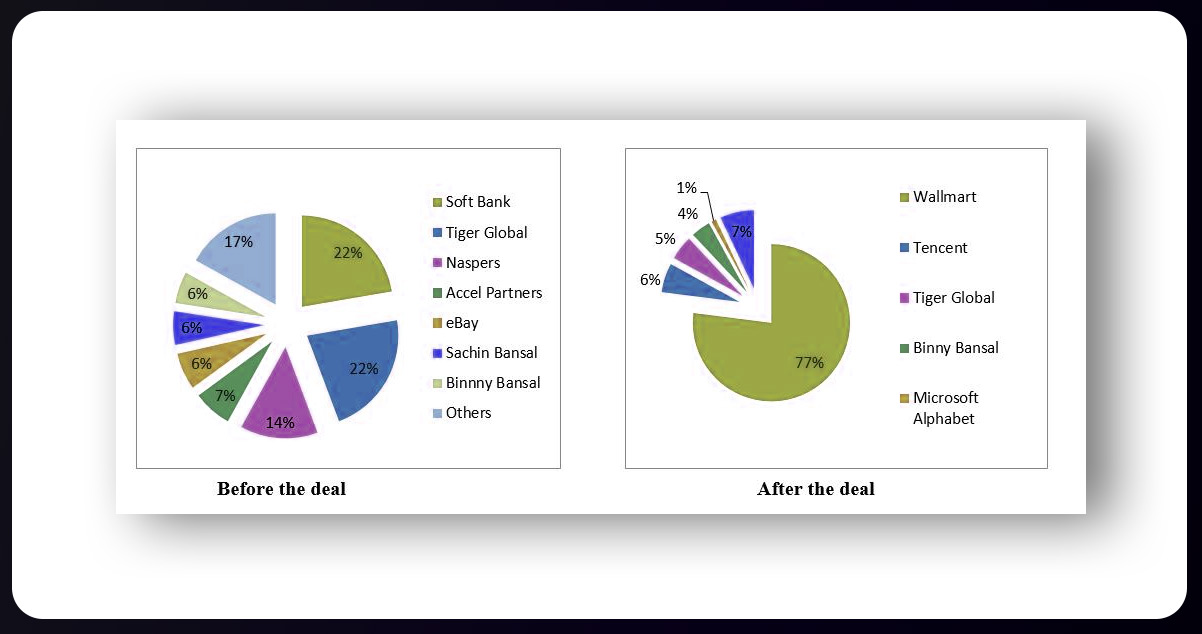

The acquisition of Flipkart by Walmart not only thrusts Amazon and Walmart into direct competition but also marks a significant transition with the complete withdrawal of co-founder Sachin Bansal, leaving Binny Bansal as the sole remaining investor. Despite this transformation, the distinct identity of the Flipkart brand remains preserved in the wake of its integration with Walmart.

However, the market response was less favorable for Walmart, witnessing a 5% drop in value to approximately $220 billion, accompanied by a $10 billion loss in market capitalization. In contrast, Amazon experienced a marginal uptick of 0.2%, reaching $777 billion in market capitalization. This transaction positions Walmart to capitalize on Flipkart's expertise, offering access to a broader customer base and the potential to overcome longstanding challenges in the Indian market over the past ten years.

The collaboration between Walmart and Flipkart introduces a unique trend by fostering a startup work culture and ethical practices within both entities. Walmart's CEO, Doug McMillon, expresses a keen interest in assimilating Flipkart's ecosystem, innovation strategies, and advancements in service and payment methods. In reciprocation, Flipkart benefits significantly from Walmart's wealth of experience in omnichannel operations, sourcing, and supply chain management.

The remaining 22% stake in Flipkart is collectively held by Binny Bansal, along with investment firms Tiger Global, Tencent from China, and technology giant Microsoft Corp. Both Flipkart and Walmart have outlined plans to bring in additional investors, with speculations suggesting Alphabet's potential investment ranging between $1-2 billion.

This comprehensive collaboration, seeking help from e-commerce data scraping services, sets the stage for a dynamic synergy, combining Flipkart's agility and innovation with Walmart's established market presence. The infusion of diverse stakeholders further augments the potential for sustained growth and innovation in the ever-evolving landscape of e-commerce and retail.

Some industry analysts express disappointment in the acquisition, anticipating the emergence of a native company scaling up to become an e-commerce giant capable of thriving in the hypercompetitive environment. However, recognizing the capital requirements and regulatory constraints in the Indian markets, the Walmart-Flipkart deal emerges as the pragmatic choice for Flipkart's evolution.

Beyond merely aiding Walmart in globalizing its customer base and enhancing technological resources, this acquisition strategically positions Walmart in direct competition with Amazon. The intensified battle among Flipkart, Walmart, and Amazon can squeeze space for smaller industry players, fostering an environment of highly competitive pricing, superior product quality, and advanced delivery services and payment options.

This transformative acquisition not only escalates competition within the retail sector but also generates increased employment opportunities. Economic sectors, particularly agriculture and infrastructure, stand to benefit substantially from the heightened rivalry between Flipkart and Amazon. The surge in demand for goods provides a notable advantage to farmers, contributing to an overall enhancement in the quality of consumer goods.

This economic stimulation catalyzes a parallel need for technological innovation within the industry. Anticipate advancements in delivery systems, payment services, and the overall design of applications and websites. The competitive landscape can drive all players to elevate their strategies, promising an overall improvement in the customer experience and setting the stage for a dynamic evolution within the e-commerce and retail space.

Consumer Landscape Shifts: Examining Transformations Resulting from the Walmart-Flipkart Merge

As the behemoth Walmart introduces an expanded array of products to the Indian market, consumers can anticipate a broader range of choices. This move is poised to intensify the competition, with Amazon expected to respond with highly competitive pricing strategies to retain its market standing. The resulting price wars and increased assortment of products and services benefit the average Indian e-retail consumer substantially.

Flipkart's pioneering cash-on-delivery system, which resonated well with Indian customers, is expected to be complemented by innovative services following the acquisition. Drawing on the expertise of both Walmart and Flipkart, this collaboration aims to enhance the customer experience, making it seamless and efficient.

While the backend synergies between Walmart and Flipkart will manifest over time, the immediate impact of the acquisition lies in containing Amazon's growth and market share. Simultaneously, there is an expectation to elevate the competitive landscape, creating a market environment where consumers can expect increased options, competitive pricing, and improved services. This strategic move sets the stage for a dynamic shift in the Indian e-commerce arena, benefitting consumers and shaping the competitive strategies of major players.

Don't hesitate to contact iWeb Data Scraping for a wealth of information! Whether you need web scraping service or mobile app data scraping, our dedicated team is at your service. Contact us today to delve into your specific requirements. Let us show you how our personalized data scraping solutions can deliver efficiency and reliability tailored precisely to your unique needs.